Updated 1/1/2019

Back in November 2017, there was news that the Citi Hilton cards will become Amex branded cards. There were talks about new product offerings, but no one knew what – or if – there would be any associated signup offers. Well, we know now. There is new newly branded mid-tier Ascend card, and the premium Aspire card.

I am excited about these new options since I am quite fond of the Hilton properties. I’ve had my share of stays at the Hiltons and the Conrads, and I most recently stayed at Hilton Tokyo when I visited Japan. Of course, I also had the unique experience of being denied access to the Executive Lounge. Side Note: Amex has a once-in-a-lifetime restriction, so you won’t qualify for a bonus offer if you had the product before. In other words, you want to make sure you’re applying for the best offer.

Application Link: Referral link

I think of the 3 product offerings this way:

1. Basic (no-annual fee) Hilton Card

The basic no annual fee Hilton card comes with a Silver status at Hilton. It’s free, and it comes with 100,000 bonus offer. If you just want a basic Hilton card, this is an option to consider. It’s a good offer for no-annual fee card, but there aren’t benefits (that I’m interested in) to write home about.

2. The Hilton ASCEND Card (comes with a $95 annual fee)

The Hilton Ascend card is considered a mid-tier premium travel card. It is the equivalent to the Hilton Surpass card. In fact, Hilton Surpass cardholders are not eligible for the Ascend card. It’s considered a name change.

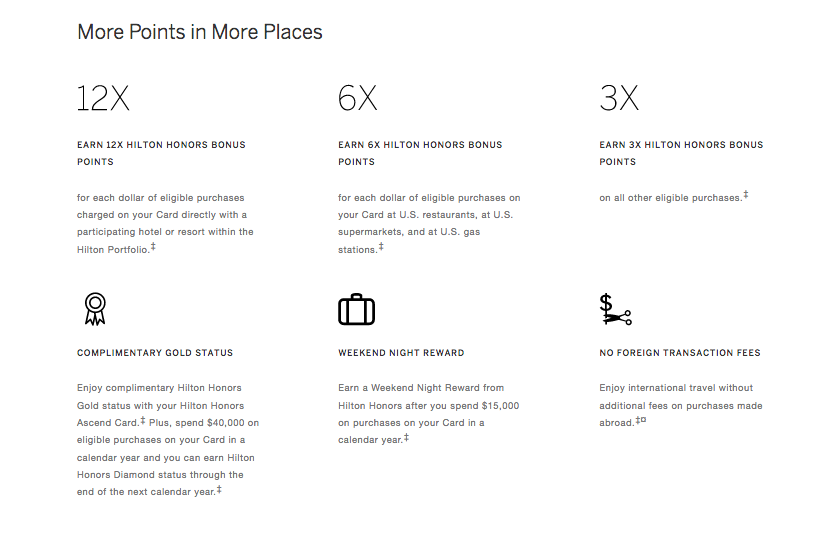

There are the key benefits of the Ascend Card:

I’m going to ignore the x per dollar spend since I like to focus on the concrete benefits.

I’m going to ignore the x per dollar spend since I like to focus on the concrete benefits.

- Complimentary Hilton Gold Status: This is a nice perk. Gold Status comes with complimentary breakfast at certain properties, which makes it worthwhile. Free food is always a nice perk.

- Weekend Night Reward: Available only after $15,000 in a calendar year. It would be nice if a free night is a benefit of the card.

- No Foreign Transaction Fee: A fairly standard benefit of most travel card these days.

- Priority Pass Select – 10 Free Visits: “Get 10 free lounge visits every year once enrolled. Additional passes are $27 per person per visit.” – not bad. I like Priority Pass program.

- 150,000 Hilton points sign up offer: $3000 spend within first 3 months. This should get you 2-3 nights at mid to higher end property.

Overal, this is a standard mid-tier premium travel card. If you want to have a card with lower annual fee, Hilton Gold status, and 150,000 Hilton points, this is a decent offer.

2. The Hilton ASPIRE Card ($450 annual fee)

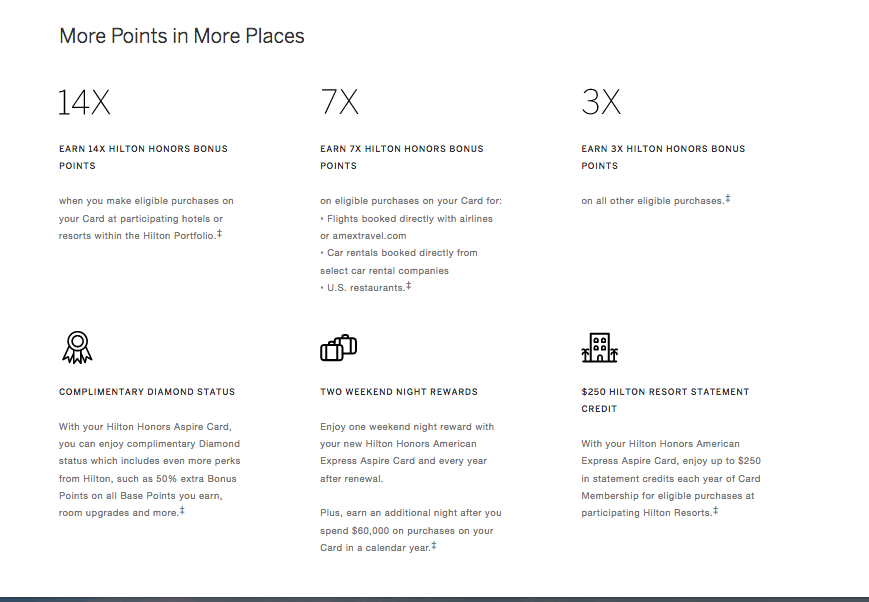

Then, there is the new Aspire card, branded as the premium travel card. As a premium card, it comes with more benefits and a higher $450 annual fee. These are the benefits:

You actually have to look at fine prints to see the details of some additional benefits:

Just like the Ascend card, I will ignore the x per dollar spend, focusing instead on the practical benefits.

- Complimentary Hilton Diamond Status: This is the top elite status at Hilton. Frankly, I am happy with the complimentary breakfast benefit that comes with Hilton Gold, but perks like guaranteed access to the executive lounge is a plus. (No more denied access)

- Weekend Night Reward: Amex advertised it as two weekend nights, which is a little deceiving. It’s one free weekend night, and the second night is only available after you meet a particular – and not an insubstantial – spend requirement. A free night can be worth hundreds of dollars depending on where you stay.

- Up to $250 Hilton Resort Statement Credit: This could be handy if you plans to stay at a Hilton Resort.

- 150,000 Hilton Points sign up offer: $4000 spend within first 3 months. Same as the Ascend offer. Given the annual fee, I’m surprised that this isn’t higher.

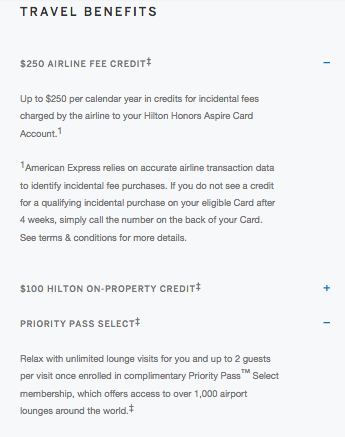

- $250 Airline Fee Credit: Incidental fees charged by airlines

- Priority Pass Select Membership: “Relax with unlimited lounge visits for you and up to 2 guests per visit once enrolled in complimentary Priority Pass”. This benefit is fairly standard among the premium travel cards.

Which Card Did I Decide On?

I decided to go for the Aspire card myself. Since I travel often, the $250 airline incidental credit and the free weekend night easily covers the $450 annual fee. All the other benefits are icing on the cake. I was pre-approved and promptly got this message when I submitted my application. I can’t wait to get it in the mail!

What are your thoughts on the these new cards? If you are planning to apply for a Hilton card, which one are you going for?