In August I attended Frequent Traveler University – Advanced in Washington D.C. and I learned a TON from some points and miles legends! From “How to Fly United like a Pro” with Matthew of Live and Let’s Fly to “Manufactured Spending without Leaving Home” with Greg – Frequent Miler, I gathered a wealth of new information and reinforced some skills.

One of my favorite and most helpful tips came from Stefan of Rapid Travel Chai regarding downgrading Alaska Airlines credit cards. In his presentation, he explained how a change from the Alaska cobranded credit card to the BankAmericard Better Balance Rewards card could earn you an easy $100-$120 a year! That may sound like small potatoes, but if that practice can be scaled to 5-10 cards, now we are talkin’ $500-$1,200. Do I have your attention?

Why Make the Change to the BankAmericard Better Balance Rewards Card (BBR)?

Free Money Reward Structure

That’s right. I said free money! BBR cardholders enjoy the following benefits:

- Earn $25 per quarter when you pay more than the monthly minimum on time each month of the quarter

- Earn an additional $5 if you have a Bank of America checking or savings account

- $0 Annual Fee

- Cardholders can have multiple cards at a time

It seems simple, but the kicker here is the $25-$30 per quarter for paying your balance! Simply set up auto-billing on a recurring payment (like cable or utilities), and then set auto payment on your BBR card(s) and you’re all set! That is some easy, passive, yet rewarding credit card action!

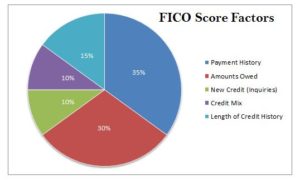

Preserve Credit Lines

Another key reason to product change rather than cancel your Alaska cards outright is to preserve credit lines. The open credit lines will keep that ever important credit score factor – utilization ratio – nice and low and will keep your overall relationship with Bank of America strong!

Repeatedly opening and closing Alaska credit cards might cause BoA to flag you as an unprofitable (i.e. undesirable) customer. You do not want that!

Dump Un-Rewarding Alaska Cards

I love the Alaska Airlines BoA credit card for the initial sign-up bonus. The card offers 30,000 Mileage Plan miles and a $100 statement credit for just $1,000 in spending in the first 3 months! In addition, the card offers a Companion Fare Discount, which some find very valuable (not me, personally). The card has an annual fee of $75, but that is quickly offset by the $100 statement.

That’s all fine and dandy, but long term: I do not love the Alaska Airlines BoA credit card. The earning structure of the card provides me little value since I rarely fly Alaska Airlines. In fact, the number of my Alaska Airlines credit cards out numbers my Alaska Airlines flight taken 2:1! Therefore, I will not pay the 2nd year $75 annual fee.

The option to dump my un-rewarding $75 annual fee Alaska Airlines credit card for a card that offers $120 per year equates to a $195 swing in the right direction!

My Product Change Experience

Even though the card is available for new signups, it seems that many people have experienced issues in converting other BoA cards to the Better Balance Rewards credit card. I researched extensively on the subject (thanks Reddit!) and determined it was possible, but would take persistence!

Apparently I was wrong about the persistence part – the conversion was a breeze!

I called the phone number on the back of my Bank of American Alaska Airlines credit card. A friendly agent answered and I explained that my travel habits changed and that I would no longer benefit from a credit card affiliated with the Alaska Airlines Mileage Plan program.

I mentioned that I was interested in cancelling my cards, unless perhaps there were no fee options available to me for a product change/downgrade.

The agent was more than happy to assist and expressed a desire to keep me as a BoA customer. She proceeded to run through the list of cards available to change to…

Agent – The BankAmericard Cash Rewards?

Me – Hmm, not interested.

Agent – How about the BankAmericard Travel Rewards?

Me – Sounds somewhat appealing, but what else is out there!?

Agent – There is the BankAmericard Better Balance Rewards card, would you be interested in that?

Me – Bingo! Let’s go for it!

And just like that, my two existing Alaska Airlines co-brand cards were converted to Better Balance Rewards cards! Just one call, no resistance expressed by the agent, just a friendly (and rewarding) experience!

Final Thought

It is possible (and preferred) to convert your existing Alaska Airlines credit cards (or other BoA cards) to Better Balance Rewards cards. The conversion will get you away from the un-rewarding long-term features of the Alaska cards, and into a relationship that PAYS YOU!

Others might say that this conversion is “dead,” I am here to tell you that it is very much alive! Post your update, Doctor of Credit – this deal is still going!

Will you be making a call to BoA to take advantage of this conversion option? Have any of you run into issues when attempting this conversion?

Happy Travels,

DW

1 comment