I’ve had a fairly standard selection of credit cards in my wallet for a while. However, there have been a couple changes in the past couple months that put me in an odd spot. My decision to downgrade my Chase Sapphire Reserve to a Chase Freedom card is certainly one. Turns out I’d rather save $450 and forfeit the premium travel card. At least for a little while.

I do have a plan for adding a new card to my wallet in a few months once I drop under 5/24. But for now I thought I would go over what I’m currently carrying for Q4 2019.

American Express Blue Business Plus

The American Express Blue Business Plus card has become my new de facto general spend card. Earning 2x Membership Rewards points on every dollar spent, up to $50,000 per year, makes it an ideal choice when a purchase does not fall within any other bonus category. I value Membership Rewards at 2+ cents each, so this is a 4% return, at minimum.

I’d wanted this card for a while, but I had to wait until I could drop another American Express credit card before I could pick it up. Now I am very glad that I have it in my wallet.

Chase World of Hyatt Visa

I’ll happily argue that the Chase World of Hyatt Visa is the best hotel card for every day spend. No other hotel card is worth keeping in your wallet on a daily basis (unless you’re traveling for work weekly). While I do have credit cards from Radisson Rewards, Marriott Bonvoy, and IHG Rewards, these stay in the desk drawer unless I need them for a specific stay.

The World of Hyatt Visa is different. I have been using it is substantially over this year to earn a hefty number of elite nights on my quest to achieve Hyatt a globalist status while spending $0 out of pocket. Hyatt points are among the most valuable hotel currencies out there, so even though I’m often only earning 1x on my purchases, I am at least still getting 1.5 to 2 cents per dollar. Plus elite night credit. The first $15,000 in spend also earns a free Category 1-4 night, so this puts your return at significantly more than 2%.

Chase Freedom (x2)

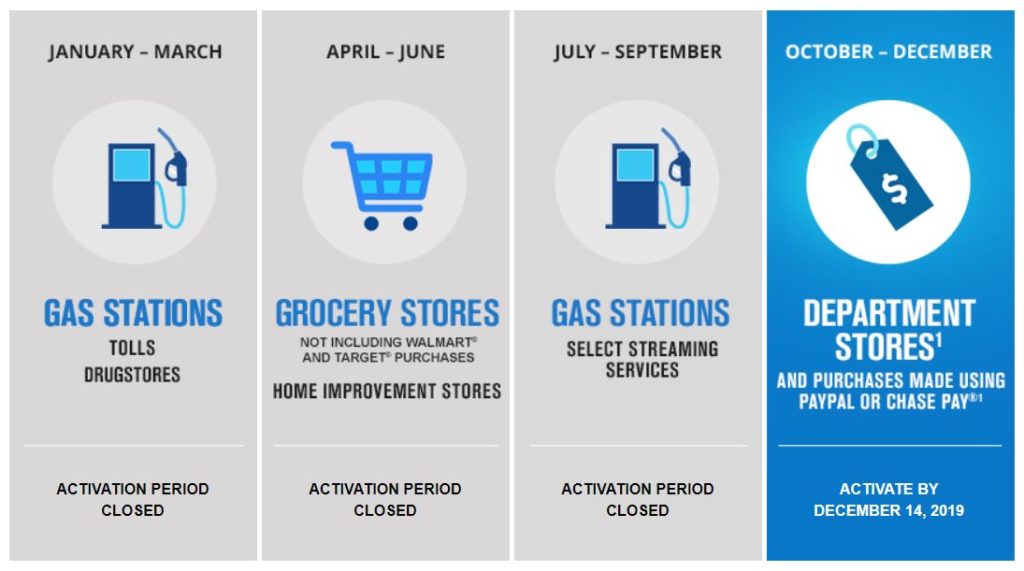

With two Chase Freedom Visa cards at my disposal, I’m ready to hit Q4 2019 hard and earn 15,000 ultimate rewards points for just $3,000 in spend. The Chase Freedom has rotating 5x bonus categories, and the Q4 2019 categories include:

- Department Stores

- PayPal purchases

- Chase Pay purchases

With PayPal as a bonus category, it’s going to be very easy to max out the spend, given the number of merchants that are payable by PayPal.

Hilton Aspire Card from American Express

Without a Chase Sapphire Reserve or American Express Gold in my wallet, the remaining best card I have for restaurant spend is currently the Hilton Aspire Card from American Express. It earns 7x Hilton points per dollar at restaurants, which is roughly a 3.5% return. Not awesome, but not bad at all.

Eating out isn’t a large part of our budget, so I don’t expect to earn a lot of points. Still, Hilton is one of my go-to currencies when Hyatt comes up short, so I can never have too many of Honors points.

Discover It Card

My Discover card is a fixture in my wallet for a couple reasons. Besides offering 5% back at various merchants each quarter, it’s my easy way for grabbing some cash in a pinch. Discover offers the ability to get cashback at select number of merchants without incurring cash advance charges.

It has save me a couple times when I’ve been headed home from the Bay Area and forgot to stick a couple $20s in my wallet. I can simply run by Safeway and pick up $20 for the bridge toll.

The Q4 2019 Discover 5% categories include:

- Amazon.com

- Target

- WalMart

These are gonna be so easy. I’m sure I’ll hit the $1,500 quarterly cap and we’ll pocket $75.

Citi Double Cash

With the new ability to earn ThankYou points with the Citi Double Cash card, I’ve a newfound love for this fairly vanilla card in the wallet. It used to be that 2% cash back was a fine alternative when there really wasn’t any other bonus category to focus on. But 2x ThankYou points per dollar? I’ll take that pretty much anytime.

With a couple fantastic transfer partners (I’m looking at you, Turkish Miles & Smiles), this card will certainly get a larger percentage of spend than it used to.

Conclusion

This quarter is definitely heavy on the rotating category cards for a lot of spend, plus some standard no-annual-fee cards for the rest of our purchases. Travel will be light in the coming months, so I’ve even dropped my Chase Sapphire Reserve. I can really only afford one premium card at a time, and swallowing another $450 annual fee wasn’t really in the cards.

What’s missing from for Q4 2019 wallet? What cards are in your wallet for Q4 2019?

Interesting, I have the same credit cards as you except AMEX blue business. I actually think that the free weekend on the $95 Hilton is worth more than a category 4 at Hyatt for spending $15000.

I love the citi double. I’m going to make the citi double and Hilton business credit cards my main cards starting January 2020.

I’ve gravitated toward Hyatt this year, and the free night is excellent, in my opinion. I like that there is no weekend restriction. But I do see the value in the weekend night if you can use it somewhere that is going for $500+ per night.