“Turn your spare change into travel. ”

I’m always excited to receive offers in the mail from the credit cards in my wallet. I’m usually excited when Barclays sends me one as they’ve been quite lucrative when it comes to small total purchases equating to fairly large bonuses, especially the Aviator Red MasterCard. So it comes as no surprise when I received this latest postcard in the mail with those aforementioned words about turning change into travel through a new pilot program.

The offer states: We’re extending to you an exclusive invitation to participate in our new Flight Cents pilot. With a first-of-its-kind twist, Flight Cents rounds up your purchases to the nearest dollar, and turns that rounded up amount into American Airlines AAdvantage miles-boosting your mileage balance on top of the miles you already earn, so you can take flight faster.

Now this is something different, but not completely in terms of how it works. Years ago I recall Bank of America sending out the opportunity to customers to round-up any purchases they may have with the rounded up amount being deposited into a separate account. It functioned very much like a Christmas Savings Club account and allowed you to interest on the rounded amounts. I never took advantage of that opportunity but I found it intriguing since I’m in the financial industry. Here I am several years later and looking with fresh eyes at the rounded up idea.

Here’s how the Barclays Red Aviator offer works:

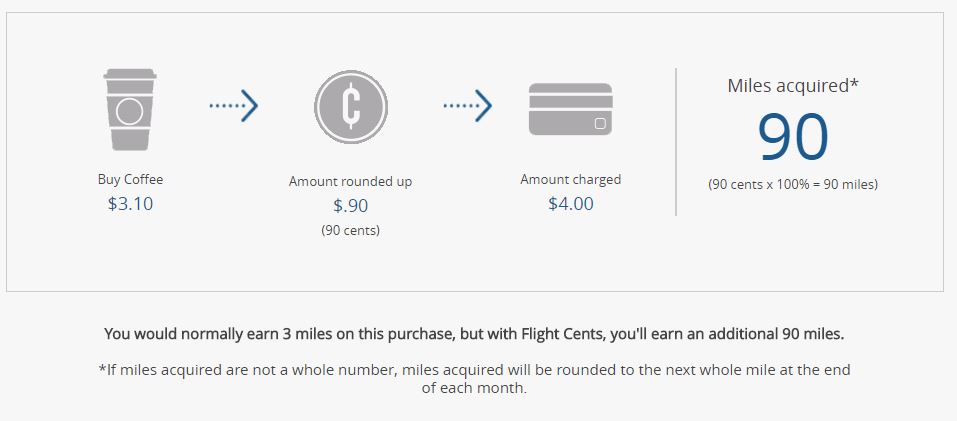

Flight Cents turns rounded up cents into AAdvantage® miles on top of the miles you already earn on purchases. So at the end of every month, we’ll take the total rounded up amount and multiply that number by 100% to determine the total number of miles acquired. You’ll see that total rounded up amount charged to your account each month. See how far your cents can take you.

They offer a scenario that shows how the program will work.

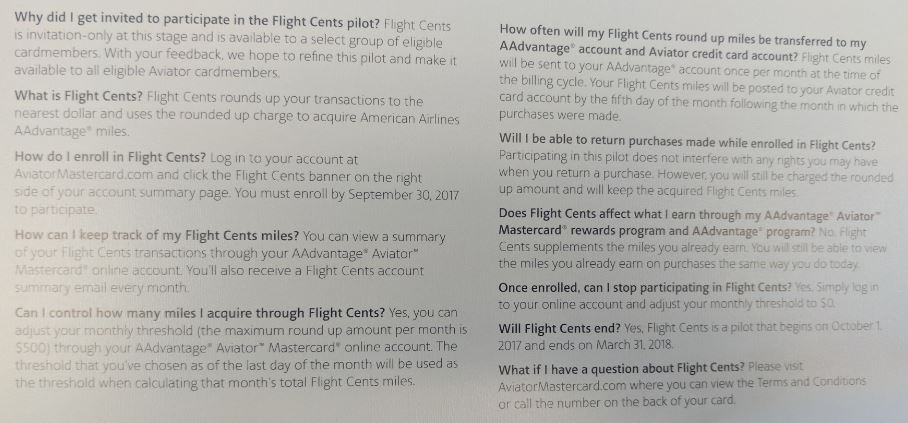

On the surface this looks like a surprisingly easy way to amass miles if I choose to use this card. The offer states that it will run from October 1, 207 thru March 31, 2018. This is a pretty good way to amass some serious miles for only pennies. From their example alone it appears that a 3 point purchase could actually be 93 miles? This seems off the charts and before I get too giddy, I really need to think this one out. I will note that the flight cents are not looked at as single transactions, instead it is a cumulative amount of round-ups. See this snapshot that explains it in detail.

If you read between the lines, it would appear that there are ways to manipulate just how much rounded up cents you could accumulate. For instance, if I only spend on items that equal a few pennies over each transaction, I should be able to increase my miles quite easy. For the most part I rarely use the Red Aviator unless I have a bonus offer come my way for minimum spends as I stated above. But, like the BoA offer I mentioned from years ago, I’m intrigued. Needless to say I’m going to register my card and see what happens over the course of a month or two.

I foresee me trying the minimalist approach and spending very little with room for much rounding up. I would assume from the rules if I routinely charged small amounts, say in the $1.05 range per transaction, I’d be charged $2.00 on my card but would receive 95 AA miles. Not bad at all, especially if you do this over and over. Which leads me to this statement in their FAQs:

Are you sure this is legit? The reference to the “Aadvanatage” cardmembers in the promo pictured above seems sketchy, like a lot of the spam email I get…

Saw that as well. If it’s not legit then Barclays has a huge problem. Anyways, this was also found in my account when I organically visited. Not a link as this wasn’t emailed to me. It was a tri-fold postcard targeted with the last 4 of my Aviator card and an offer within my personal account.

Is there a way to see if you’re targeted besides the email? I just got the card last week.

I was also able to see the same message in a pop-up when I logged into my account. The pop-up was a one time thing but it showed the offer in the lower right side of the account details when I registered for it yesterday. I have not seen or heard of a page that you could simply enter in your info with a response. Seems highly targeted.

this sounds like a win-win for banks and consumer. If it is gamed, the only loser will be the merchant because they often pay on a per transaction basis. The bank likely purchases the point from AA at .1c or less in bulk. I guess I would be a buyer of points all day long at 1c per AA mile….

That’s my assumption as well.