If you love the ‘new’ American Express Platinum card, then you probably belong to a section of customers that is already making purchases with their partner brands. As a frequent traveler, my goal with this blog post is to simply elucidate why I’m planning to dump the card when it comes up for renewal next year.

Amex Platinum Card Changes

Last week, I tweeted out my dismay at the latest changes to the Amex Platinum card. Amex added new benefits, but most importantly, increased the annual fee to $695.

The new Amex Platinum Card – with a $695 annual fee, so that you can buy overpriced stuff that you don't need at a price that you don't want to pay. Oh, btw, so many credits that you'll definitely forget to use one of them every month. Chase Sapphire suddenly looking much better.

— The Points Pundit (Ashish) (@thepointspundit) July 1, 2021

As a frequent traveler, I’ve loved carrying the card ever since I first picked it up with the $450 annual fee. Then that fee became $550. I still stuck around. Now, I simply can’t justify renewing it for another year. Here’s why.

Why I’m Canceling

On this blog, I always tout the golden rule before deciding whether to get or keep a credit card.

Ask yourself these questions:

- Am I having to drastically alter my purchasing patterns or buyer behavior simply to utilize a benefit on my card?

- Am I switching brands just to make sure I don’t miss out on a monthly credit or benefit?

- Are the brands that offer these credits already overpriced?

My travel and shopping patterns simply do not match with the new benefits that Amex just added. Also, I don’t intend to drastically change my habits just to get a partial statement credit each month.

The Good

Let me first highlight the new benefits that I truly liked. These are primarily travel related benefits.

$200 Hotel Credit

As a frequent traveler, I’ve used the Amex Fine Hotels and Resorts benefit over the years multiple times. This is indeed a good addition to the card benefit lineup.

$179 Clear Credit

I already have access to Global Entry and TSA Pre-check. In most cases, it helps me breeze through airport security and immigration.

However, this is a travel benefit that many can use, but the biggest downside is that if your home airport doesn’t have Clear, then you’re out of luck. Therefore, in my case, I value the benefit at almost $0.

The Bad

Saks Credit

This is a newish benefit and not recently announced. However, as soon as Amex announced it and increased the fee to $550, I immediately started having second thoughts about keeping the card. As the next section highlights, the newest benefits only tipped me over the bar and made my decision to cancel even easier.

The Ugly

Entertainment credit

Here’s where I really decided that it’s now time to cancel. When the initial rumors started floating about changes to the Amex Platinum Card, I was still hopeful that I’d at least find the entertainment credit useful. Given Amex’s recent temporary benefits and credits, I was almost certain that the credit could be used for streaming services like Hulu, Netflix or Amazon Prime Video. However, much to my disappointment, it turned out be something totally different.

Simply put, I don’t read the New York Times, I only watch actual Peacocks at a Zoo or in a forest. Moreover, I listen to select podcasts on my apple devices for long form conversations without paying any subscription fees. Therefore, I simply don’t want to change or switch my consumption patterns to Audible or Sirius XM in order to utilize a monthly credit.

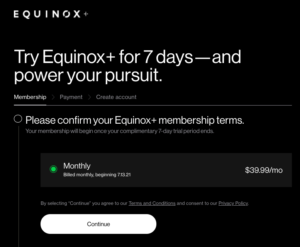

Equinox

I love the outdoors. The pandemic has drastically changed our lives and shifted a lot of our exercise activity to online apps and video. With the Covid-19 risk on the wane, I intend to slowly ramp up outdoor activity, which simply includes stuff like training for the next half marathon or doing a few hikes. Equinox fits nowhere into my consumptions patterns when it comes to fitness or training. Therefore, I’m assigning a big fat $0 to this benefit.

Ease of Use

Here’s the real kicker. In an attempt at gaining value through breakage, Amex has slowly moved many of its benefits to monthly credits instead of annual. The new Amex Platinum card has a total of 8 credits. In terms of using benefits, this has to be the most complicated value proposition.

- You can use the Airline fee credit, Hotel credit and Clear credit annually

- The equinox credit, Uber credit and digital entertainment credit are monthly credits

- You can use the Global Entry/TSA pre-check credit once every 5 years

- The Saks credit is once every 6 months per calendar year

In addition to all that goes on in life with travel, work and family, are you ready to keep in mind all these credits and expiration dates? In contrast, the Chase Sapphire Reserve offers a simple blanket travel credit and a DoorDash credit, both annual in nature.

In terms of premium credit cards, I already carry the Hilton Aspire Card. Even though it has the $450 annual fee, it fits nicely with my travel patterns. Most of my business and leisure hotel stays are with Hilton. Moreover, I can easily use the $250 airline fee credit and the annual free night to more than offset the $450 annual fee. In addition, I also get top tier Diamond status just for keeping the card.

Other Options

So did Amex just launch the perfect commercial for the Chase Sapphire Reserve and the Citi Prestige without Chase or Citi having to pay a dime out of their ad budget? However, Citi Prestige seems to have disappeared and no longer shows up on Citi’s website. On the other hand, I’m seriously considering moving to the Chase Sapphire Reserve due to its ease of benefits and the fact that Chase is also looking to expand its lounge network.

I still value American Express points slightly higher compared to Chase’s Ultimate Rewards points. I can still keep my Amex points active by using my no annual fee Blue Business Plus credit card every now and then.

Chase Sapphire Reserve, after seeing the launch of the 'new' Amex Platinum Card pic.twitter.com/2t7zHSyA3d

— The Points Pundit (Ashish) (@thepointspundit) July 1, 2021

The Pundit’s Mantra

In short, barring the $200 hotel credit, I’m really not finding much value in any of the other new benefits that the Amex Platinum card has launched. Moreover, while I’m still looking to carry a premium travel rewards card in my wallet, my focus still remains on premium travel and not shopping or lifestyle.

Also, I don’t intend to drastically change my buyer behavior or switch brands to simply get the illusion of recouping the $695 annual fee. However, your situation may be different. How do you see Amex’s new benefits? Do you find them valuable or do you intend to cancel the next time your annual fee is billed? Tell us in the comments section.

___________________________________________________________________________________________________________________

American Express is currently running elevated welcome bonuses on personal and business versions of their Hilton co-branded credit cards.

The no-annual fee Hilton Honors card by American Express is offering a limited time welcome bonus of 130,000 Hilton Honors points. The $95 annual fee Hilton Surpass Card and Hilton Business cards are offering a whopping welcome bonus of 180,000 Hilton Honors points.

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

I just got the card last month. My expected value year one is $3420. Year two about $345. I guess it just depends on how you use it and which credits make sense. For me a bunch just fall into line. I already subscribe to NYT, will get a lot of use from Clear, my wife loves perfume, so I have her chose one every 6 months, etc. I have no use at all for the Equinox credit. Anyway, just doing the math in this, it’s keeper card for me at this time. Sorry it’s not the same for you.

Awesome!

They’re basically the same card. Reserve has the slightly better travel insurance but Amex beats it on almost everything else. I live in Dallas, so I have Clear and a Centurion Lounge and Saks and pick up my Uber Eats or use the credit for a ride to the airport. Amex is highly beneficial for me. YMMV

Amazing, Glad that the math works out great for your situation!

I value Amex points higher compare to Chase UR. However, the Reserve’s credits are a lot easier to use compared to the maze of credits that that Plat offers.

The Saks benefit is 3 years old now so not sure why that has anything to do with you wanting to dump the card now? Its a little silly for Amex to break up into 6 month increments but I have had no trouble getting things I would’ve bought anyway (underwear, socks, t-shirts etc) for the same price at a different store. Its a nice reminder every six months to refresh on some of the essentials for me.

Also, even if Clear isn’t at your local airport, wouldn’t you get some value out of having it when flying home from one of the airports that do (or the stadiums that use it)?

Agree generally with idea of not altering purchases too much to accommodate spending, but if you were okay with the card last year, I’m not sure why the cards less valuable now. Adding a $200 hotel credit for a $150 fee should make it a wash if you can use those credits (especially on non-chain hotels) even if you value the rest of the benefits close to zero.

Having to jump thru hoops is what’s causing me to cancel the card. Also, in my opinion, Saks is already overpriced. Uber Eats is often overpriced if you compare prices directly with the restaurant. So I’m not really getting a great deal in any way. That effectively means that many of the credits that the Plat offers cannot be taken at face value. I stuck around for a while because Amex was still offering temporary benefits during Covid like the $30 PayPal credit.

Also, I look at the opportunity cost. I can pay $550 and switch to CSR – get a $300 flat travel credit and a $60 DoorDash credit without really having to do much or remember stuff every month. I also get a flat 1.5 cpp redemption value with Chase travel or PYB.

Again, I’m glad you find it useful, but I as consumer am no longer interested in shopping and lifestyle benefits. I’ll simply stick to cards offering travel benefits.