I Just Hit My First Spending Bonus Ever and It Actually Caught Me Off Guard

Nearly a month ago, I started my first semester of college. After taking a semester off, I’m relieved to finally be back on a campus studying and socializing. Though college is a fantastic experience both socially and academically, it’s unbelievably expensive. Everyone is fully aware of the typical expenses associated with college: tuition, books, room, and board. However, what many forget to include are the incidental expenses including supplies, dorm furniture and decor, and food off campus.

So, what does college have to do with my first ever spending bonus? Thanks to the astronomical cost of higher education, I managed to hit my first ever credit card sign-up bonus. Here’s what credit card I used and how I used it.

Earning 30K Miles with the Gold Delta SkyMiles Amex

Currently, American Express is offering 30,000 Delta SkyMiles (40,000 if you use click this link) after you spend $1,000 in the first three months of opening the account on Delta’s cobranded Amex Gold Card. $1,000, at least to an 18-year-old college kid, is a nice chunk of money. (Disclaimer, when it comes to spending money, I’m amazing at it and I fully accept that fact that I spend way more money than the average college student. Still, $1k is a lot of money.) For many readers, I completely understand how easy it is to spend $1,000 in three months on a single card. So, this post might not be all that relatable.

What motivated me to apply for the card wasn’t anticipating the costs of college but something entirely different. In late December, I opened this card to pay for part of that Air France First Class error fare that was short-lived. The fare was around $500. The Gold Delta SkyMiles Amex offers cardholders a $200 statement credit on purchases made through Delta. At the moment, American Express will offer you a $50 statement credit on Delta purchases. If you open the card when booking a Delta ticket, you can take advantage of the $200 statement credit. Anyway, $500-$200 is $300 plus I’d be earning additional SkyMiles so applying for the Gold Delta SkyMiles Amex was a no-brainer.

We all know what happened to that $500 Air France First Class error fare. Understandably, it wasn’t honored but rather swiftly canceled. I entirely expected to lose my $200 statement credit due to the cancellation. However, I was pleasantly surprised to see that the $200 statement credit was applied to my business class ticket to Mexico I ended up taking a week or so later. My one-way business class ticket to Mexico City from St. Louis ended up costing me just $125 after that $200 statement credit. Additionally, that statement credit was applied just days after my business class ticket on Delta posted to my American Express account.

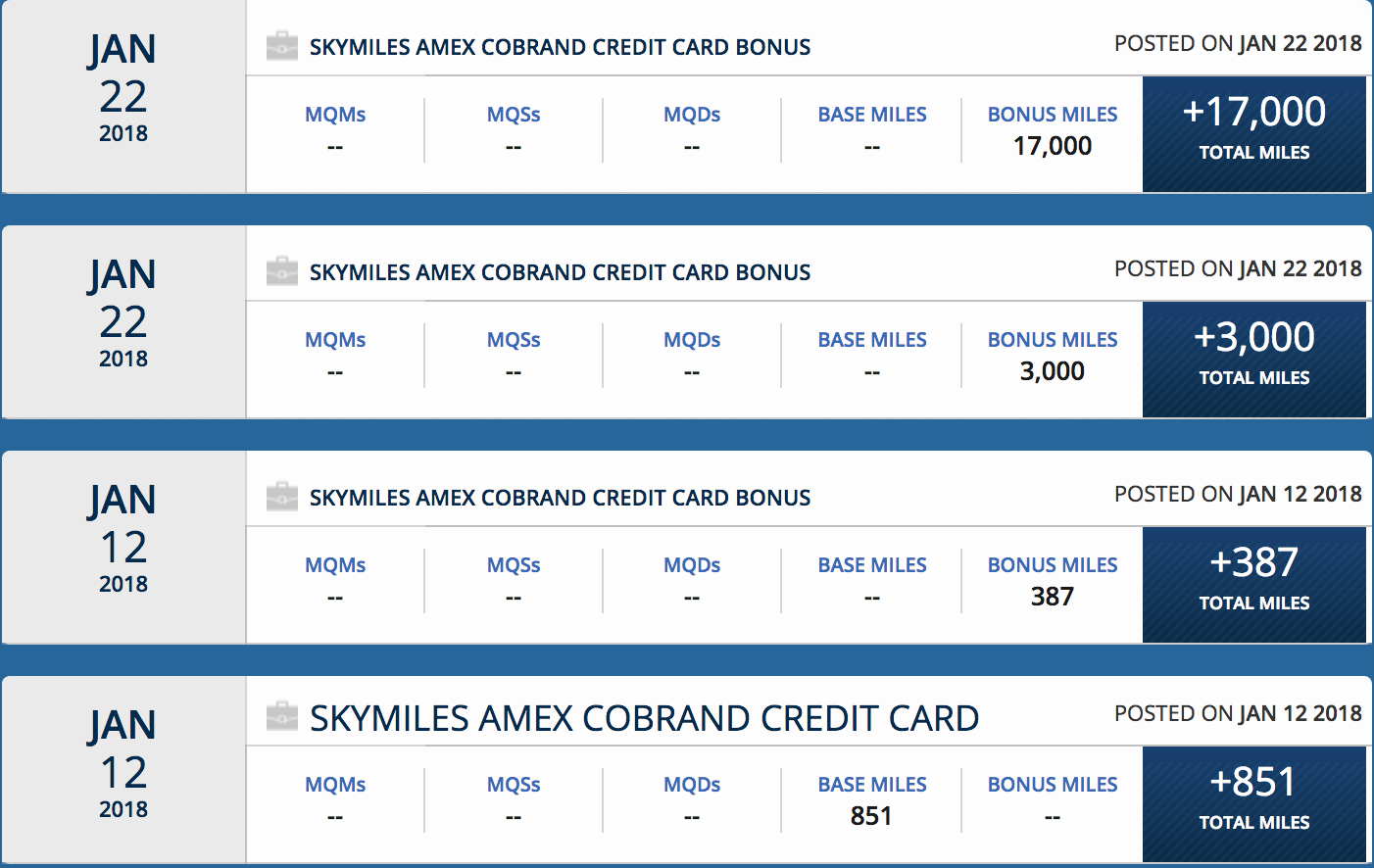

Weeks later, sometime in January, I opened my American Express account dashboard to make my first payment on the card. To my surprise, I had 20,000 additional miles in my Delta SkyMiles account since the last time I had checked. I was caught off guard. How did this happen?

It turns out, I had spent $1,000 in under a month. Just like that, I had hit my first ever sign-up bonus.

The Benefits of the Gold Delta SkyMiles Amex

At just $95 a year, the Gold Delta SkyMiles Amex doesn’t come with a bunch of lux benefits like the Amex Platinum Card. Still, a $95 annual fee, waived for the first year, isn’t much for a mid-range credit card. Additionally, you will get a few benefits that are great for travel on Delta. Here they are:

- Earn 1 mile per dollar spent on everyday purchases — there’s no limit on how many SkyMiles you can earn

- Earn 2 miles per dollar spent on purchases made with Delta Air Lines

- Get your first checked bag free — Saves $50 round-trip

- Zone 1 Priority Boarding on Delta flights

- No Foreign Transaction Fees

- 30,000 Bonus SkyMiles after spending $1,000 in the first 3 months of opening a card — 40,000 Bonus SkyMiles if you use this link

Now, as a Delta Medallion member, the benefits of the Gold Delta SkyMiles Amex probably aren’t that attractive. Even as a Silver Medallion, you receive all of these benefits (aside from the earning rates associated with making purchases with this card). But, if you’re an occasional Delta flyer or elite Medallion hoping to boost the number of miles you earn, this is a fantastic card.

What Can 30,000 Delta SkyMiles Get You?

Delta is notoriously stingy with the value of SkyMiles. In the past few years, the value of SkyMiles has decreased sharply. However, if you plan ahead and are creative, you can still manage to get a lot out of 30,000 SkyMiles.

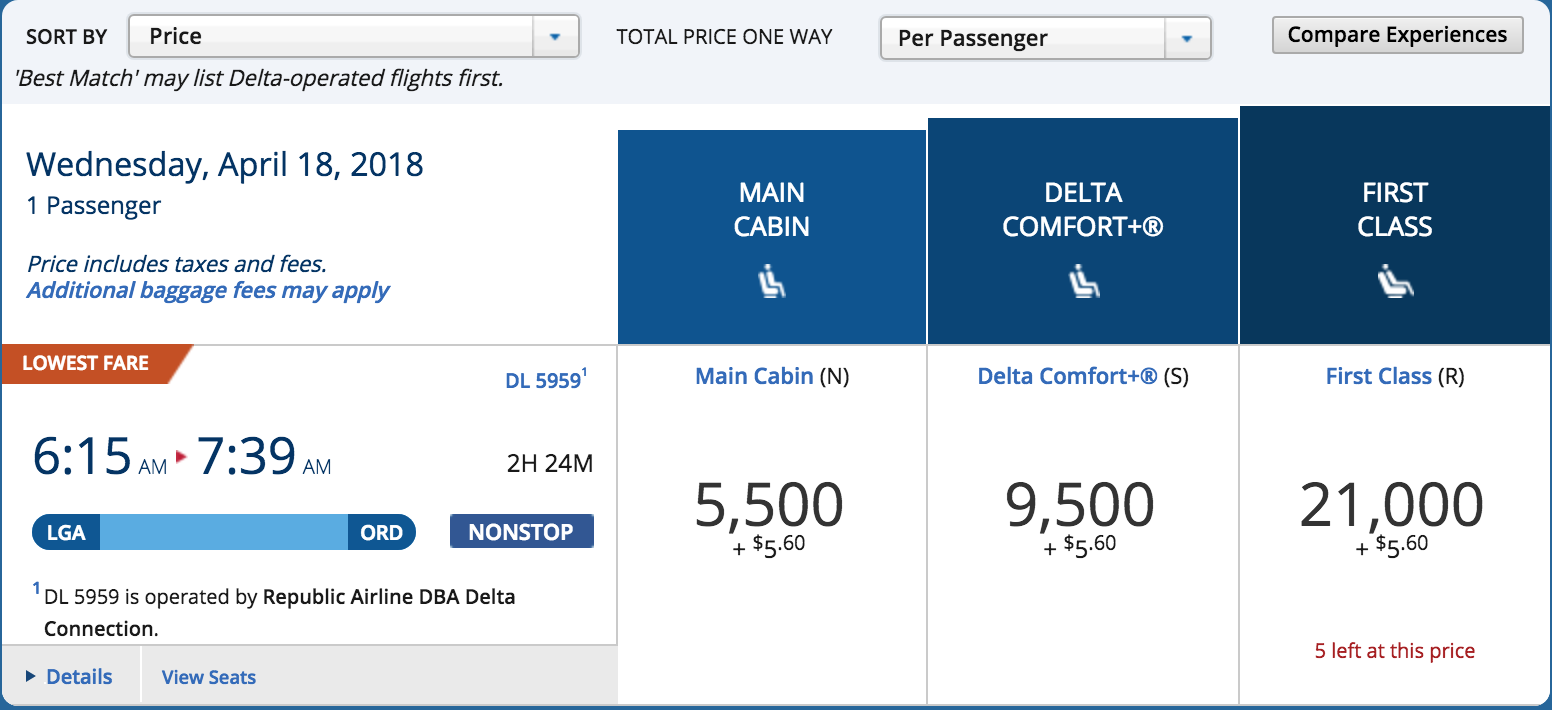

If you want to use your SkyMiles domestically, there are many options that allow you to get a few trips out of the sign-up bonus. For example, you can find one-way main cabin redemptions between New York and Chicago for 5,500 SkyMiles. On that same route, 21,000 SkyMiles will get you a seat in First Class. Though not a super memorable redemption, it’s a great use of miles.

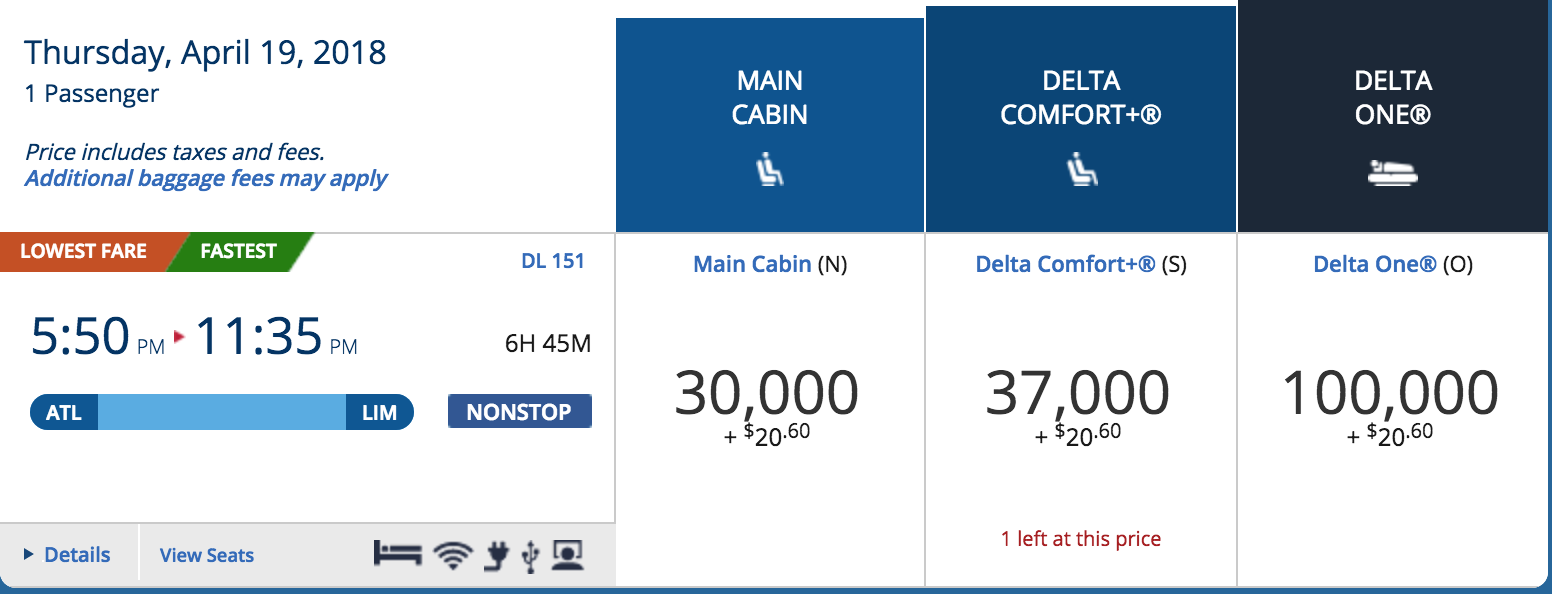

Moreso, a better use of the 30,000 SkyMiles sign-up bonus is a one-way redemption between the United States and Europe. Albeit, you’ll have to spend a few hours in the main cabin, you’ll be scoring a ticket to Europe for 30K miles and $5.60.

Delta doesn’t officially publish a mileage chart nor do they offer luxurious redemptions at a reasonable price point so I’m going to let you decide how you use your SkyMiles. I don’t plan on looking for Air France Business Class space or flights in Delta’s new Delta ONE Suites with my sign-up bonus. Instead, I plan on using them for domestic main cabin redemptions over the course of a few flights. There are dozens of better programs to hoard miles for extreme award redemptions.

Overall: The Gold Delta SkyMiles Credit Card

The Gold Delta SkyMiles Amex Credit Card is a great mid-range co-branded credit card. With a low threshold for the sign-up bonus of 30,000 SkyMiles (40K with this link) (just $1,000), signing up was a no-brainer. I also don’t plan on making Delta my go-to carrier this year meaning I’ll likely lose my status. My Gold Delta SkyMiles Amex will still allow me to earn additional SkyMiles and board with Zone 1. I get that this card might be somewhat underwhelming for many points and miles enthusiasts but it will always have a special place in my wallet after becoming the first credit card to earn me a sign-up bonus.

Do you have the Gold Delta SkyMiles Credit Card? Have you considered the Gold Delta SkyMiles Credit Card?