Earning and burning points may be one of the most satisfying hobbies a traveler could ever have. It opens up a world of possibilities that may have seemed at one point unattainable. For most it’s just a simple taste that can open the flood gates to more opportunities and more points. But with those points comes more cards, more deadlines and more fees. In order to make this hobby work in your favor at the least possible risk there is exactly one thing that you must be and that is organized.

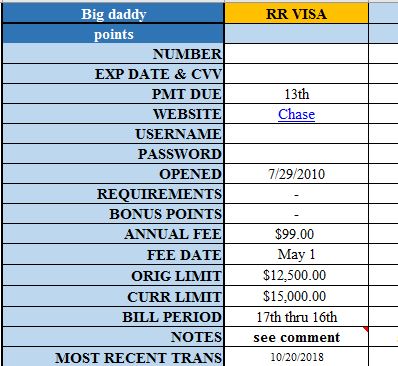

By organization I don’t mean having a nice little credit card holder in a safe place, although that is fundamentally important. I mean the details, everything from the annual fee, the dates in which it will be charged, the credit lines, etc. These are just a few of the important details you should be tracking. Our lives are hectic enough to even consider just keeping up with multiple cards in your head. You must have this information in a simple to use format. Some people just hold onto the original disclosures and refer back to them but the best way to organize this information is using a spreadsheet.

The Simplest Way to Stay Organized

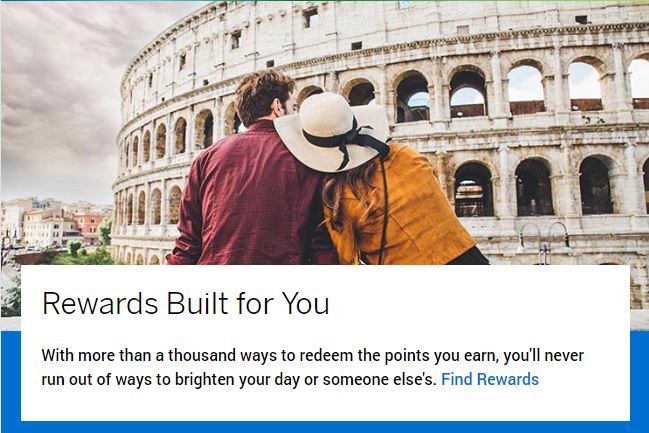

You don’t have to be an excel guru to make a simple spreadsheet, you only need the basic tools. Below is a snapshot of my current system for reference.

I also choose to add notes to each one that goes into greater detail on the amount of points I may receive, loyalty offers, credits, etc. You can essentially set it up any way you choose but having this amount of detail all in one place allows me to stay on top of my data. This can be helpful when you have the, ahem, US Banks out there who refuse to credit back your annual fee because you missed the date.

This is only an option for many of you. However you choose to keep up with your cards, points and dates are up to you, but this is not a hobby that rewards laziness or disorganization. Don’t find yourself upside down in fees and charges due to your own lack of oversight. Do you have a different way or keeping your card information organized? Let us know!

“Live within your means, Travel beyond them”

Joy mention the bank crediting back your Anual fee. I’ve never heard about that. Can you explain?

Yes, so it’s best to not just take the annual fee. I’d say a majority of my cards, not including the upper tier cards such as Amex Platinum, will generally waive your fee if you ponder the thought of cancelling the card. Never go through an automated system on this. Try to get to a retention Dept. At the least many will offer you a possible bonus offer or statement credit to offset your fee. Always try though, worst they will say is no, but I’ve gotten out of countless annual fees.