Introduction to Layaway

I was brainstorming for posts to write, when I stumbled across this article from Yahoo! Finance detailing how to finance your vacation. The novelty intrigued me, and I checked out two examples of layaway websites for airline ticketes, where consumers pay an upfront fee and then the balance of their purchase over time. The ticket is not released to the consumer until the final payment is made. This article will review the current purchase process, and comparatively examine the two websites. It is an intriguing concept, although layaway is not new. For example, it is regularly used by big retailers such as Walmart, for large purchases or holiday gifts, etc.). Paypal also has a similar financing program called Paypal Credit, although this is more of a loan rather than a financing over time.

Current Payment Practice

Typically, people purchase their flights on a company website, such as Virgin or Southwest, or third-party aggregator, such as Orbitz. Payment methods include credit or debit card, or other less common options such as gift cards, vouchers, travel banks, PayPal, etc. Or, people redeem their loyalty rewards points and frequent flier miles for flights as well.

With credit cards, consumers earn rewards points, miles, or cash back. Additionally, their cards carry an interest rate (APR) of anywhere between ~0-28%, depending on the card, compounding daily. If you are paying any sort of interest on your balances, carrying them from month to month, stop reading here. Focus on paying off the balances on the regular and avoiding interest.

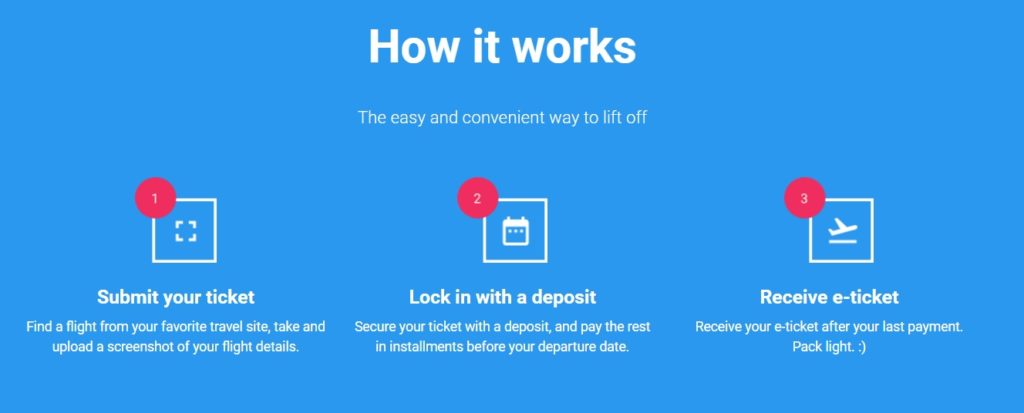

Airfordable

A pretty basic idea, Airfordable requires an upfront deposit for flight tickets. Tickets must be a minimum of $200, per the FAQ. Payments are bi-weekly with the balance due before the departure date. The 10-20% fee is comparable with the other option, FlightLayaway. The website is slick, efficient, and modern.

Airfordable Details

- Fee – 10-20% of flight cost

- Credit Check – None

- Upfront Deposit – Yes

- Payment Term – Bi-weekly

- Payment Method – Credit or Debit Card

- Price Lock – Yes

- Flight Changes – Standard Airline Fee Schedule

- Promotion – $100 Cash Back for First Trip over $1,500

The promotion is an eye-catcher, however $100 is under 7% of the $1,500 minimum requirement. Thus, you would still be paying anywhere from ~3-13% on that flight, which is about $45 to $195. Quite expensive to layaway!

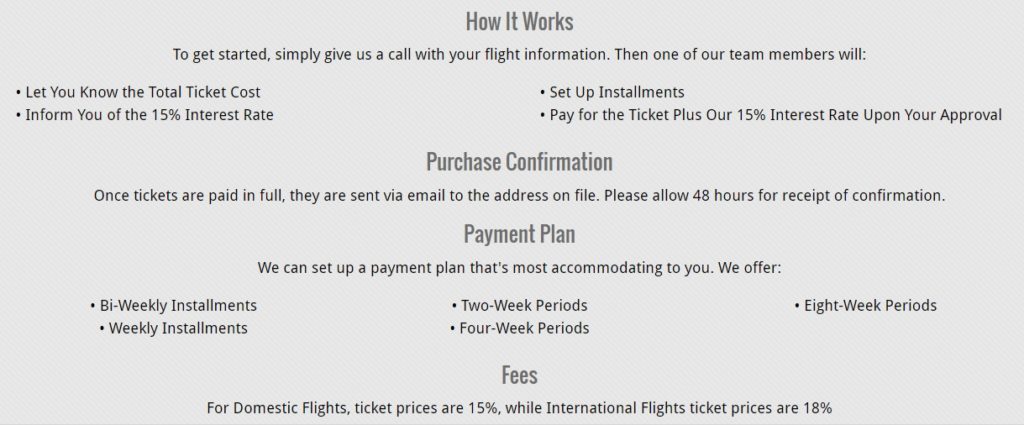

FlightLayaway

FlightLayaway, by contrast, does not appear to require an upfront deposit and rather just pay over time. It also works on cruises, but most business is flights (hence the name). Fees are 15% for domestic tickets, and 18% for international tickets. The website is less clean and professional than Airfordable, and harkens back to the simpler sites of the 90s and 00s. It also clarifies less than Airfordable and does not have a FAQ, making it less easy to navigate and compare.

FlightLayaway Details

- Fee – 15% domestic, 18% international

- Credit Check – Unclear

- Upfront Deposit – No

- Payment Term – Various, over 2, 4, or 8 weeks, or every 1 or 2 weeks.

- Payment Method – Unclear (assume Credit or Debit Card)

- Price Lock – Assumed

- Flight Changes – Standard Airline Fee Schedule

- Promotion – None

15% relative to 10-20% is a crapshoot. Neither site is a particularly attractive option, as explained below.

Analysis & Conclusion

Layaway makes little to no financial sense, especially for what is typically not a mandatory expense (personal flights). The economic analysis is always against paying unnecessary fees and interest. Should you find yourself considering layaway, realize that the only way it makes financial sense is when the fee paid (~10-20%) is more than the alternative cost of financing (on credit cards). An example is below.

Option A: Finance your $1000 flight on credit card (18% APR) which comes out to about 19.7% effective interest rate, annually. This is higher than stated APR due to daily compounding of interest. For the sake of example, let’s round that to 20%, which on a $1000 flight is $200 in interest.

Option B: Use one of the above options, and pay a 20% upfront fee. Again, this is $200 in financing cost.

You would only choose option B, if you believe you would incur that full year of interest cost on the credit card ($200). If you were to pay if off earlier, you would save on that interest! This does not even consider Option B’s time value cost, since option A requires only a minimum payment upfront.

Regardless, this drastic option of financing should be rserved for emergency, mandatory flights only – such as an interview, funeral, etc. Otherwise, stay away from lay away! It will end up costing more in the long run. Focus more on achieving solvency, being able to comfortably covering monthly expenses, and building and emergency fund (for such an occasion).

Featured Image from Unsplash, by 贝莉儿 NG

What do you think of my layway perspective? Have any questions? Let me know in the comments, or reach me directly at TheHotelion@gmail.com! Like my posts? See more here, on TravelUpdate! Follow me on Facebook (The Hotelion) or on Twitter and Instagram: @TheHotelion

came across this in optiontown.com But as you point out there is no free lunch. There is always a cost of not paying your bills fully.

Very intriguing. Never thought of layaway for flights and this confirms I should not use it!