Bilt launched their Bilt Rewards Mastercard nearly two years ago. It’s been a unique option on the rewards card landscape. A card specifically designed to earn you points on rent? This feature is what makes Bilt unique. And it seems to have worked for them. A niche focus usually works out better than a broad one.

I considered getting the card when it first launched. However, my rent at the time was minimal, and I didn’t consider it worth an application, as I was trying to drop under 5/24 to pick up a few Chase cards. With that well behind me now, I finally decided to pick up the Bilt Rewards Mastercard (personal referral link). Overall, I’ve been pleased with it. It’s unique, but not revolutionary. There are some great upsides and few downsides.

Bilt Rewards Mastercard Pros and Cons

In a nutshell, here are the upsides of the Bilt Rewards card:

- Earn points for paying rent without any fees

- Great set of transfer partners

- Competitive earning rate on dining for a no annual fee card

- Great travel protections for a no annual fee card

- Bonus points every month on the 1st day of the month (Rent Day)

- Fun and engaging Rent Day promotions

The card has some downsides as well, which are the following:

- 1X general earning

- Relatively uncompetitive earning rate on travel

Bilt Mastercard Earning Rates

The Bilt Rewards Mastercard earns points as follows:

- 3X points on dining

- 2X points on travel

- 1X points on rent payments – up to 100,000 points per year (and no transaction fees)

- 1X points on all other purchases

In order to earn points, you must make a minimum of five purchases within the billing period. Given that Bilt is likely taking a small loss on rent charges, I see no issue with this requirement. I usually use the card for a couple dining purchases and a couple other small purchases to round out the required five.

The travel earning rate is uncompetitive. I’d rather earn points with at least a few other cards before I’d opt for 2X with Bilt. However, the 3X points on dining is solid. Sure, you can get 4X with the American Express Gold Card. But that card has a $250 annual fee.

One other bonus is paying for Lyft rideshare. You earn 2X points on Lyft normally (as a travel purchase). But you can earn an additional 3X (for a total of 5X) when you pay with your Bilt Rewards Mastercard.

Paying Rent with Bilt

One thing is for sure: you need the Bilt mobile app. Much of the functionality happens seamlessly through the app, and this includes paying rent. For example, if you need to send a check to pay rent, you’ll need to set up and complete the payment using the app. I do my best to be a luddite, but I do have a smartphone that I use for situations like this.

Bilt has two main ways to pay rent. What you don’t do is simply pay directly with your card, assuming you can pay your rent with a credit card. This nearly always incurs a card processing surcharge. If by some miracle it doesn’t, you don’t need to use the Bilt Mastercard.

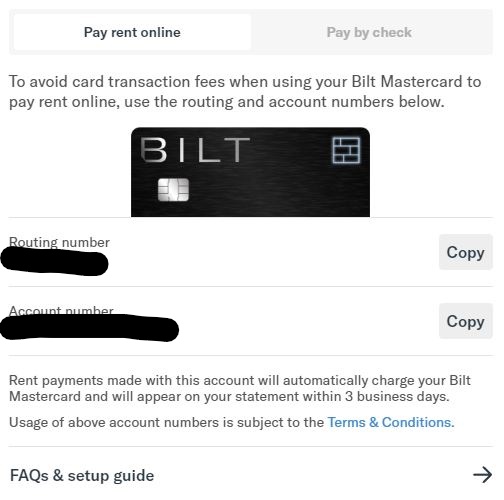

If you need to pay rent online through a bill pay portal, Bilt provides access to a routing and checking number that is attached to your card account. You can find this by logging into your Bilt Rewards account and navigating to Rent. Rather than use your Bilt credit card number, provide these numbers in the bill pay portal. You’ll still earn 1X rewards on your rent payment.

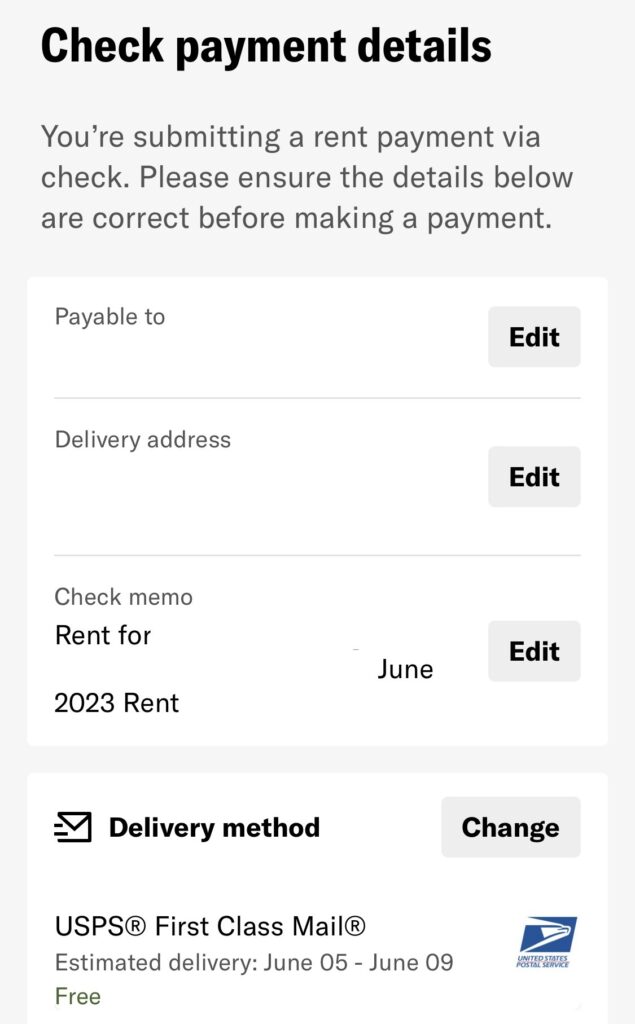

If you need to pay rent by check, as I do, you’ll need to set up your address and payment details in the Bilt Rewards app. Navigate to Pay Rent and walk through the steps. It’s very straightforward. The timeframe on check payment seems to be 4-7 days after submitting payment.

Bilt Dining

I’m not going to go into much detail about Bilt Dining. What you need to know is that Bilt launched a dining program, similar to other dining programs associated with airline and hotel loyalty programs. You can earn 5X Bilt points by paying with a card in your Bilt Wallet. I haven’t mentioned the Bilt Wallet yet — this is a digital wallet you can use through the Bilt app. What this allows you to do is use cards other than the Bilt Rewards Mastercard at restaurants to earn bonus points on dining (e.g. the American Express Gold Card), plus the 5X Bilt points.

The only downside to Bilt Dining is that it has a very limited footprint. It’s currently only available in the following cities:

- Atlanta

- Boston

- Chicago

- Dallas

- New York City

Redemption and Transfer Options

You can redeem your Bilt Rewards in a variety of ways, including:

- Directly for travel through Bilt — including flights, hotels, rental cars, and activities

- To offset rent payments

- Transfer to travel partners

Don’t use your points to pay rent. You appear to get about 0.5 cent per point. It’s a terrible redemption.

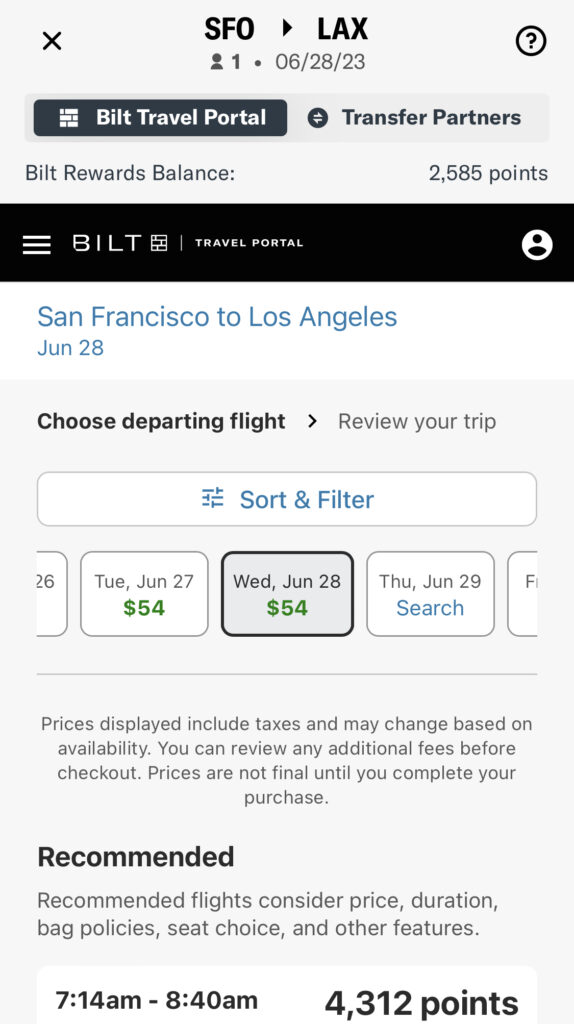

Booking travel directly yields decent value. The Bilt Travel portal gives you 1.25 cent per Bilt point when you use your points to offset the cash cost of a booking.

The best value, however, is likely transferring your points to partner programs. Bilt partners with the following travel programs:

- Aer Lingus AerClub (Avios)

- American Airlines AAdvantage

- Air Canada Aeroplan

- Air France / KLM Flying Blue

- British Airways (Avios)

- Cathay Pacific Asia Miles

- Emirates Skywards

- Hawaiian Airlines HawaiianMiles

- Iberia (Avios)

- Turkish Airlines Miles & Smiles

- United MileagePlus

- Virgin Atlantic Flying Club

- IHG One Rewards

- World of Hyatt

This is a great array of partners, with all airline alliances represented and one solid hotel program.

What’s even cooler is that Bilt lets you search for award flights directly through the Bilt app. This functionality is powered by point.me. This feature isn’t offered by any other card or bank program, making it another unique Bilt feature. You can even easily toggle back and forth between the Bilt Travel Portal and Transfer Partner portal in the app.

Bilt Rent Day Promotions

The Bilt “Rent Day” promotions occur on the first of the month, every month. What’s always offered is double points on everything except rent. The card earning rates jump to:

- 6X points on dining

- 4X points on travel

- 2x points on all other spending

The bonus on dining translates to 11X points at Bilt Dining restaurants. Assuming you use your points with a transfer partner where you can get in excess of 2 cents per mile, this approaches a 25% return. Sure, it’s just one day. But that is excellent.

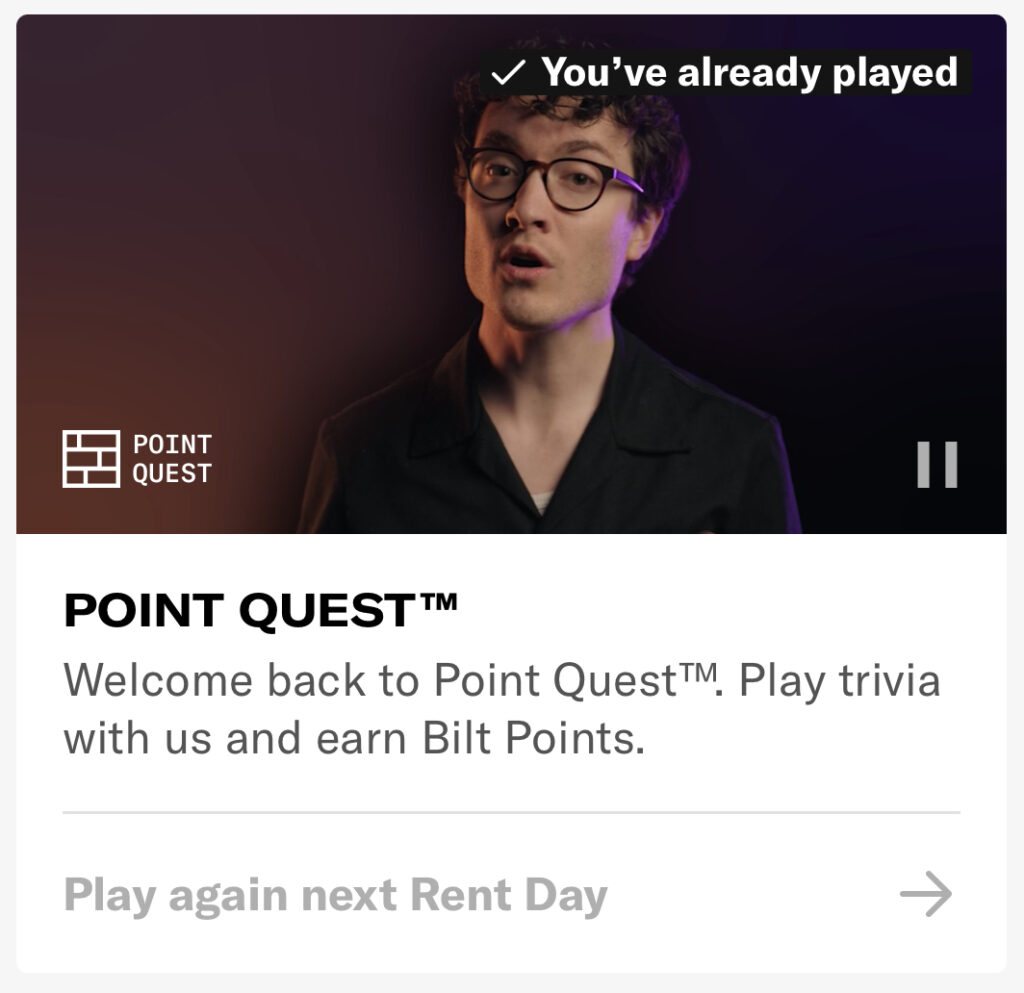

Maybe I’m a sucker for gamified promotions, but Bilt’s are enjoyable. The monthly Point Quest trivia promotion lets you earn points by answering a variety of questions. The more you answer correctly, the greater the total points you earn. You can earn up to 250 points, maximum, if you answer all questions correctly. For those of you who think you can Google the answers, you better be blazingly fast. Bilt gives you 10 seconds per question.

Bilt ran a birthday Rent Day Challenge this year, offering prizes such as bonus points, a covered rent payment, and free flights. It was a fun little game, but the minimum prize is pretty lame. Most people I know received 50 points.

Final Thoughts

The Bilt Mastercard is a niche card, ideal for those who rent. It’s not a gamechanger by any means, but the ability to pay rent fee-free is certainly unique. A primary upside is having yet another flexible points currency to use to top off various airline accounts. I’m slowly accruing a stash of Bilt points for the day I need them for a specific redemption.

Let’s face it: if I didn’t rent, I wouldn’t have gotten the card. Most of the other features are available with other products. The 3X earning on dining is great, but it’s not worth an application just for this. I’ll stick with the Citi Premier. The travel protections are nice, but I have those features on other cards as well. Earning free points on rent is the standout.

Consider the Bilt Rewards Mastercard if you rent. It could be worth it to for that value of those points alone. Here’s my personal referral link, which I’d appreciate you’d use if you’ve found this review helpful.