Now that I’m nearly six months into ownership of the AMEX Platinum card I’d like to share a few thoughts on what I do and don’t like about this card. When reading this review, the number one thing to keep in mind is “your mileage may vary.” I’ll talk about what works for me and what doesn’t and whether or not you should get this card based on the type of traveler you are.

Annual Fee

This is the low hanging fruit. Nobody wants to spend a ton of money on annual fees, but it’s the name of the game when it comes to premium cards so the $550 cost of the card isn’t a complaint for me.

Uber credits

Look, getting $200 worth of Uber credits is great, make no mistake about it. But there’s one problem with this perk that I just can’t look past.

Amex deposits $15 into your Uber account each month ($35 in December) rather than give you the $200 up front.

Here’s the issue with this.

I don’t use Uber often and when I do it’s because I feel obligated to use my credits before they expire. Even so, a round-trip ride almost always ends up with me spending more than the $15 credit for that month, which in sum, adds up!

For example, suppose I take one trip per month using Uber to go downtown for a nice dinner with my girlfriend. A round-trip ride in Philly easily costs $25, probably more.

Months 1-11: $25-$15 credit = $10 x 11 months = $110 spent out-of-pocket

Month 12: $25-$35 credit = $10 remaining credit

Total: $110 spent for months 1-11 less $10 remaining credit = $100 net spent per year

If AMEX gave me the $200 up front, I’d probably use Uber ten times a year:

$25 x 10 = $250 less $200 annual credits = $50 spent out-of-pocket

I’m nitpicking, I know, but this goes to show you that you really have to think about the Platinum perks before paying $550 for the card. As I said, “Your mileage may vary.”

In AMEX’s defense, they release Uber credits in $15 increments in case somebody opens the card and cancels it mid-year. This way, when AMEX refunds a prorated amount of the annual fee, they can also recoup the rest of the Uber credits for that year. Makes sense.

Go or No Go: Just okay.

Membership Rewards

If you’re lucky enough to score a 100,000 Membership Rewards offer on the Platinum card, lucky you. I got the 60,000 MR offer and I’m definitely feeling a bit salty.

At the end of the day, 60K MRs are great to have and can save you a ton of money on free flights, especially for short-haul using British Airways Avios.

For example, round-trip tickets are $300+ to Orlando in October. I booked my girlfriend using 15,000 Avios and five bucks. I’ll take it!

Go or No Go: GO GO GO

Centurion Lounge / Priority Pass Access

This perk is a major GO and probably the single most important reason I got this card. Traveling for work sucks, but having lounge access makes it suck a whole lot less.

You can argue that Centurion Lounges aren’t plentiful, and you’d be right. However, Priority Pass lounges do a good job of filling the void in airports that don’t yet have the Lounge. Luckily for me, Philly has a Centurion Lounge, but the only Priority Pass lounge is Minute Suites (boo).

Go or No Go: GO

Platinum Concierge

With your Platinum card, you’ll get access to AMEX’s mighty fine squad of concierges, ready to book reservations and plan trips for you at no extra cost.

This perk is always one that is hotly debated.

Personally, I think the Platinum Concierge is the most underrated feature of this card. I’ve used them now twice to book me a table at EXTREMELY hard-to-book restaurants in the area and they were able to accommodate me. I requested the table even after I looked for myself and saw there were none available — no problem for AMEX.

Also, having the ability to shoot the team a quick e-mail to take care of your plans while you go about your day is incredibly convenient.

Go or No Go: GO

AMEX Travel

Having a portal to book travel is always nice, especially given that you can book using Membership Rewards. While it isn’t the most optimized way to use your points, it can be useful in a pinch when the value is decent.

All in all, while this feature is nice to have, it’s just “meh”.

Go or No Go: No Go

Global Entry / PreCheck Fee Credit

Self-explanatory. The best part about this is the benefit is NOT limited to the cardholder. You can get your spouse free Global Entry!

Go or No Go: Go.

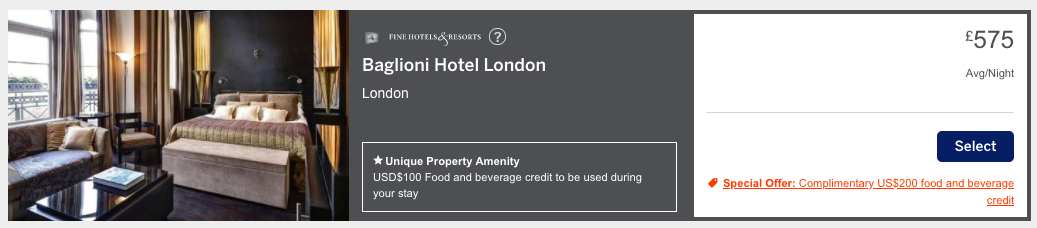

Fine Hotels & Resorts Access

This is the baller perk. If you have money and can afford the exorbitant rates that Amex FHR properties charge, then you’ll love this perk. When you make a reservation with Amex Fine Hotels & Resorts, you’ll receive the following benefits, which are very lucrative:

- Room upgrade upon arrival, when available

- Daily breakfast for two people

- Guaranteed 4 pm late check-out

- Noon check-in, when available

- Complimentary Wi-Fi

- Unique amenity valued at US$100, such as a spa or food and beverage credit

These benefits can nearly recoup the amount of the annual fee, IF you are able to stay at an FHR property. The breakfast alone can be worth a couple hundred bucks.

Go or No Go: For me? No Go. For others? Go.

$200 Airline Credit

This is a good one if your purchase actually qualifies. Here’s the thing, unlike some other cards, the Amex Platinum airline credit doesn’t give you cash back for airfare purchases. The credit is actually only for incidental purchases like baggage fees.

However, there is a way to get around it in some cases. Best way is by purchasing airline gift cards and using those gift cards to buy flights.

I was able to buy two American Airlines gift cards for $100 each no problem, but this strategy doesn’t work for every airline.

Mommy Points has a good post about this, with data points!

Go or No Go: Iffy, but Go.

Hilton Honors / SPG Gold Status

This is a great benefit to have. Staying at hotels without status isn’t the end of the world, but it’s certainly nice to have. At Hilton you’ll get free continental breakfast (when available), free bottles of water (2), fifth night free, and space available upgrades. SPG Gold gets you choice of a welcome gift such as bonus Starpoints, complimentary premium in-room internet or a beverage.

Again, nothing groundbreaking, especially given the scarcity of complimentary upgrades these days, but it’s better than nothing!

Go or No Go: Go.

Should You Get This Card?

All things considered, I still say yes. If you don’t travel much I think you can get enough out of the card to make up for the high annual fee. If you’re on the fence (like I was), do a trial year. Pay the $550, use the hell out of the benefits and see if renewing makes you nervous or happy. I’m still on the fence for renewing, but I have until January to decide.

Another thing to consider is if you’re a Delta flyer, this card is nice because you’ll get free access to SkyLounges when flying Delta. For me, being based in Philly, it doesn’t make sense.

Are you on the fence about the Platinum card? What’s making you hesitate?

Hilton/Marriott status is iffy. When you book through AmEx Travel, they use a third-party like Expedia. That means you don’t get hotel points and the hotel may not even know you’re Gold Elite. They also won’t allow you to add your Elite number when you arrive, saying you received a special rate, so are not eligible for points. Officially, they sold the room to Expedia, not you.

The offset is, you get 5x points per dollar on the stay, which you can transfer to your Hilton/Marriott account if you wish. Still, if the hotel doesn’t know or recognize your Elite status, you don’t get upgrades, free breakfast, etc., so how is that helping you – other than the points? You really need to decide if you want the 5x points or the perks from Elite status. It’s rare you will get both.

You forgot 5x MR points for airfares purchased on airlines.

I just renewed my Amex Platinum and upon review of the T&C’s of the Uber credit, Uber Eats is specified as a valid use. The FHR rates are not necessarily exorbitant. With FHR I’ve enjoyed a 1,200 sq ft villa Four Season Residence in Carlsbad for less than a standard room at the Sheraton. Even the Grand Hyatt Seoul’s rate is the same between FHR and Hyatt’s site, but FHR include the $100 food and beverage credit.

Chase Sapphire provides trip interruption and trip cancellation insurance. The CSP is $95 per year. This card does not provide either. For me, the cost to purchase those insurances negates the cost of the annual fee. Chase for the win!

Don’t forget you can use the uber credits for uber eats. I don’t use uber either but uber eats works well.

Nice point!

” IF you are able to stay at an FHR property. The breakfast alone can be worth a couple hundred bucks.”

Where is breakfast $100/head?

Sorry I wasn’t clear! That would be a couple hundred bucks over the course of a week stay or so.