“Hobby” Introduction

Those in the churning and manufactured spend “Hobby” are very familiar with the standard practices. Churning is the practice of signing up for credit cards to get their bonuses, cancelling them shortly thereafter and moving to the next card. With the tightening of bonuses (save the Chase Reserve craziness) I have shied away from churning and more towards manufacturing spend. This is the practice of making “purchases” of items that ultimately returns the funds to you, allowing you to “spend” without actually laying out the full amount of funds, earning you rewards points or cash back in the process.

For those who are interested or curious, my spending is done only on my Starwood Preferred Guest Card, since I value the points there and flexibility of the system most highly. Sign up now through my link for 25,000 bonus points after just $3,000 spend! This card has covered so, so many Starwood and Marriott hotels around the world, and is a godsend.

Apologies for the shameless self-promotion.

The Normal Manufactured Spend

Standard manufactured spending processes are below, which are heavily documented and researched all throughout the internet. I use r/churning as my resource to stay up to date on the industry and trends.

- Visa Gift Cards (VGC) to Money Orders

- Serve / BlueBird etc.

- NationWide (NW) Buxx

- Radpad and similar (Evolve Money, etc.)

- Paying for other’s purchases and having them reimburse you – whether it be for movies, meals, Amazon.com, etc.

There are others I’m sure, which are tried and true, as these are all executed in large amounts on a regular basis.

The Abnormal

However, manufactured spend simply means creating the impression of spending funds. Thus any vehicle where you can spend with a credit card and get the money (or most of the money) back to you would work. I looked into investment vehicles with credit cards, and found some below.

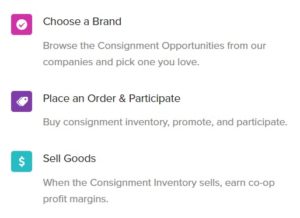

Kickfurther

Kickfurther is a US-based online investment platform, where you can partner with brands to invest in their manufacturing process. You “own” a percentage of their inventory in that run, and as they sell it they return the funds to you with a previously stated profit. In theory, it makes sense, but in my execution and experience there are many issues. If you’d like to learn more, you get a $5 bonus for signing up, as well as another $10 for linking your bank account.

I’ve invested a significant amount into Kickfurther, and have yet to be positive. While the premise of investing with my credit card (making the ~2% in points) and getting my money back plus interest months from now sounds appealing, in actuality it is more convoluted and flawed. If there are issues, they may take weeks or months to resolve, and there is no guarantee by Kickfurther or in the invested companies regarding the security of your funds or return. I would not recommend this service, but it is a novel and intriguing concept.

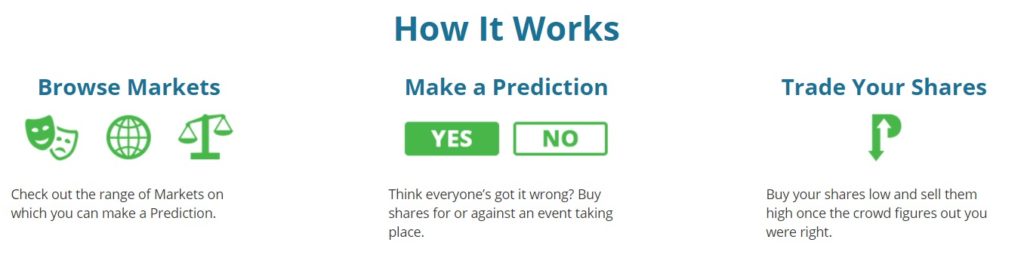

Online Betting

Before you call for my head (think of the children!) please understand that within the United States, onling gambling is legal in several states. However, I speak of betting – on sites such as PredictIt, a brainchild of Victoria University of Wellington. Here, you can bet, or predict, the future of politics, who wins, loses, or any variety of prop bets. It is definitely not a sure thing (see: 2016 Election). I lost nearly 100% of my bet on that fiasco, so buyer beware! They also charge pretty steep fees, but it’s also an interesting (and legal) concept.

_

Conclusion

When looking for MS (that’s manufacturing spend for those who forgot) pathways, understand the cost/benefit analysis. For the Visa gift card angle, you’re typically spending roughly 1.2% as a purchase cost. However, you are netting anywhere from 1-5 points per dollar (the Chase Ink I’ll never be able to get) which is well worth the cost. If you are able to find a new way of “spending”, be sure to take this into consideration. For example, Kickfurther takes a 1.5% fee on withdrawals, but that cost is mitigated through rewards points. This cost is puportedly to cover the fee of transferring, and to encourage reinvestment. Hopefully there will be new ways of spend helping us achieve the points and aspirational travel.

Disclaimer: this post contains one or more affiliate links where I may earn a commission. Thank you for supporting my blog.

Have any questions? Let me know in the comments, or reach me directly at TheHotelion@gmail.com! Like my posts? See more here, on TravelUpdate! Follow me on Facebook (The Hotelion) or on Twitter and Instagram: @TheHotelion