Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links

American Express is one of my favorite card issuers. The bank offers an impressive suite of credit card products, especially in the miles and points space. In addition, I’ve been continuously impressed by their amazing customer service when things have gone wrong. Amex Offers has been a popular introduction that Amex has made. It provides multiple opportunities to customers in order spend with merchants and earn cash back or valuable Membership Rewards points.

Amex Offers

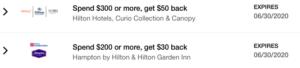

In this post, I’ve highlighted how Amex Offers work and why they’re such a valuable addition to some of the card benefits that Amex currently offers. However, there’s been one thing that has always been a bit of let down. Don’t know if it’s just me, but Amex somehow tends to target me for Amex offers at Hilton properties on my Membership Rewards earning cards instead of the Hilton co-branded cards.

Co-Branded Hilton Credit Cards

If you remember, not that long ago, Amex still had foreign transaction fees for their co-branded Hilton cards. That made no sense whatsoever of a chain of Hilton’s size and global footprint. Thankfully, Amex removed that and now all of their co-branded Hilton cards do not charge a foreign transaction fee.

I frequently keep logging into my Amex account in order to look for offers. Amex runs these types of offers quite often.

On paper, these offers are pretty good. However, when you read the terms and conditions, you’ll find the issue that I have with these offers.

Offer valid only at DoubleTree by Hilton™ and Tapestry Collection by Hilton™ properties in the US & US Territories. Reservations for DoubleTree by Hilton™ properties must be made online at doubletree.com, via the Hilton Honors App or by calling 1-800-445-8667.

The Ideal Scenario

Now, I understand that Amex has its own business contracts and obligations with their partners. However, here’s my argument. Firstly, Amex removed foreign transaction fees from all of their co-branded Hilton credit cards. Secondly, Hilton’s footprint is truly global with over 900,000 rooms spread over a 100 countries. If these offers were valid globally, the value of these offers would immensely increase for many.

Thirdly, a majority of my travel is international in nature. I’m loyal to the Hilton brand and it usually is my first choice while making a hotel booking. Removing the US purchase restriction would significantly improve opportunities to book hotels in cash instead of using points.

Finally, I find Hilton Hotels outside the US to be significantly better than those in the US. Some of my most memorable Hilton stays have all been at Hiltons outside the US.

The Pundit’s Mantra

If Amex were to remove the US purchase restriction, that would signal a significant improvement in the way some of these Hilton branded Amex offers are run. It would open up a plethora of opportunities to make cash bookings at Hiltons around the world.

Also, if you already hold a co-branded Hilton credit card, you can significantly boost your points earning by using these cards for your Hilton stays. Currently, you can earn a sign-up bonus of 150,000 Hilton Points and a free weekend night with the Hilton Aspire Card!

Do you find the Hilton branded Amex Offers useful for your travel patterns? Let us know in the comments section.

___________________________________________________________________________________________________________________

This card is a personal favorite of The Points Pundit. A Welcome bonus of 80,000 Ultimate Rewards points! with the Ink Business Preferred Card by Chase (Chase’s 5/24 rule applies to this card)

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

I’m assuming that restriction is there because they give offers by country… I have one that’s for Hilton properties in Mexico only, although that is on my Gold card and not on a Hilton co brand.

They haven’t been useful as much since I’m not overly loyal to hotel brands, and my hotel pay goes on a CSR.

Hi Jinxed_K,

Yeah, I’ve seen those offers for the UK, Mexico and Hawaii. I use my Aspire card for Hilton stays, just because of the ability to earn buckets of Hilton Honors points. I don’t think it will happen any time soon, but it would be a welcome change if I could use these offers at a Conrad Bali or a Hilton Cartagena.