I’ve been thinking about the array of hotel credit cards, which I like, and which I don’t like. Most I keep just for the perks and annual points or free night, although I’ll dust them off when I book a stay with one of their brands.

Hotel cards all have room for improvement across the board. I’ve decided to tackle one way in which each hotel card could be significantly improved. I’m only going to pick one card from the families that have multiple hotel cards through one or more issuers since it would be a bit laborious to go through them all.

World of Hyatt Credit Card

Nothing. It’s perfect in every way.

Just kidding. I might be very satisfied with the World of Hyatt Visa as it stands, but everything can use improvement. The card doesn’t have a glaring, obvious deficiency, though. Personally, I love the ability to earn free nights, so I’d be ecstatic to see them offer a second free night when you hit $30,000 in cumulative annual spend. This would give you not only a great return, but you’d have earned 12 elite nights when you hit the threshold.

Marriott Bonvoy Brilliant

Up the earning rate to 3x Marriott Bonvoy points across the board. The card is solid already, with the annual Marriott credit. But this is a premium card, and it would be nice to have a premium earning rate. An earning rate of 3x on general spend would put the return back above 2%, which would actually make me consider spending on the card. Top-tier hotels now have Hilton-esque pricing, but no Marriott card offers a good return on spend.

Of course, I’d love to see all Marriott cards offer 3x spend. RIP, old SPG card.

IHG Premier Credit Card

The new IHG card is a decent product. I’ll come out and say that. The fourth night free benefit is a nice perk if you tend to have longer stays. With no foreign transaction fees and a better earning rate on IHG stays, I hope to pick it up once I fall under 5/24 later this year.

What the IHG card badly needs is a better earning rate. The current 1% rate is awful, considering the constant IHG devaluations over the past several years. A base earning rate of 2x or 3x, with 4x on certain categories, would be far more enticing.

Hilton Aspire American Express

It would be amazing if the spend for an annual free night was reduced to $15,000 like the lower-tier Ascend. I mean, sure, Hilton is already giving you a free night. But $60,000 in spend for another?! No thanks. I don’t have that much discretionary (or manufactured) spending to put toward that goal. At least match it with the Ascend.

Even better: offer multiple free nights for every $15,000 in spend. I’d happily take these, even if they were capped at a maximum point value per night.

Radisson Rewards Visa

Honestly, I have no complaints about this card, other than its earning rate. It earns 5x points on all spend (not great, but not enticing), yet only 10x on spend with the chain. Given that other chains offer 3-4x on spend at their properties, the Radisson Rewards Visa should at least be 15x points when paying for stays. Considering that their points are worth only ~0.3 cents apiece, that is still just a 4.5% return. Hyatt offers a 6% return, assuming you peg Hyatt points at 1.5 cents each.

Choice Hotels Visa

For a free credit card, the Choice Hotels Visa isn’t all that bad. I’ll keep it as long as that annual fee is $0. But it’s also very lackluster in its benefits. Earning 5x points at Choice Hotels is fine. Low tier status is fine. A whole lot is fine when you’re not charged anything for the card.

What would make this card a winner is offering a whole lot more points for the annual spend. If they upped the annual spend perk to around 16,000 points (common free night amounts) for the same $10,000 in spend, I might actually put some spend on the card. Right now I can still do better by just using my Blue Business Plus, which earns 2x Membership Rewards on everything that can be transferred to Choice.

Wyndham Rewards Visa

Wyndham may actually be considering improving their co-branded Visa card in the future. They sent out a survey with a bunch of interesting improvements to gauge customer interest. Of all the ideas, I would most like to see a card that offers 15,000 points per year, good for 1-2 free nights (two nights at lowest tier properties, 1 night at the primary tier). This isn’t asking a lot for a $75 annual fee, given what other issuers offer.

This used to be a feature of the card. I’m still hanging onto the version that offers 15,000 points every anniversary.

Best Western Rewards Mastercard

The earning rate. When you have a lackluster earning rate on your own hotel spend and abysmal earning rate on general spend, the card is a complete non-starter. Two points per dollar on everything is south of a 1% return. For a card with a fee, this is terrible.

More reasonable: 15x on Best Western hotel stays and at least 3x on everything else. A spend of $8,000 would then generate 24,000 points, enough for a free night at some nicer (among Best Western) places.

The other option: account anniversary bonus points to offset the fee.

Conclusion

What are your thoughts on each hotel credit card? What are some other things you’d like to see offered?

Keep in mind as well that the idiotic Radisson card charges a foreign transaction fee! So frustrating to visit an international hotel, use their branded credit card, and then get dinged with a fee for using it. Ugh.

Very true. I’m glad American Express rolled this back on some of their Hilton cards.

Very good analysis. I’d say that the IHG card needs to revert to offering a free night at any hotel again. There’s no value in spending on the card, the elite status that comes with it is effectively worthless, and nothing is more dear to IHG’s heart than a nice juicy devaluation. Not the best combination.

The uncapped free night would be amazing!! But there is no way they roll back to that, nor can I see the weak elite status changing. IHG has some incremental gain in people spending on their card, so that is about the only thing one can hope to change.

Until Radisson free nights apply to properties outside the USA I’m not interested. Staying at a Country Inn that normally goes for $80 a night is not a good use of these types of awards. Now a Radisson Blu in Scandinavia is a whole different matter.

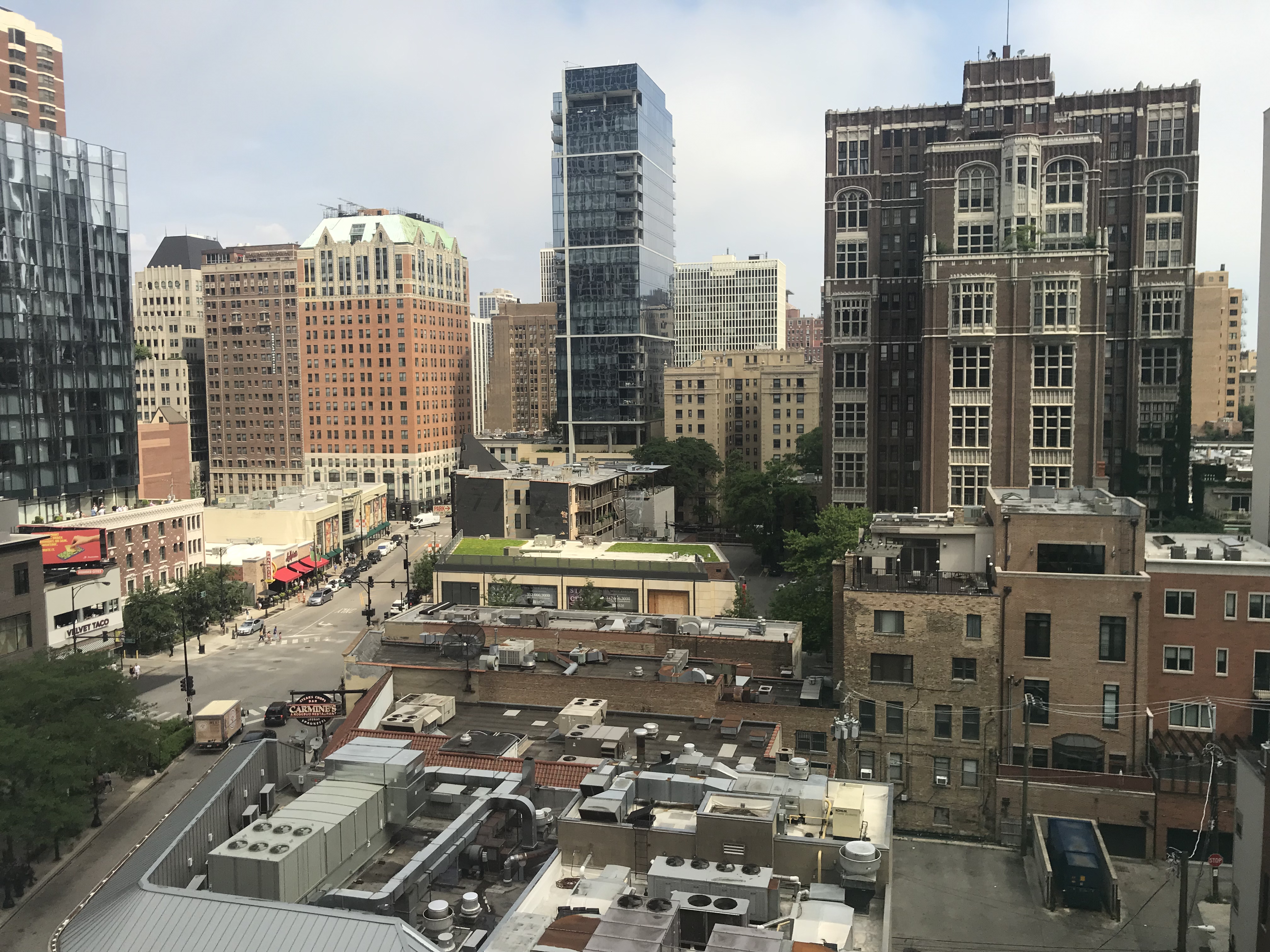

That is frustrating. There are a couple decent hotels, though. The Radisson Blu Chicago always comes to mind.

How about all resort fees are waived when you pay with the brands credit card?

That would be amazing!! Hilton and Hyatt already have ways around these. This would be an ideal benefit for Marriott cards.