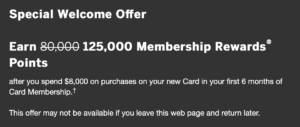

I’ve always had a love hate relationship with the Amex Platinum card. When I first signed up for the card when it carried the $450 annual fee, I simply loved it. Amex has made a plethora of changes over the years. The annual fee now stands at $695 (a 54% increase). However, there are new benefits which may or may not be useful for everyone. So, with Amex now offering 125,000 points on the card, should you still go for it?

Amex Platinum Card

With this offer on the Amex Platinum card, you’ll earn a welcome bonus of 125,000 Membership Rewards points after you spend $8,000 in the first 6 months of card membership.

Click here for the 125,000 points offer

The American Express Platinum card has a ton of different benefits and credits, all created in a way to make you head spin. No kidding. However, here’s the golden rule that I usually follow while signing up for any credit card. Here are the questions that I ask myself:

- Am I significantly altering my consumption patterns just to utilize the ‘credits’ on a card?

- Opportunity cost: Would I rather get better ROS (return on spend) if I were to put the spend on a different card?

Credits

So, let’s first start with the credits and you’ll know what it makes my head spin.

- $155 Walmart Credit for a Walmart+ membership

- $200 hotel credit (when you book with Amex Fine Hotels and Resorts and the Gold Collection)

- $240 digital entertainment credit ($20 per month)

- $200 airline credit

- $200 Uber credit ($15 per month Jan-Nov, $35 in Dec)

- $100 Saks Credit ($50 Jan-Jun, $50 July-Dec each calendar year)

- $300 Equinox credit when you pay for Equinox Membership

- $300 credit on the purchase of a Soulcycle bike

- $189 Clear credit

There you go. You have annual credits, monthly credits and credits split half way through the year. If that wasn’t confusing enough, then you also have to remember that some of these memberships that you sign up for auto-renew.

Benefits

Amex does offer you a generous 5x points on flights when you book directly with the airline. Moreover, you’ll also earn 5x points per each dollar that you spend on prepaid hotel booking with Amextravel.com. In addition to these extra points, you also get the following benefits:

- Lounge access with the Centurion Lounge, Priority Pass select and more

- Marriott Bonvoy Gold Elite Status

- Hilton Honors Gold Elite Status

- Complimentary elite status with Hertz, Avis and National

- Access to the International Airline Program, Fine Hotels and Resorts and The Hotel collection

- Purchase Protection, Extended Warranty, Return Protection and Cell Phone Protection

- Car rental loss and damage insurance

- No foriegn transaction fees

The Pundit’s Mantra

Overall, I don’t see a great deal of merit beyond getting the card for the welcome bonus and keeping it for the first year. Ideally, I’d sign up now, get the bonus, double dip on some of the credits and then cancel next year.

However, your situation may be different. Do you find the Amex Platinum card valuable beyond the amazing welcome bonus? Tell us in the comments section.

Click here for the 125,000 points offer

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!