Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links

Just yesterday, I wrote about how Airlines are on the verge of bankruptcy. There’s a possibility that they could go bankrupt as early as May. However, as people self isolate and stay put at home, airline bailouts seem to be imminent. Quite expectedly, they could reignite the income inequality debate that already gaining momentum.

Possible Airline Bailouts

The New York Times and several other outlets have already reported about the ongoing discussion of bailing out various companies, which includes the airline industry.

They’re asking for over $50 billion, the WSJ reports. And carriers like Delta and American are also asking banks for billions in loans. That’s not including the $10 billion that U.S. airports reportedly want, or the unknown amount that Boeing is said to be negotiating for itself and its suppliers.

What’s the biggest issue here? Up until the end of last year, we’ve seen Airlines make a lot of money. However, Airlines have only added more fees and haven’t improved customer experience. On the contrary, they’re cramming in more seats. While Airline CEO compensation has only gone up, airlines have spent 96% of their cash flow over the last decade doing stock buybacks. However, President Trump seems to be supporting these airline bailouts saying “We are going to back the airlines 100 percent”.

This clearly leads us to the elephant in the room. While the average person sees a dip in overall productivity and opportunities, should government assistance be provided to the airlines who raked in record profits but never passed on benefits to their customers?

Income Inequality

Before we make any conclusions, let’s look at the data and how it informs us. This report by Pew Research highlights certain aspect of how income inequality is playing out in the US over the last few years.

- The highest earning 20% of families in the US made more than 50% of all US income in 2018

- US has the highest level of income inequality among all G7 nations

- From 1970 to 2018, median middle class income grew 49% to $86,600. However, median income for upper tier income households grew by 64%, to $207,400

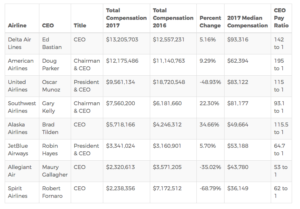

On the contrary, airline CEO compensation has been at its peak. These are stats from 2018, as reported by Skift.

- Ed Bastian received a total compensation of $13.2 million in 2016, which was 142 times the pay of the median Delta worker

- American Airlines CEO Doug Parker was second with $12.2 million in total compensation. AA’s ratio is worse, as its CEO make 195 times the average AA worker

This chart by Skift is quite telling and makes the picture crystal clear:

The Pundits’ Mantra

I strongly believe that good compensation is vital to attract top talent and drive businesses. However, we need to strike a balance. When Airlines have raked in record profits, in-flight experience has only gone downhill. AA’s standards keep falling, whereas United’s response while helping customers amid all the Covid19 chaos can only be described as tone deaf at best.

What do you think about these possible airline bailouts? Do you think Airlines truly deserve these, given the widening income inequality, falling service standards and increasing Airline CEO remuneration? Let us know in the comments section.

___________________________________________________________________________________________________________________

This card is a personal favorite of The Points Pundit. A Welcome bonus of 85,000 Membership Rewards points! with the Business Platinum Card by American Express.

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

In ‘merica profits are private and losses are public. The airlines made huge profits and plowed it all into buybacks which evaporated in the last 30 days. Any one of us could have mismanaged that kind of largesse for much less of the compensation those geniuses get. They will fire thousands of employees, ruining lives, and then give themselves raises, bonuses, or golden parachutes. Now is the time to exact better treatment of fliers and restrictions on executive salaries in return for any rescue. These idiots think they are special. Recent events have demonstrated that they are not.

Or as some may put it: “Capitalism for the poor, socialism for the rich.”

The current president will hand out money to big corporations with little to nothing in the way of restrictions. He certainly doesn’t concern himself about income inequality.

Hi Christian,

Yes, it was quite staggering how wide the divide is. While researching for this post, the numbers I saw were truly staggering. I hope common sense prevails in the long run.

This is trump and republican’s America, fueled by smart, but immoral/corrupt politicians and by uneducated, ignorant, imbeciles who repeatedly vote against their own self interests.

I’m hoping that people realize and pay attention, so that mistakes from the previous recession aren’t repeated.

I 100% support a wealth tax over 10 million. Anyone with assetsover 10 million should pay 5% of wealth tax indexed to escalation.

Any discrepancy between income tax forms and bank loan forms should automatically mean prison i.e trump should be in prison.

Those reforms will take a long time even if they were to pass and a lot would depend on who wins the next election.