As we gradually see cities and countries lift restrictions, there’s some positive news on the travel front. If you intend to fly any time soon, you can follow @TSA on Twitter to get the latest updates.

Airline passengers are allowed to wear cloth face coverings during the #TSA screening process. Be prepared to adjust your mask so that a TSA officer can visually confirm your identity during the checkpoint screening process. pic.twitter.com/gmAvptEE1L

— TSA (@TSA) June 1, 2020

Countries gradually lifting restrictions on travel is great news. However, it does seem like we’ll see a second wave of airline layoffs once CARES funding restrictions expire in October. Here’s a quick recap of the stories covered this week.

US Big 3 airline layoffs loom large: After United, it’s Delta and AA

We could see a second wave of layoffs in October once CARES funding restrictions expire at the end of September. United is already making moves and we won’t be surprised if AA and Delta make similar announcements soon.

How I maximized my $200 Amex Credit

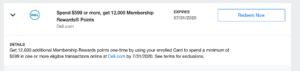

A few weeks back, Amex swiftly revamped many of their credit cards. They offered temporary benefits and credits in response to changing consumer spend behavior post Covid-19. Similarly, they doubled the Dell credit on their Business Platinum card from $200 to $400, split equally between the first and second half of the calendar year.

In this post, I outline the different strategies I used in order to gain maximum value out of that credit. Not only did I save some money, but I earned some valuable miles and points. Just this week, Amex added a new offer for Dell.com purchases which makes this deal even sweeter. Please check your cards in order to see which version of the offer you’ve been targeted for.

After Chase, Amex could make credit card approvals a lot tougher

In this post, I outlined some of the possible responses card issuers could come up with during this recession. It does seem like we’re seeing this pan out as issuers impose new restrictions. After Chase tightened their approval requirements, Amex could well be next, based on what their CFO stated publicly at a recent conference.

Are the new Chase Sapphire Benefits worth the hype?

Chase recently added temporary benefits to two of their most popular cards: the Chase Sapphire Preferred and Reserve. In this post, I analyze the benefits and ask the question whether they’re really worth it. Are these temporary benefits enticing enough to persuade someone to apply for these cards anew? Or are they simply a smart play by Chase that customers don’t jump ship and cancel their cards as customers reduce their overall travel spend.

___________________________________________________________________________________________________________________

This travel card is currently offering a lucrative 60,000 points welcome bonus, for just a $95 annual fee!

___________________________________________________________________________________________________________________

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

No link for the $200 airline credit.

You can refer to these posts for some of the recent data points for the airline credit.

https://travelupdate.com/these-flight-tickets-triggered-my-amex-airline-fee-credit/

https://travelupdate.com/amex-airline-fee-credit-whats-still-working-recent-data-points/