PREMISE

I haven’t been traveling, but I have undergone a very strenuous property acquisition, and upgrading my living situation to a nice luxury-hotel-like experience has done wonders for my mental health. I found this article from CNBC about refinances falling and interest rates rising and found it quite interesting, having spoken with many friends and colleagues about mortgages and refinancing.

Details

The article is a quick and easy read, with some key points below:

- Mortgage application volume down 3.3% WoW

- Refinance demand down 5% WoW, still up 38% YoY

- Mortgage applications for new home purchases up just 1% WoW but up a whopping 27% YoY

- Average conforming loan rate up 7bp to 3.13%

Additionally, there is a massive demand problem and not enough supply. Makes sense to me, as I’ve been living it! Hopefully in the near future my friends and others would be able to take advantage of historically low interest rates and spur consumption, helping the economy along. For example, our purchase of the current property allowed the previous owners to move and make renovations as well, with the multiplier effect in action!

My Experience

We have been searching for a Bay Area property the last six months or thereabouts, and things have snapped up quickly, usually 5-10% above asking. We lucked into this acquisition at just under list price, and are quite happy with the very favorable rate that we secured at 2.5% for a 10/1 ARM. That actually makes our previous home the more “expensive” of the two, at a 3% 7/1 ARM!

Our lender (a very large national brand-name bank) actually said that they are no longer doing refinances and have bumped up the rates since due to overwhelming mortgage applications and demand, that is taxing the underwriters and operations which have been hit hard by COVID. Our current strategy is to pay off the old house as quickly as possible, since it’s now more expensive. Perhaps we’ll go to Vegas once this nonsense is all over so we can use those winnings towards the mortgage!

We locked in 2.5% back in early July, but after some delay in which we paid some additional fees to the seller, we finally were able to close and are very thrilled to be (nearly) done moving.

Resources

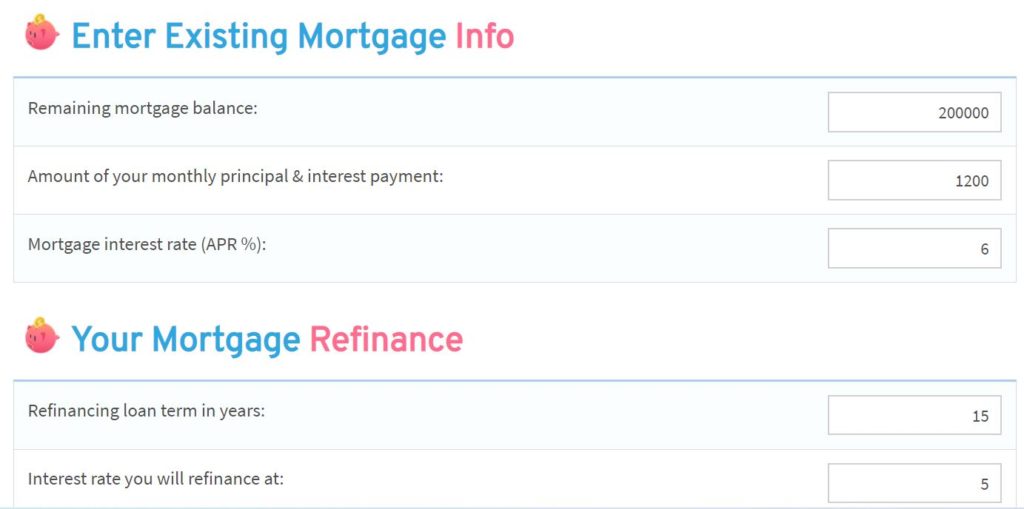

This site – mortgagecalculators.info – is a wealth of knowledge regarding all the financial matters of a mortgage. It would have been helpful to have when applying for mortgages both times I have done so – particularly around the necessary debt-to-income calculations. Understanding the effect of paying early, paying more frequently, or paying more, all can be done with such a calculator.

Very helpful coming back from casino trips or side hustles to throw at the behemoth that is our debt, but getting an automatic 2.5-3% ROI always feels very good. Yes, the debt is cheap, but this is the first time I’ve had such a large obligation and it motivates me to pay it off as quickly as possible. Additionally, as a landlord, their tax savings benefits estimator helps me come tax time.

Conclusion

Mortgage rates are low, demand is high, and property demand is going bonkers. I’ve used mortgage calculators all throughout the shopping process as I compared rates across 10+ banks/mortgage websites, and it is imperative to understand all the fundamentals about what is the largest purchase in most people’s lives.

By using a site calculator such as Pigly, for example, I was able to understand the savings for a 1/8th or 1/4th point for our mortgage, and factoring in other points and additional fees across different lenders. While this particular calculator is for refinancing, it does allow you to easily compare offers by banks that vary in costs and rate.

Why is this travel related, you might ask? It’s not, really, but it is a wondrous feeling every time we come back from a casino / Las Vegas and drop the entire profit towards the principal for our mortgage, getting a guaranteed 3% ROI each year, every year, through interest savings.

Featured Image from Pixabay. Disclaimer: This post may contain affiliate links which, should you click through and/or make a purchase, grant me a commission. Also, I only post in the best interest of my readers. Lastly, thank you for supporting my blog and my travels.

What do you think of my writing? Have any questions? Let me know in the comments, or reach me directly at TheHotelion@gmail.com! Like my posts? See more here, on TravelUpdate! Follow me on Facebook (The Hotelion) or on Twitter and Instagram: @TheHotelion