Credit Card Strategy

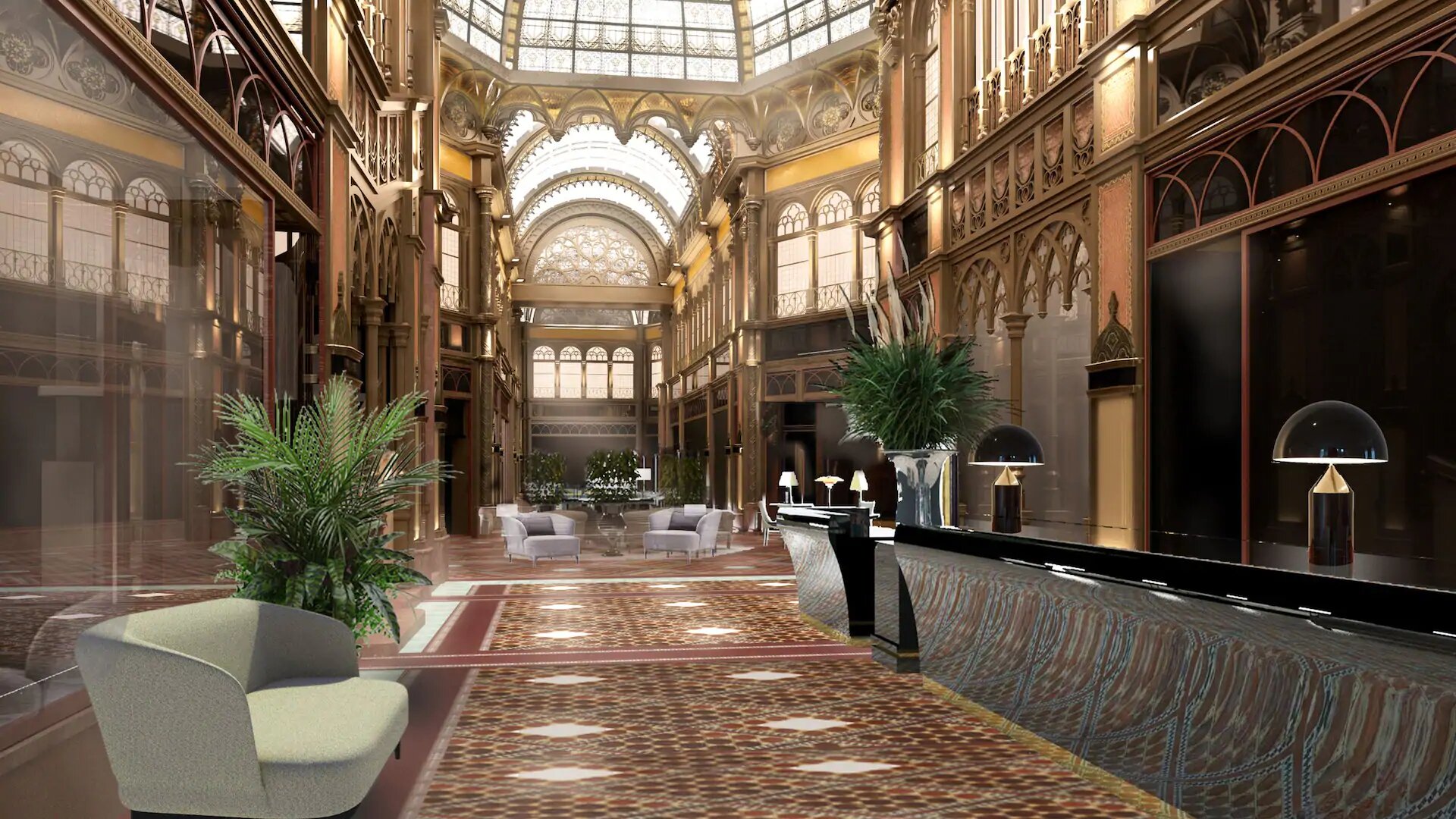

Miles and points aficionados love to get the best travel experience for the least amount of money spent. This hobby is all about being frugal and yet enjoying some of the most stunning travel experiences. It’s about getting the correct miles and points credit card to fulfill your wanderlust.

Business Credit Cards

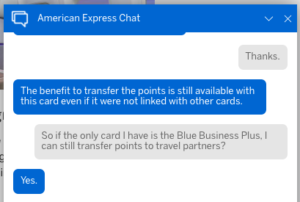

Discussions centering around business credit cards are often dominated by the Chase Inks and Amex Platinums of the world. While these cards have a great rewards system, they also have annual fees. You can offset a lot of the annual fees if you travel frequently. But what if you travel moderately? You can still get a card that gives you some amazing return on business spend. Unlike the Chase ecosystem, this no annual fee credit card enables you transfer points to Amex’s airline and hotel partners.

Blue Business Plus Credit Card

The Blue Business Plus Credit Card from American Express comes packed with an impressive suite of benefits for everyday spend. For a card with no annual fee, it’s a fantastic proposition to keep long term. Here’s a run down of some of the great benefits that come with this card.

Sign-up Bonus

This card usually doesn’t offer a public sign up bonus. Currently, you can earn 10,000 Membership Rewards points for signing up for this card via referral. You’ll earn 10,000 Membership Rewards points after you spend $3,000 or more in the first three months of card membership. Referring yourself is a risky proposition though as Amex is cracking down on self-referrals by clawing back points.

0% Intro APR

For a lot of small businesses, the intro APR is a vital component of making spend related decisions. With this offer, you’ll get a 0% introductory APR for purchases and balance transfers for the first 12 months after you open your account.

Bonus Earning

- 2x Membership Rewards points per dollar spent (up to $50,000 spent)

- 1x Membership Rewards points per dollar spent on purchases thereafter

This is my favorite part about the card. Its benefits are crystal clear and simple.

Additional Cards

Employee cards also have no annual fee. Additional employee cards also earn Membership Rewards points.

Additional Benefits

Along with the above benefits, you also get Amex’s supplementary benefits like Car Rental and Damage Insurance, Baggage Insurance, Purchase Protection, Extended Warranty and Amex Offers. Benefits like Purchase Protection, Extended Warranty and Amex Offers have already helped me save over thousands of dollars when things have gone wrong.

Transfer Partners

If you’re familiar with the Chase ecosystem, you’ll know that merely having the Ink Business Unlimited or the Chase Freedom Card would not be sufficient. You’d need to have a card like the Chase Ink Preferred or the Chase Sapphire preferred in order to have the ability to transfer points to Chase’s travel partners.

However, with the Blue Business Plus Card from American Express, you can still transfer your points to Amex’s travel partners, without having to carry a card that has an annual fee! Amex has a lucrative roster of points transfer partners:

Airline Transfer Partners

- Aer Lingus

- Air Canada

- AeroMexico

- Alitalia

- ANA

- Asia Miles

- Avianca

- British Airways

- Delta

- El Al

- Emirates

- Etihad

- Flying Blue (KLM and Air France)

- Iberia

- Hawaiian Airlines

- JetBlue

- Singapore Airlines

- Virgin Atlantic

Hotel Transfer Partners

- Marriott Bonvoy

- Hilton

- Choice Hotels

The Pundit’s Mantra

This card is a fantastic proposition if you’re looking to have a credit card that earns points rapidly on everyday spend. If you already another Membership Rewards earning card like the Amex Gold Card or the Amex Everyday card, this card adds serves as a great sidekick to still earn 2x Membership Rewards points per every dollar spent on all spending.

Which is your favorite no annual fee credit card? Let us know in the comments section.

Never miss out on the best miles/points deals. Like us on Facebook to keep getting the latest content!

I agree that this is a great credit card. I want to get it but I’m waiting for a signup bonus.

The standard bonus is around 10k membership rewards points. It may go up to 20k, but I don’t ever see the bonus going above that. I’ve seen the 10k bonus around quite consistently via referral.

The BBP does not have a standard sign-up bonus because of its flat and high earning rate. That’s one of the weaknesses of this card. The BBP is a great long-term earner if that’s what you’re after.

The next best option to a sign-up bonus is a referral bonus from a friend who has the card. You can also refer the card to others and earn points if you decide to get it.