Is Capital One really mimicking the Chase 5/24 rule for its applications? It appears so! After taking a year off for the most part in chasing credit card offers, my wife and I have been fairly aggressive for the most part to try to stock up some points for some big trips on the horizon. The year off was mainly taken out of necessity at the time in order for us to see if we could somehow climb out of the Chase 5/24 rule that seemed to have handcuffed us recently. Sometime around the beginning of 2017 we basically threw our hands up in the air and said “Screw it!” and decided to be open and available for any offers that came our way. Essentially our thinking was we hit Chase pretty hard years ago in our initial churns and if they didn’t want us anymore due to our hobby…so be it!

Move on and conquer new lands was essentially the approach we have taken over the last 10 months and have been pleased to make use of several offers this year that we may have passed on while awaiting parole on Chase. One such offer was the recent Capital One Venture offer with an increased point bonus of 50,000 points. This issuer hasn’t really piqued my interest over the years and because of that we have nothing with Capital One. Finally, after ignoring them since my foray into credit cards years ago, I figured what the hell? Easy picking as they are obviously “not in our wallet”, so what I envisioned was an easy approval and a quick way to get $500 in travel spend in the near future.

When Reality Rears its Ugly Head

It just so happened that we applied for my wife for the card first at which after approval, I would be in line next to make it a cool grand of travel spend. With a thud that I hadn’t felt in some time as I grabbed a cup of coffee while the decisioning wheel spun furiously, the judgement came through. Denied! A word that we hadn’t seen in some time and the cruel face of reality settled in as I stared blankly at my screen wondering what the hell just happened. How could Capital One, of all the issuers turn us down. Credit score nearly perfect, no debt, loan to asset ratio spot on. Even a quick search of blogs and data points gave me zero direction as almost everything pointed to too many Capital One cards over a certain time period. We have none!

Further investigating the surprise decision, we discovered the ugly side of Capital One which is they don’t “really” have a reconsideration line to call. As a matter of fact their customer service side of things is lacking tremendously when compared to other issuers. But we had to find something out as the response was quite vague and only mentioned that more information would be available in a letter that we would receive in 7-10 business days. In my need now philosophy, this amount of days, business days at that, wasn’t acceptable. My wife quickly got on the phone to their listed customer service line to get a better explanation. Their explanation wasn’t vague as it really wasn’t anything. “we can’t tell you why you were denied as we have no access to that information. Foiled again.

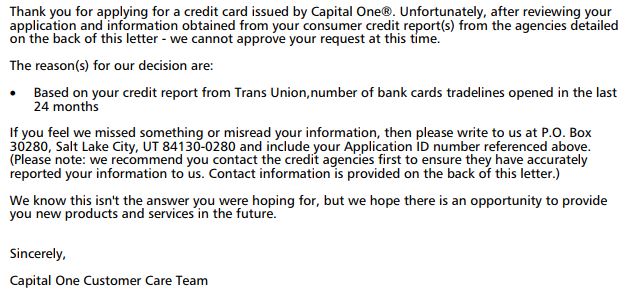

So the wait for the letter began as we wondered what misstep had we taken when applying for this card. To our surprise, an email popped up two days later in my wife’s inbox with a subject “More on your credit card application decision”. Finally we can see the mistake Capital One made in reviewing our application. Instead, we were confronted with the verbiage I could have easily done without.

Crap! This wasn’t exactly the word I blurted out as you can imagine. What happened! I hadn’t seen anything recently to suggest that there was ever a threshold for Capital One cards. I don’t read every blog post that’s out there I’m sure. But I look at almost every headline and nothing was able to satisfy my dismay. My mind went wild as I envisioned everyone jumping on the Chase bandwagon and it sure appears that this is the case. Notice it was the Transunion report but Capital One pulls all three. We even did the automatic reflex of pulling that particular report. Maybe, God forbid, my wife’s identity had been used to open another Capital One card. Happily, this wasn’t the case.

Is This Becoming the New Normal?

And so that brings it to where we are now. It is certainly possible we are over 5 cards if that’s the model Capital One is now using but I have nothing to suggest what threshold they are employing in their approvals. But this I know and everyone needs to be aware, they are checking now and it’s all cards, not just their own. It’s frustrating to see, but at least we didn’t try to open on both accounts. We will for the time being avoid Capital One and Chase and simply look for other opportunities. Has anyone else experienced this recently from Capital One? I would certainly like to know.

I think they have an algorithm that spots people like me who qualify for the top bonuses and zero interest ect., take advantage of their generosity then ditch them like a bad relationship! Fers! Cap One sure as hell won’t earn one red cent from me ever again!

Wish I had seen your post a few days ago. I received the “too many bank cards tradelines opened in the last 24 months” decline last night despite not having applied for a Capital IOne card in years and currently only carrying two cards total.

I know this is an old post, but Capial One is still denying people for having more than 5 credit cards. We’ve only recently in the last year opened 3, the others are cards we’ve had for several years. We have everything you described, perfect credit, paying off balances and we were still denied. Very frustrating!!

Yes , i also got this letter a few days ago. I only have 5 open credit cards with a balance of 2k total on them. This is complete bullsh^*t. But thats fine because i went to over to Citi and opened up an american airlines credit card and now I am happily gaining points on that card instead. #SayNotoCapitalOne

Yup… I got this just two days ago. My email came today with the exact reason. I called the reconsideration line several times and once was put on hold (so hopeful), but I was only given the option to reprocess the application. I updated my salary to include a bonus, but I’m not hopefull that I’ll get any other result than denied. 🙁

I know this is an old post- guess I should have done my research first! I was just denied for “too many bank cards tradelines opened in the last 24 months.” I happen to be right at 5.

Yes, it appears that anything over 9/24 results in an auto decline. Customer service accepts requests for recon, but these requests are really declined without consideration as this is a hard rule, they just won’t tell you directly. If you’ve had 10 or more card accounts opened in the last 24 months, do not apply.

You had to know that other banks would start adopting these types of limitations. Personally, I haven’t been approved for a Capital One card in about 10 years.

Thanks for the warning. I guess people will just have to start apply for only 1 credit card every 6 months with all of these rules.