Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links

Many miles and points lovers like to try out different credit cards to maximize earning. However, certain people prefer having fewer cards and focus on optimizing high spend on those cards. As banks compete to offer better bonus spend categories, there’s still one credit card that remains my personal favorite when it comes to offering amazing return on non-bonused spend. I love this card for two simple reasons, the simple 2x per dollar spent and the amazing airline and hotel transfer partners it offers.

Also Read: Tuning your Miles & Points Strategy amid a Coronavirus slowdown

Credit Card Strategy

Miles and points aficionados love to get the best travel experience for the least amount of money spent. This hobby is all about being frugal and yet enjoying some of the most stunning travel experiences. It’s about getting the correct miles and points credit card to fulfill your wanderlust.

Also Read: Should you apply for Limited Time Credit Card Offers

Business Credit Cards

Discussions centering around business credit cards are often dominated by the Chase Inks and Amex Platinums of the world. While these cards have a great rewards system, they also have annual fees. You can offset a lot of the annual fees if you travel frequently. But what if you travel moderately? You can still get a card that gives you some amazing return on business spend. Unlike the Chase ecosystem, this no annual fee credit card enables you transfer points to Amex’s airline and hotel partners.

Blue Business Plus Credit Card

The Blue Business Plus Credit Card from American Express comes packed with an impressive suite of benefits for everyday spend. For a card with no annual fee, it’s a fantastic proposition to keep long term. Here’s a run down of some of the great benefits that come with this card.

Also Read: 8 ways in which you can get the highest possible credit card sign-up bonus

Sign-up Bonus

This card usually doesn’t offer a public sign up bonus. Currently, you can earn 10,000 Membership Rewards points for signing up for this card via referral. You’ll earn 10,000 Membership Rewards points after you spend $3,000 or more in the first three months of card membership. Referring yourself is a risky proposition though as Amex is cracking down on self-referrals by clawing back points.

0% Intro APR

For a lot of small businesses, the intro APR is a vital component of making spend related decisions. With this offer, you’ll get a 0% introductory APR for purchases and balance transfers for the first 12 months after you open your account.

Bonus Earning

- 2x Membership Rewards points per dollar spent (up to $50,000 spent)

- 1x Membership Rewards points per dollar spent on purchases thereafter

This is my favorite part about the card. Its benefits are crystal clear and simple.

Additional Cards

Employee cards also have no annual fee. Additional employee cards also earn Membership Rewards points.

Additional Benefits

Along with the above benefits, you also get Amex’s supplementary benefits like Car Rental and Damage Insurance, Baggage Insurance, Purchase Protection, Extended Warranty and Amex Offers. Benefits like Purchase Protection, Extended Warranty and Amex Offers have already helped me save over thousands of dollars when things have gone wrong.

Transfer Partners

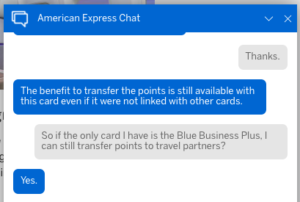

If you’re familiar with the Chase ecosystem, you’ll know that merely having the Ink Business Unlimited or the Chase Freedom Card would not be sufficient. You’d need to have a card like the Ink Business Preferred or the Chase Sapphire preferred in order to have the ability to transfer points to Chase’s travel partners.

However, with the Blue Business Plus Card from American Express, you can still transfer your points to Amex’s travel partners, without having to carry a card that has an annual fee! Amex has a lucrative roster of points transfer partners:

Airline Transfer Partners

- Aer Lingus

- Air Canada

- AeroMexico

- Alitalia

- ANA

- Asia Miles

- Avianca

- British Airways

- Delta

- El Al

- Emirates

- Etihad

- Flying Blue (KLM and Air France)

- Iberia

- Hawaiian Airlines

- JetBlue

- Singapore Airlines

- Virgin Atlantic

With Amex’s Airline partners, I flew to India, then Singapore and then all the way to Queenstown, New Zealand!

Hotel Transfer Partners

- Marriott Bonvoy

- Hilton

- Choice Hotels

The Pundit’s Mantra

This card is a fantastic proposition if you’re looking to have a credit card that earns bonus points rapidly on everyday spend. If you already have another Membership Rewards earning card like the Amex Gold Card or the Amex Everyday Card, this card also serves as a great sidekick to still earn 2x Membership Rewards points per every dollar spent on all spending.

Now you may ask why I’m not listing the newly refreshed Citi Double Cash Card. In my opinion, I find Amex’s transfers to be a lot more valuable compared to Citi’s. Also, Amex frequently offers transfer bonuses, like it’s currently offering with Hilton.

Which is your favorite credit card for non-bonused spending? Let us know in the comments section.

___________________________________________________________________________________________________________________

This card is a personal favorite of The Points Pundit. A Welcome bonus of 80,000 Ultimate Rewards points! with the Ink Business Preferred Card by Chase (Chase’s 5/24 rule applies to this card)

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

you clarified a good point that I had not noticed on other mentions/reviews of this card — that you do not need another premium card in order to transfer points.

Hi OR97,

Thanks for your comment. Yeah, I love the fact that unlike Chase where you have to pay at least a $95 annual fee, you can have transferable points with Amex with a no AF card like the BBP.