Affiliate Disclosure: In the interest of full disclosure, The Unaccompanied Flyer earns monetary compensation on selected links. When you click on an affiliate link, I may receive compensation for your purchase(s) through said link. These affiliate links are noted at the beginning of each post. Thank you for your continued support. Full Disclosure

How I’m Building My Credit Score While In College

For the past four years, I’ve become enamored with credit cards, especially travel credit cards. Like many frequent travelers, my obsession with travel credit cards began when I came across One Mile At A Time and View From the Wing. I was amazed at just the thought of being able to fly in the world’s most luxurious first class cabins for next to nothing.

Of course, that clever tagline used by virtually every points and miles blogger comes with some fine print. Yet, for the past two or so years, I’ve managed to do my best to earn points and miles with airlines, at hotels, and through credit cards as an authorized user. Now that I’m 18, I’m ready to begin working my way towards spending bonuses and eventually flights on the world’s top airlines. However, there’s one major issue I completely overlooked. I don’t have a credit score.

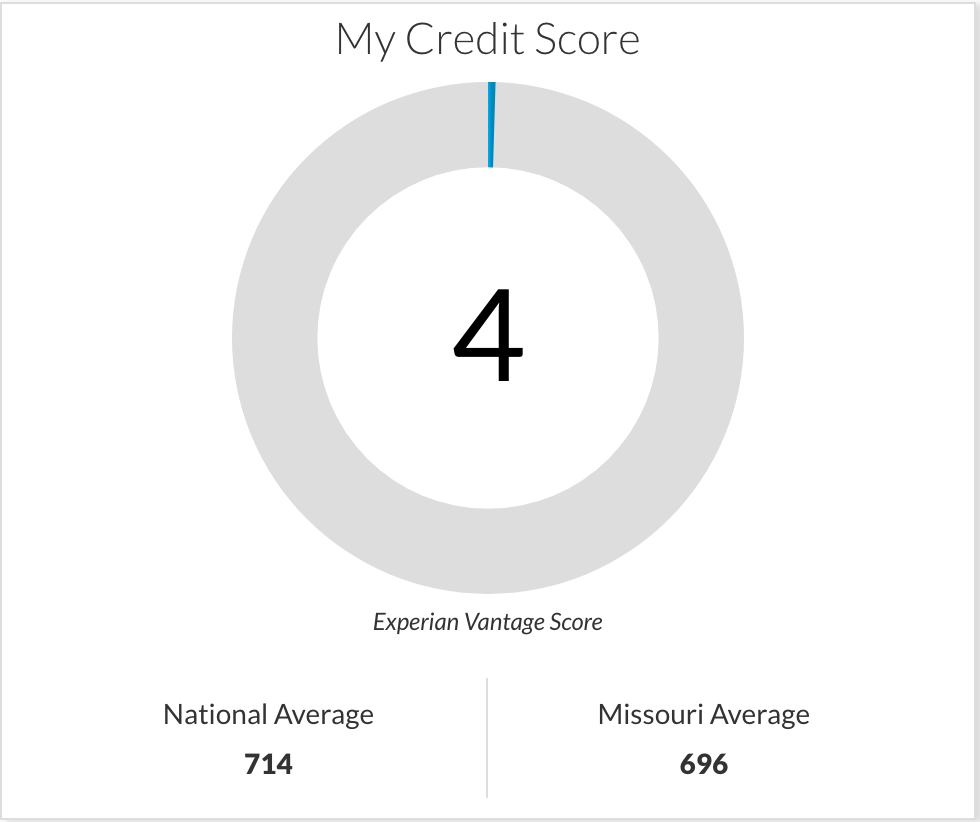

Starting From Scratch, My Credit Score is “4”

I’m not embarrassed to admit that my credit score is a four at the moment. Why am I not embarrassed? Well, for starters, I’ve only been able to apply for credit cards and loans for the past month. Until you turn 18, you can only use a legal guardian’s credit cards or have them co-sign loans. You don’t have your own credit score and you can’t build a credit history.

Last month when I turned 18, I visited a few of the popular credit card review sites and began searching for student credit cards. I thought for sure that’d as long as I applied for student cards, I’d get approval. I reviewed my first application, an application for the Citi Thank You Card for students. Within a minute, I received the bad news. I had not been approved for the card. Moments later, I tried again, this time for the Capital One student credit card. I ended up with the same result. I was not approved.

Not wanting to wreck my non-existent credit score, I stopped applying for credit cards and continued to do some research. I initially thought that the reason I wasn’t approved was based on my income. However, after giving it some thought, I realized that that couldn’t be it. I was applying for student credit cards and most students have similar incomes. Finally, I realized something. I didn’t have a credit score.

Why I Don’t Have a Credit Score

It turns out Experian, Equifax, and TransUnion aren’t waiting for kids to turn 18 to assign them a credit score. Even if that was the case, what would they use to determine their score? It seems counter intuitive and almost cruel but to improve your credit score you need a credit score. 18-year-olds (and non-US citizens) don’t have a credit score. As a matter of fact, it’s not just 18-year-olds. An individual who goes their entire life avoiding credit cards and loans won’t have a credit score. It makes sense, though. If you don’t have a credit history, you can’t get a credit score.

So if you don’t have a credit history, how can you even begin to build a credit score? That’s the question I was faced with after two denials and not to mention the two hard inquiries that would be reflected on my credit history for at least the next two years. I turned to the internet and found the answers.

Short-Terms Loans via Self Lender

I want to thank Self Lender for contacting me directly via Twitter. After my two denials, I took to Twitter and tweeted out my concerns. Other college-aged bloggers and some followers abroad responded to my tweet voicing similar issues. One response came directly from Self Lender.

Self Lender is aimed at helping college students and individuals with poor or non-existent credit scores increase their scores by creating a credit history. In the coming days, I’m going to post a full review of Self Lender’s services but for now, here’s a general overview.

It’s free to sign up for a Self Lender account. Upon signing up, you’ll be presented with a few options regarding your short-term loan. You can adjust your monthly payment or time over which you want to pay off your loan. Once you’ve decided how much of a loan you want and how long you want to make payments, you then submit your application. If you’re approved, you pay a $12 fee. The final step is paying off the loan. Self Lender claims that you should see results in as little as 60 days.

Also noteworthy is that the loan you’re applying for is actually a short-term CD. You get all of your payments back plus any interest once you’ve successfully paid off the loan. Additionally, signing up for Self Lender gives you access to credit monitoring tools.

Be on the look out for the full review of Self Lender. For now, you can sign-up using this link and start improving your credit score today.

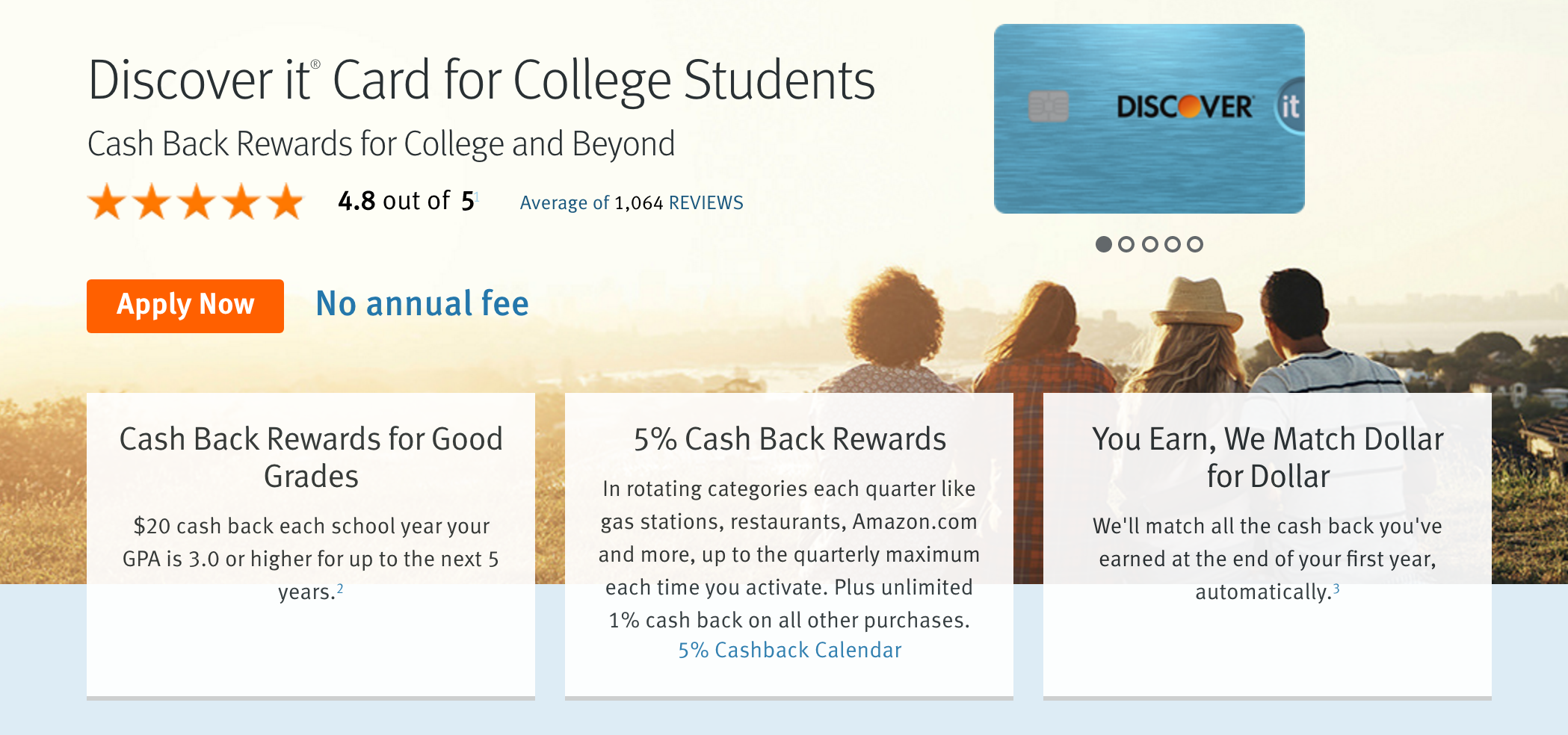

My Discover it Card

I do have some positive news on which to report. There was one credit card for which I was approved. That was the Discover it Card for Students.

I’m going to post a full review of the Discover it card for Students in the coming days. However, I will say that my experience thus far with the card has been phenomenal.

First off, the card doesn’t have an annual fee which is a must for someone on a tight budget (like myself). Second, the interest rate is reasonable.

I’ve received offers in the mail from random banks trying to get me to sign-up for their student cards. One card carried an interest rate of 40.99%. Yes, that’s right. 40.99%. I laughed and recycled the offer immediately. Compare that 40.99% interest rate to Discover’s 20% interest rate.

Moreso, my line of credit isn’t insanely low either. I don’t plan on putting much on the card, however, Discover approved me for a $750 line of credit. Not bad for my first approval. Finally, the card offers cash back for everyday purchases and good grades.

Secured Credit Cards

Secured credit cards are a great place to start if you’re trying to rebuild your credit score. Secured credit cards require that approved cardholders make a security deposit. The deposit varies with the line of credit for which the cardholder is approved. Additionally, the line of credit with secured credit cards is typically a very small amount. Finally, the interest rate on most secured credit cards borders on insane.

Still, though not as desirable as most student credit cards, secured credit cards are an excellent way to build or rebuild your credit score.

Student Loans

Ugh. Student loans. I don’t plan on taking out much when it comes to student loans, however, I will take out student loans. When I do, I will be co-signing the loan with my parents. Co-signing allows me to piggy back off of their credit score and income to get a lower interest rate and larger loan. When I begin paying back my student loans, my credit score will (hopefully) benefit from the loan repayments.

Overall

I get that this isn’t the most relatable topic for most readers, however, I know there’s a growing interest among college kids and recent graduates when it comes to frequent flyer programs and sign-up bonuses. The reality for most of us college students and recent graduates is that access to the cards with high spending bonuses and premium benefits will be nearly impossible. Luckily, time is on our side and if you develop a plan early enough, you should be able to improve your score.

Do you have any recommendations for college students when it comes to credit scores and histories?

Support The Blog

I’ve been avoiding outright asking for ‘support’ and I’ve even avoided affiliate links. However, it turns out that college is kind of expensive. Even with my current income, I will likely have to stop blogging come September due to budget concerns. If you’ve enjoyed this post or other posts, consider supporting the blog. I appreciate your support as I enter the next stage in my life.

Get someone with a good credit score to add you as an additional card holder on an AMEX card. As long as they have good credit and pay the card on time it will carry over very quickly to your credit score. It won’t give you access to instant approvals because they will still see your history but it should boost your score. I did this with my college aged son and within a couple months his score went from none to 750’ish using an SPG Amex with him as additional card holder.

Dan,

Interesting that you brought this up. I was checking Credit Karma last night, only hours after I posted this and my score was up from 4 to 704! I’ve been an authorized user on my parent’s Amex for the last two(ish) years but never thought that I’d ever see any results from this. It turns out, the authorized user trick works like a charm.

Thanks for the advice,

-Max P.

Keep in mind that this only works for some credit card companies. Amex is the only one I know of personally. My Dad did this for me like 30 years ago and it still works today. Apparently AMEX creates a credit profile for each card user unlike other companies that provide the extra card with another name on it but it’s still under the primary card holders credit file for the most part.

You know what’s worse than a college student with no credit score? An international student with no credit score 😉

Good luck with your credit building 🙂

Ugh! I can’t imagine that. If you’re studying in the US, I recommend this https://www.selfscore.com/. I wasn’t able to apply since I’m a US resident but if you’re a student here in the US, it’s perfect for you.

Good Luck!

-Max P.