If you’ve seen any of my previous posts, you know of my preference for Starwood’s loyalty programs and hotels. However, that does not preclude me, and it should not preclude you from pursuing other options that may not only complement but also accentuate your travelling experience. Several other cards, such as this Chase one, also are important to obtain and keep for various reasons.

WHAT IS THE CHASE HYATT CARD?

This is not going to be a generic review of the Chase Hyatt Credit Card, as there must be dozens or hundreds of reviews of this card and another one would not provide much additional information. I will quickly recap the benefits and summary of the card to catch readers up to speed.

Initial Signup

- Spend $1,000 in the first 3 months, get 2 Free Nights at any Hyatt hotel, valid for 1 year. (Current offers sometimes say $2,000 spend in 3 months)

- Add an Authorized User (AU) for 5,000 Gold Passport Points, enough for a category 1 hotel

- Stay at a Hyatt within 90 days of card opening, get a $50 Statement Credit (varies with application timing)

Note – Chase Hyatt has standard disclaimer of availability if you do not have the card and have not received the bonus in the previous 24 months.

Ongoing Benefits

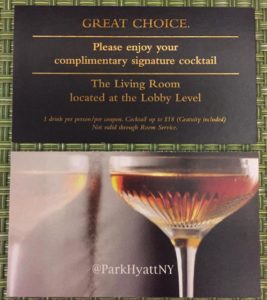

- Hyatt Gold Passport Platinum Status – 15% point bonus, preferred rooms on arrival, elite check-in, late check out, premium wi-fi, etc. Pretty standard benefits and nothing terribly outstanding. Note some specific properties, including my absolute favorite Park Hyatt New York, will go above and beyond for Platinum and Diamond guests – with special amenities such as discounted spa treatments, free drinks, breakfasts, etc.

- Card specific – 3x points at Hyatt, 2x restaurants and travel, 1x everything else. No foreign transaction fees, travel coverages, again, pretty standard

Annual Cost Benefit Analysis

- 1 Free Night per year (Category 1-4), up to roughly $200-250 value.

- Annual Fee $75

The Chase Hyatt is standalone one of the best cards and worth keeping annually (along with IHG), with its yearly perk (one free night) outweighing the cost of its fee ($75). Having just received mine and redeemed it without any problems (you can do it online!), I am very much looking forward to my free stay.

.

ON TO THE MATCHING!

This post focuses on why Chase Hyatt is the best status matching card. It all starts with the key benefit of automatic Hyatt Platinum.

Hilton: Typically once or twice a year the hotel chains have a promotional period where they will try to steal loyal customers who have status at other chains by offering status matches. This year, I was able to take advantage of one of the promotions, matching my Hyatt Platinum status provided by this card to Hilton Diamond – their highest tier! This qualifies me for elite service at Hiltons, as well as excellent breakfast at each stay. I believe the matching required one previous stay (on the Hilton side) to show that I have in fact stayed at the chain previously.

IHG: Another I was not quick enough to take advantage of was the IHG matching promotion. Upon introduction of their new highest tier IHG Spire Elite, I have read of others being able to match their Hyatt Platinum status to this new tier with IHG. Hyatt also participated in this matching earlier in the year (starting in November 2015) but quickly limited it to matching Hyatt Diamond for SPG Platinum. Previously I read of others matching their Hyatt Platinum to Hilton Diamond, then from Hilton Diamond to Hyatt Diamond. Incredibly ingenious and I am all to sorry I was not quick enough to act.

Matching Program Notes

However, since these promotions are limited time only, all chains have since suspended them, and so I remain on the lookout for when they will pop up again. Most companies when not offering matches will propose status match challenges – stay a certain number of nights in 90 or 180 days and achieve status. This is especially good for those with work travel or some other reason, as they would already be staying a number of nights. Keep in mind they typically are once in a lifetime status matching offers, from what I have read. Try to plan out your year of travel and maximize the benefit and perks from chains with the most stays during that year. I go where my points take me and feel a bit guilty I have Hilton Diamond but stay primarily at Starwood hotels, especially as my Hilton Diamond status expire next year.

CONCLUSION

Ultimately, the Chase Hyatt card is worth keeping on its own, even if you do not participate in status matching with other hotel chains. Hyatt’s decent portfolio and range of properties is very strong and you should have no problem maximizing the value of the free nights gained from the card. An excellent rule of thumb is restricting the free nights to the most valuable hotels possible. why not try to get the most for free! I spent mine at the Park Hyatt New York, surprising my lady with such impeccable perfection that, as a result, she now barely bats an eye at luxury. When I start with the flagship Hyatt and one of the most expensive and luxurious U.S. hotels, it is rather hard to outdo myself.

As for status matching, the regular chain to chain matchings come up sporadically, so be sure to monitor your favorite blogs (like this one) or the subreddit r/churning, where I spend an exorbitant amount of time. The next post will further delve into niche matching programs with the Chase Hyatt and Hyatt Platinum. It will be more regionally focused but still highly advantageous to participate in.

Featured Image from Park Hyatt Website

Have you matched before? Disagree about this card being the best? Love my writing? Don’t love my writing? Moderately tolerate my writing? Let me know in the comments, or reach me directly at TheHotelion@gmail.com! Like my posts? See more here, on TravelUpdate! Follow me on Facebook (The Hotelion) or on Twitter and Instagram: @TheHotelion

Not sure where you found the information about IHG matching or how it worked for you…As far as I know they’ve refused to match any status for years.. (I tried again the other night with Hyatt Diamond AND Hilton Diamond, and a few years back with Hilton Gold…Every mention I’ve seen online has had the same result.. Very curious.

Certainly. Earlier in the year there were SOME datapoints of using Hilton Diamond / Starwood Platinum to match with IHG Spire. They quickly shut that down, but some were able to make it through. I was not – as that time they restricted to SPG Platinum and I did not achieve that yet. I think this was due to the recent Starwood/Marriott merger – any time something that big happens, with hotels or casinos, all the others relax their matching rules a bit as they try to gobble up as many whales as possible who are departing the sinking ships.

Do you happen to know if this card falls under 5/24?

My understanding is all chase cards now fall under 5/24. Previously it didn’t include these third party branded ones, but I think they’ve changed all of that and now you should be cognizant of your applications.