Over the past month, my wife and I applied for a total of 7 cards, collectively. I applied for 3 cards, she applied for 4.

For those of you that have never heard of an “app-o-rama,” the concept is pretty simple: apply for multiple cards within a few minutes to give yourself a better chance of being approved. When you apply for cards within seconds of one another, most of the time, the hard inquiries won’t hit your credit report before the next bank pulls it. Some say that this method of applying for cards is dead, but I’ve yet to run into any issues.

Also, please note that this post isn’t going to delve into the details and benefits of each card, I’ll simply be reporting application results.

Round 1

I’ve applied for a lot cards over the last 7 years since jumping into this hobby, so my options are slowing running out. Believe it or not, I’ve never had a Bank of America issued credit card, so I figured I would apply for 3.

Bank of America Merrill+ Visa

This is a great no-fee card that comes with a 50,000 point sign-up bonus after $3,000 of spend in the first 90 days. these points are good for up to $1,000 in airfare. Unfortunately, this bonus is now only available if you call Bank of America at 866-751-1257 to apply.

Results: Pending – Approved after calling reconsideration.

Bank of America Alaska Airlines (Personal)

In the past, this card has been extremely churnable. I regret that I didn’t apply for it sooner. The bonus was 30,000 Alaska miles after $1,000 in spend within the first 90 days.

Results: Pending – Approved after calling reconsideration. I was able to get both cards approved in 1 call, but I would reccomend calling once for each card.

Bank of America Alaska Airlines (Business)

The business version of Alaska Airlines card also comes with a 30,000 mile sign-up bonus after $1,000 of spend in the first 90 days. Again, this was once highly churnable card, but as of late, BoA has been cracking down.

Results: Pending – Based on other’s results that I read on FlyerTalk and BoardingArea, I opted to wait for my letter instead of calling business recon. There were a number of reasons for this, but it seemed like most had good luck by just giving the system some time to do its thing. About 2 weeks after applying, I received my letter and to my surprise, it said that BoA believed I was a victim of identity theft! I immediately called business reconsideration and discussed the situation. I told them that I did in-fact apply for this card and that I would like my application to be reconsidered/reopened. They said they could not reopen the app and that I would need to reapply. After getting the same answer from 2 supervisors, I asked if they would remove the hard inquiry from my credit report since they labeled it as “fraud.” What I didn’t tell them was that the inquiry had already combined with my other 2 BoA pulls from that day. They agreed to remove it, and as expected, it removed all 3 inquiries 🙂

Round 2

This round of apps was for my wife, who before applying, was at 4/24. She has also had a number of cards over the years and was also running out of options. Given that we only had 1 app to give, Chase was first…

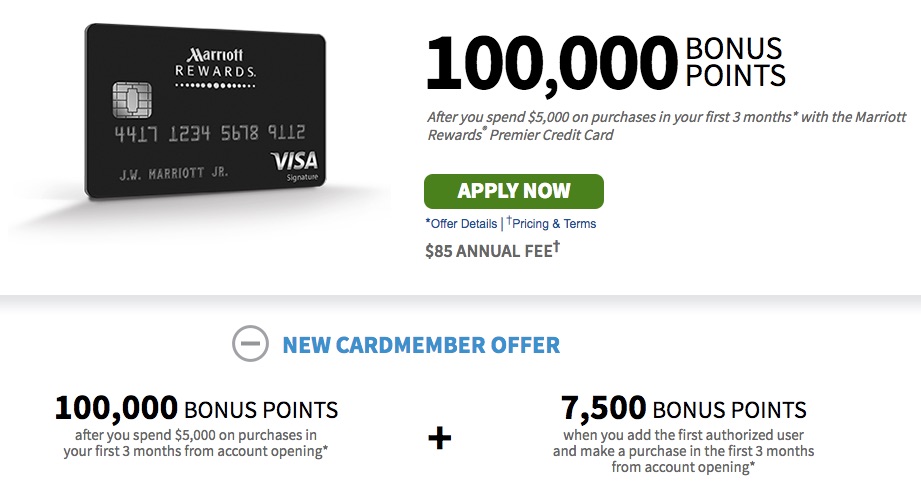

Chase Marriott Rewards Card

With the 100k sign-up bonus on this card, I couldn’t resist the opportunity to to cushion my wife’s Marriott/SPG account. The $85 fee wasn’t waived for the first year, but we plan to keep this card longterm given the free annual night.

Results: Pending – Approved after reconsideration call and moving some idle credit from another card over to this one.

American Express SPG (Personal)

We’ve been holding out on applying for this card for my wife for some time. I’ve had it for a few years now and put almost all of my non-bonus spend on it when I’m not trying to reach minimum spend on another. Seeing as how this card will most likely be gone/rebranded in the near future, we decided to give it a shot. We applied for the 35k offer with $5,000 in spend to get the full bonus.

Results: Auto-Approved.

Bank of America Alaska Airlines (Personal)

Since this was such an easy bonus to get, we also got my wife this card with the 30,000 Alaska miles bonus after $1,000 in spend within the first 90 days.

Results: Auto-Approved

Bank of America Asiana Airlines Card

I wasn’t anticipating that she would be approved for this card with a 30,000 mile sign-up bonus, but it was a freebee since we already applied for another Bank of America card moments before. As mentioned earlier, when you apply for 2 BoA cards in the same day, the hard pulls are combined (in most cases).

Results: Denied – Waiting on the letter, but it hasn’t come. Will update after recon call.

Final Thoughts

All in all, I was happy with these two app-o-ramas. We were able to get approved for some good cards that will help with upcoming trips. One lesson I learned: watch out for Bank of America’s tricks. I’m still not sure why I was approved for 2 cards and the third was flagged as “fraudulent.” If you’ve applied for a few cards recently, feel free to post some data points below for fellow readers.

Which website or where do you monitor your credit? I noticed you knew the inquiries had combined for the BofA, how did you check that?

I use Credit Karma. It’s free and pretty reliable. They will show you both Transunion and Equifax data/scores.

You’re correct in that business apps don’t count toward 5/24 in most cases, but the point of this application round was to stock up on SPG, Marriott and Alaskan points for a trip to the south pacific. Plus, we already have a couple of Chase Business cards each and it would have been a very tough recon call. If you’re wanting to stock up on UR points, then go for the Ink first.

Out of curiosity, on your wife’s apps, why not apply for a Chase business card before the personal? My understand is that they are subject to but don’t count toward 5/24.

You’re correct in that business apps don’t count toward 5/24 in most cases, but the point of this application round was to stock up on SPG, Marriott and Alaskan points for a trip to the south pacific. Plus, we already have a couple of Chase Business cards each and it would have been a very tough recon call. If you’re wanting to stock up on UR points, then apply for the Ink first.