A few weeks back, I wrote about how I booked my second Maldives trip in two years. I primarily leveraged the Hilton Aspire card to bank free night certificates and book premium properties in the Hilton portfolio. While the Hilton Aspire card is a fantastic card for people who stay frequently at Hilton, it may not be for everyone, given its $550 annual fee. If you’re looking to save on annual fees and simply dip your toes, then the Hilton Honors card is a great starter card.

HILTON HONORS CARD

I started dipping my toes into the world of miles and points in 2012. I had corporate travel each month, which meant that I had to stay at an Embassy Suites, given its proximity to my office. That’s when I first picked up a co-branded Hilton Honors card by American Express. If you’re looking to get started and want some points to book your Hilton stay, then the Hilton Honors card is a great option.

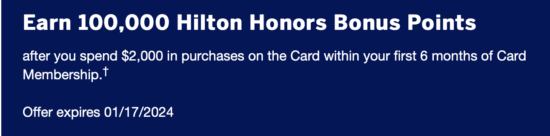

100,000 BONUS POINTS

The Hilton Honors card charges no annual fee. With this welcome bonus, you’ll earn 100,000 Hilton Honors points after you spend $2,000 in the first 6 months. This is really easy to attain as you only need to spend $334 per month.

APPLY NOW FOR THE 100,000 POINTS BONUS

EARNING POINTS

With the Hilton Honors card, your points can add up fast. The card offers some really lucrative bonus categories.

- 7x points for every dollar you spend at Hotels in the Hilton portfolio

- 5x points for every dollar you spend on dining/takeout/delivery, grocery and gas in the US

- 3x points for every dollar you spend on all other purchases

Simply put, this is a great card to use for expenses that you would incur during the month. I really like the 5x points category as it’s pretty broad and covers most of the categories I spend on during the month. If you drive to work and eat out on the weekends, then you can really earn a ton of points simply on those expenses.

Let’s say you spend $3,000 in a month in the 5x category. You’ll earn 180,000 Hilton Honors points in a single year if you put all those expenses on your card.

ELITE STATUS

In addition to bonus points, the card grants you Silver Elite status. You’ll enjoy the following benefits:

- No resort fees on award stays

- Digital check-in and check-out

- Free Wifi

- 20% bonus points on stays

- Free bottled water

- 5th night free on reward stays

While it’s not as great as Gold or Diamond status, it’s a good option if you’re just getting started with the Hilton portfolio. However, you can be upgraded to Gold status if you spend $20,000 on your card in a calendar year.

OTHER OPTIONS

If you’re looking to get Gold status for the breakfast benefit and other added benefits, then the Hilton Surpass Card may be a better option for you. If you’re a frequent traveler like me who primarily likes to stay at premium properties, then I’d highly recommend the Hilton Aspire card.

| Credit Card | Free Night Certificates | Welcome Bonus Offer | Apply Now |

| Hilton Aspire Card – Complimentary Diamond Status | Upon account opening and renewal, another after $30k spend, another after $60k spend in a calendar year | 180,000 Hilton Honors points + 1 free night certificate | Click Here |

| Hilton Surpass Card – Complimentary Gold Status | $15k spend in a calendar year | 170,000 Hilton Honors points | Click Here |

| Hilton Business Card – Complimentary Gold Status | $15k spend, another after $60k spend in a calendar year | 130,000 Hilton Honors points | Click Here |

THE PUNDIT’S MANTRA

Overall, the Hilton Honors card is a great option to get started with earning points in the Hilton portfolio. While I’d highly recommend the Hilton Aspire card, it may not be for everyone, depending on your frequency and style of travel.

If you simply want to rack up a ton of Hilton points, then the Hilton Honors card and the Hilton Surpass card make perfect sense.

Which is your favorite co-branded Hilton credit card? Tel us in the comments section.

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

Under page of TravelUpdate shows 170,000 HH points after click referral offer changed to 130,000 HH points . Watch out fooling!!!! Please read below I tired to claim 170,000 HH points. Deceiful.

Hilton Surpass Card – Complimentary Gold Status$15k spend in a calendar year170,000 Hilton Honors pointsClick Here

REFERRAL OFFEREarn 130,000 Hilton Honors Bonus Pointsafter you spend $3,000 in purchases on the Card within your first 6 months of Card Membership.†

You probably missed out on this post talking about these limited time offers clicking on Jan 17th. https://travelupdate.com/last-day-for-huge-co-branded-hilton-credit-card-bonuses/