Picking up a new credit card is usually an easy choice. Typically, there is an elevated sign-up bonus, desirable perks, or some other reason that makes a card highly attractive. But often the value proposition changes down the road. Typically, I make a decision to drop a card that is providing no ongoing value after the first year. But it is a bit more rare for the calculus to change after several years.

This is the case with my Wyndham Rewards Visa. I picked up the card four years ago (I think?) when it was offering a 45,000-point sign-up bonus and 15,000 points every account anniversary. I’ve kept it year-to-year since then, but this year I’m really considering dropping it. Here’s why:

Why Dropping The Wyndham Visa Makes Sense

The card costs us $69 per year, but provides 15,000 Wyndham Rewards points every account anniversary. When you are using Wyndham points for a value of $150-250 per night, it’s an easy choice to keep it. I’ve gotten over $1,200 in value off of ~$275 in annual fees.

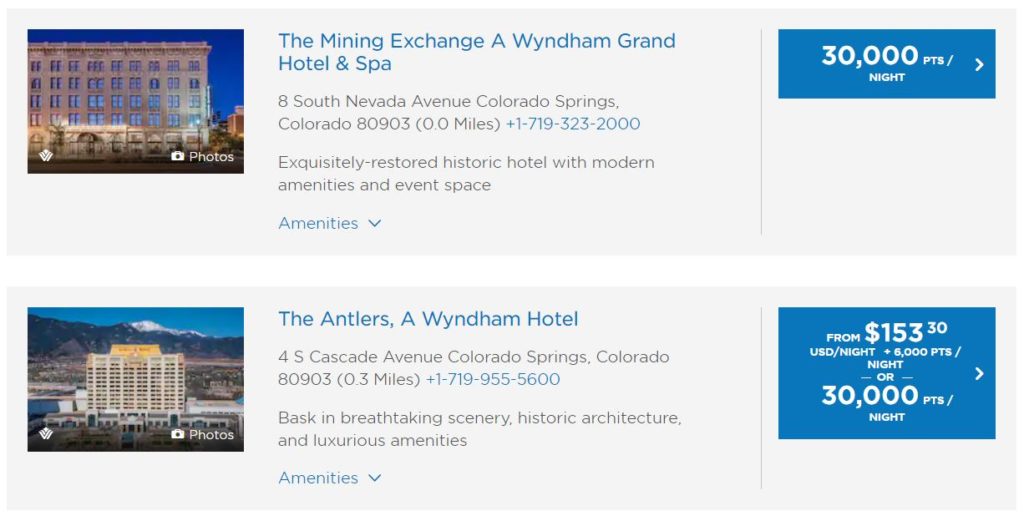

However, using Wyndham points at high value is harder than ever. I’ve reserved my points usage for stays at Wyndham’s hard-to-find upper tier properties when award nights cost 15,000 points across the board. Now many of the places where we’ve stayed charge 30,000 points per night. In other words, the free night I was getting is no longer truly a free night anywhere. The move to three award tiers heavily devalued the program, in my opinion.

Examples of properties I stayed at for just 15,000 points include The Mills House, Charleston and The Mining Exchange in Colorado Springs. I’ve also booked (but canceled) a stay at the Silverado Resort and Spa in Napa, and looked at booking the Wyndham Santa Monica At The Pier multiple times. All of these locations now charge 30,000 points. Here are the Colorado Springs options:

Sure, there are less-nice properties in town. But the anniversary points no longer provide a free night at the nicest. Without the ability to use the points at Wyndham’s nicest properties, I’m far less interested in hanging onto the card. We could just plan to use the card at the Vino Bello Resort Napa, but Wyndham likes to play games with award inventory at their vacation rental and resort properties.

The other reason dropping the card makes sense is that Wyndham and Barclays are looking to revamp the card. I’m going to guess that this will potentially come with a decent sign-up bonus, so dropping the card in anticipation of picking up a new product (and saving money) is convincing. Dropping the card to free up credit for picking up any Barclays product is also a plus.

The Argument For Keeping My Wyndham Visa

The things holding me back include the fact that the version of the card I currently hold is not available anymore. The 15,000-point annual renewal bonus was only offered for a limited time. This is good for two nights at lower tier properties and one night at the standard tier. Sure, the top properties are off the table, but a free night of $100-150 in value for $69 isn’t too bad.

The other reason is that it is just $69. There are certainly Wyndham properties that charge less than $69 per night, but there are plenty in the $80-$120 range that would offer a marginal return on my decision to keep the card.

Conclusion

The fee just hit a couple days ago, so I still have a little time to decide whether to keep or cancel. The 15,000 points used to be a no-brainer for a $69 annual fee, as I’ve always gotten far more than this in value. But with the move away from a single award tier, less use of Wyndham in general (I hit up Choice Hotels far more often these days if I need a budget stay), and the potential to easily divest myself of the program entirely leaves me wondering if I should cancel.

What would you do in this situation? Do you think the card worth keeping?

Use the points in Vegas!!! 🙂

Goes against all my principles. 😉

I say it all depends where you will use the pts, myself I just downgraded to the no fee card after being denied it as a new card. Reason I keep it is simple theres a Ramada I stay at twice a year for a week+ that has a rate just under $300 a night. MSing via supermkts costs me apx $100 in fees for every 15k in pts, alot less via SM with the 1K cards

That Ramada is not your typical Ramada either, so if a person can find a hotel where @ 15K it pays then its best to keep the CC. Now should supermts lose their 2x earning and/or SM gets rid of their 1K cards then Id have no reason to keep the CC

To be fair I usually never look at the so called top hotels simply to brag about what Im saving, so I can be found at a Fairfield Inn way before a Ritz even if they were the same amount of points, unless The Ritz has the FI beat location wise

Glad you have a go-to! We have a couple decent options, I just don’t know if we will end up there every year or two. And when it would just be to burn the points we’re paying $69 for, it might just be best to keep the cash in the wallet.