‘Limited time offer’ is probably the most eye catching headline for miles and points lovers. It attracts attention, starts a dialog and often leads to heated discussions. Let’s break down what these offers are and which ones you should really opt for.

If you refer to my very first post on this blog, you’ll see that I often talk about using your own discretion while signing up for some of the best miles and points credit card offers. A lot depends on your location, airline availability at your local airport and your choice of hotel benefits.

So why do limited time offers on credit cards garner so much attention? Are they all just hype? Let’s have a look.

Buyer behavior

Credit card companies have marketing departments which focus solely on customer acquisitions. Their incentives are determined by a combination of factors, with one of the primary ones being new customer sign ups. They are incentivized to have as many people sign up for the card as possible.

Credit card companies know that buyer behavior is often irrational. Credit card bonuses need to be looked at as rebate programs. When you spend x amount of dollars, you get certain benefits to which you can ascribe a dollar value.

Limited Time Offers

We usually see two types of limited time offers. One of them is with a specific end date, while another one is open ended. The open ended ones are trickier because they often don’t have an end date and can be pulled at any time. One such recent offer was the Capital One Venture 75,000 Miles offer before the end of 2018. It got pulled eventually without any announcement of an end date. Delta recently had a 75,000 miles offer on the Delta Gold Sky Miles Card from American Express with an end date of February 20.

Creating the urgency

A lot of times we see offers disappear after an end date, only to return after a while. This could probably because the team didn’t meet its sales target and wants to reintroduce the offer to attract more credit card sign ups.

Travel Goals

The only factor that should decide if you should sign up for a credit card is your travel goals. I passed the Capital One 75,000 mile offer last year because it didn’t align with my travel goals. Signing up for a limited time offer is of no use if you are just going to let those miles sit in your account merely for the process of accumulation. Miles and points in general lose value over time, so it makes no sense just to accumulate them without having any particular idea about redeeming them.

Referral Offers

A lot of times you’ll see better offers if you use your own referral links to refer a friend. I’ve found this to be true about a lot of American Express offers that I’ve seen through personal referral links.

Shopping Cart Trick

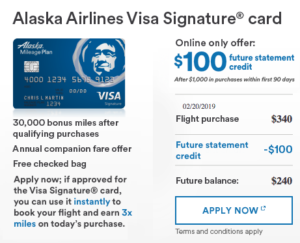

Ultimately it’s all about running the numbers. Marketers run A/B tests all the time. The idea is to run two or more variants of the same offer in order to better understand buyer behavior. Until February 20, 2019, I kept getting offers in the mail for the Bank of America Alaska Airlines card for a sign up offer of 40,000 Miles after spending $2,000 in 3 months. The card has a $75 annual fee.

However, I went to the Alaska Airlines website and started making a dummy booking. After entering all the details, here’s the offer that came up.

So which offer is the better one? Would you rather save on the annual fee with the statement credit or earn the extra 10,000 miles? If your goal is to fly in business class, then those extra 10,000 miles might be worth for you for a small price of $75. If your goal is to fly as much as possible for the least amount spent out of pocket, then the offer in the picture above might just suit you best.

The Pundit’s Mantra

Credit card companies are businesses that run in order to make a profit. It’s ultimately about attaining sales quotas, acquiring customers and meeting targets. In the same way, before you sign up for a credit card, have a look at your personal finances and travel strategy. Given a combination of those two factors, which card would be the most suitable for you? Which offer have you jumped on recently?

1 comment