This post may contain affiliate or personal links; as always, thanks for your support if you choose to use any!

SoFi Money is an excellent cash management account for travelers. With no monthly fees and refunded ATM fees worldwide (as long as the terminal bears the Visa®, Plus®, or NYCE® logo, which is most), it is all upside and no downside when it comes to using SoFi Money for international travel. I was really pleased after testing my SoFi money card on a recent trip to Barcelona, where the ATM fees were refunded instantly, as expected.

On top of that, SoFi Money offers $25 (down from $50), just for signing up and depositing $100 into your account. It’s super easy money, requiring no hard pull and a very minimal deposit!

My Experience Using SoFi Money at an ATM in Barcelona

I arrived with a single €5 note in my wallet, the leftovers from a previous trip to Europe. I typically pull out a little cash, just to have available in a pinch, and I like to do so on arrival. However, airport ATMs can sometimes be some of the worst of the bunch, offering poor exchange rates and high fees.

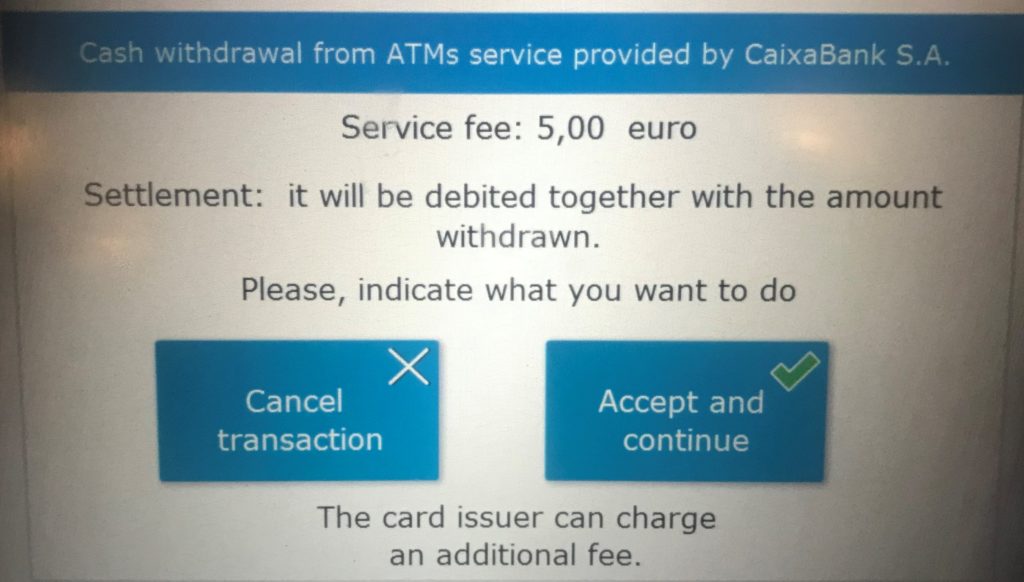

This is exactly what I encountered with the first ATM where I tried my SoFi Money card. The exchange rates was an abysmal 0.837 EUR for 1 USD. Plus, the fee was an incredible €5.00. This was enough to make me move on to the adjacent option. I would assume SoFi would still refund the massive fee, but I decided not to test it.

The next ATM was better, offering 0.873 EUR per dollar, plus a €1.75 fee. This still isn’t a great exchange rate, considering the going rate should be closer to 0.89 EUR per USD, but this should only amount to ~40 cents of loss on the transaction. Saving the €1.75 is fantastic.

I navigated the ATM, electing to withdraw just €20. It should be enough for the small stuff I might encounter, and I could always pull out more now that I’m not worried about getting feed to death with multiple withdrawals.

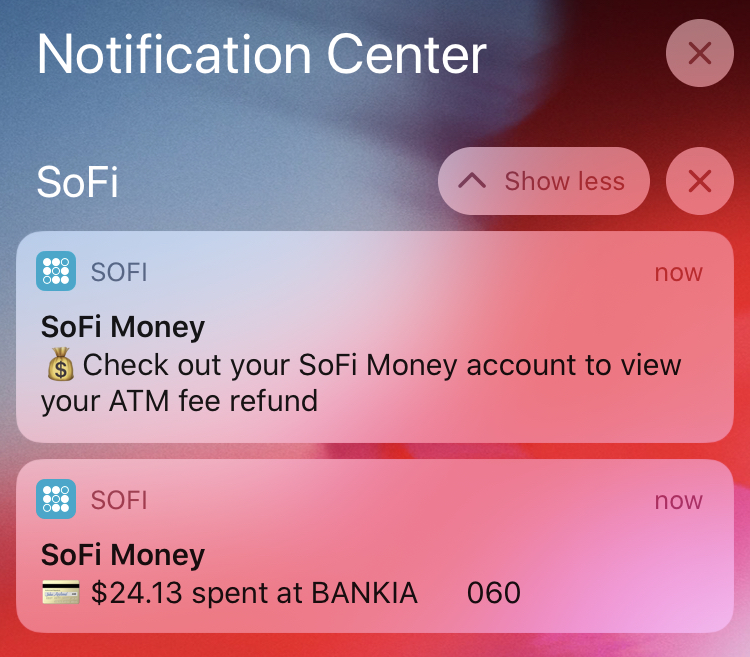

Within a minute after completing the transaction, I received a notification on my phone from the SoFi Money app. Yes, it is that quick! The SoFi app showed an instant refund of $1.94, which is the converted amount of the €1.75 fee. The instant fee refunds make SoFi Money a fantastic travel account and debit card to carry when you’re out of the country.

SoFi Money $25 Bonus Offer

If you haven’t already signed up for SoFi Money, here is the current offer for signing up for a new SoFi Money account:

- Free to sign up

- No minimum balance requirement

- No account fees

- Deposit $100 to earn a $25 sign-up bonus offer

- ATM fees instantly refunded worldwide at ATMs bearing the Visa®, Plus®, or NYCE® logo (which is most)

- Easy ACH money transfer between your SoFi account and other bank accounts

- Current interest rate of 1.6% APY on your SoFi Money funds

Signing up for SoFi Money takes less then 3 minutes. They make it quick and easy to set up a new account, and many major banks will allow funds transfer nearly instantly. If you bank at a credit union, like I do, the process can take a few more days. The bonus typically posts 1-2 days after you make the required deposit.

With the ability to have ATM fees instantly refunded and no minimum account balance or fees, SoFi Money is definitely my go-to travel debit account. Plus, the card just looks snazzy.

I find that it is almost always better to simply take the local currency out of the ATM card. Visa will convert it at the current exchange rate (1% fee is sometimes reimbursed – Schwab). If you allow the bank/ATM to do the conversion, you lose big time.

Agreed. The exchange they offer is poor. The issue is that the screen on both ATMs was confusing, where no/cancel made me wonder if I was going to cancel the whole transaction.