For many in this hobby, using travel credits is often a tough task. Over the last few months, we’ve seen many blogs report how United’s Travel Bank can be an option to use up your airline free credit. However, you’ll need to keep the terms and condition in mind before you load up your United TravelBank account with funds.

United TravelBank

Over the last few months, many data points have indicated that this has worked successfully for many people in different denominations, right from a $50 load to a $250 load across different card products and issuers. However, unlike United’s MileagePlus miles which no longer expire, United’s Travel Bank funds do expire.

Expiration Dates

You’ll need to remember two sets of rules here. Firstly, the T & C’s that determine when your individual travel fund loads will expire. As soon as you load an amount to the Travel Bank, you can use that amount for five years on any United operated flight. The flight must be on United metal. However, you can use your travel bank funds to book flights for someone else.

Members can choose from six purchase amount options and once purchased the value remains valid for five years from the date it is deposited in your TravelBank account. Purchases are not refundable and are limited to $5,000 per day per MileagePlus account. This purchase is also subject to all of the TravelBank terms and conditions.

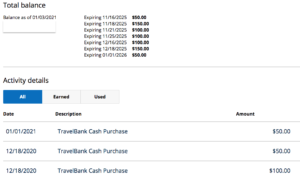

These funds expire in batches, on a rolling basis every five years. Here’s a snapshot of how it looks in my account.

Secondly, there are T & Cs that also determine travel fund expiration due to inactivity.

As a general rule (and unless stated otherwise by United under the terms of a particular offer or the terms of certain qualifying activity as determined by United from time to time) all accrued TravelBank Cash in an Account is subject to expiration and/or forfeiture for any Member who fails at any time to engage in Account Activity (as defined above) for a period of eighteen (18) consecutive months. United may, but shall have no obligation to, send a Member a notification of TravelBank Cash nearing or subject to expiration.

The Pundit’s Mantra

While United TravelBank is a great option to use your credits, you’ll need to keep a couple of things in mind. Firstly, the funds you load will expire every 5 years, but in batches. Secondly, if your TravelBank account has no activity for 18 months, you may lose all the funds in your account. Moreover, United may or may not send you any notification about expiring funds well in advance.

I hope this post was able to shed light on the complexities of travel bank fund expiration. While this option is great, the last thing you’d want is to load thousands of dollars into it and lose all the funds due to lack of activity for 18 months.

___________________________________________________________________________________________________________________

The American Express Gold Card is currently offering a welcome bonus of 60,000 Membership Rewards points. You’ll earn a welcome bonus of 60,000 Membership Rewards points after you spend $4,000 in the first 6 months after you’re approved for the card.

Moreover, the card offers lucrative bonus earning categories, benefits and credits.

- 4x points on dining (including takeout and delivery) and grocery spend

- 3x points on flights

- $120 dining credit annually

- $120 Uber Eats/Uber credit annually

- $100 airline credit (ends on December 31, 2021)

- No foreign transaction fees

Apply Now

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

i tried to book with my travelbank, leaving ~$1 to pay with my united credit card so i could get a free checked bag. it didn’t go through. anyone had success with this?

Does the 18 month account activity requirement still apply? I can’t find the clause in the terms and conditions.

I’m almost at 18 months no activity, so am worried about expiration

Here are my TB purchases:

01/04/2021

$100.00

01/04/2021

$100.00

01/02/2021

$50.00

10/18/2020

$50.00

10/18/2020

$100.00

So does that mean my earliest TB deposit on 10/18/20 will expire on 4/18/22?

I heard the 18 month thing was phased out, but the verbage is still there on the T&C.

If I buy another $50 TB on 4/17/22, then do ALL of my TB then reset to expire 18 months from that purchase date? (e.g. 18 mos from 4/17/22)?

Or Can I just book a fully refundable ticket for $400 (my total TB amount) and then refund it after a couple days?