With so much of my focus on earning points and miles from my credit cards, I often forget about some of the other perks and benefits offered by the cards. This includes things like cell phone protection coverage benefits, a feature of multiple cards that I have. A recent “near miss” reminded me that benefits are not without real value.

Losing My Phone At the Beach

It’s not often that you can enjoy a really nice day at the beach where I live. Even less often is it this nice in February. So when my youngest suggested we go, I was all-in. It was a great idea. As has happened at least once before, we ran into some of my kids’ friends (like I said, on rare nice days, everyone goes to the beach).

We played 2v2 beach football, so I stashed my keys and phone in my shoes and placed them well above the water line. At the end of the day my shoes rode home on the floorboard of the pickup.

Hours later, I couldn’t find my phone. In the moment, it isn’t a huge loss. But when it didn’t turn up after searching the house, truck, and outside, I became worried. Needing it for work the next day was high on the list.

Am I Out $300?

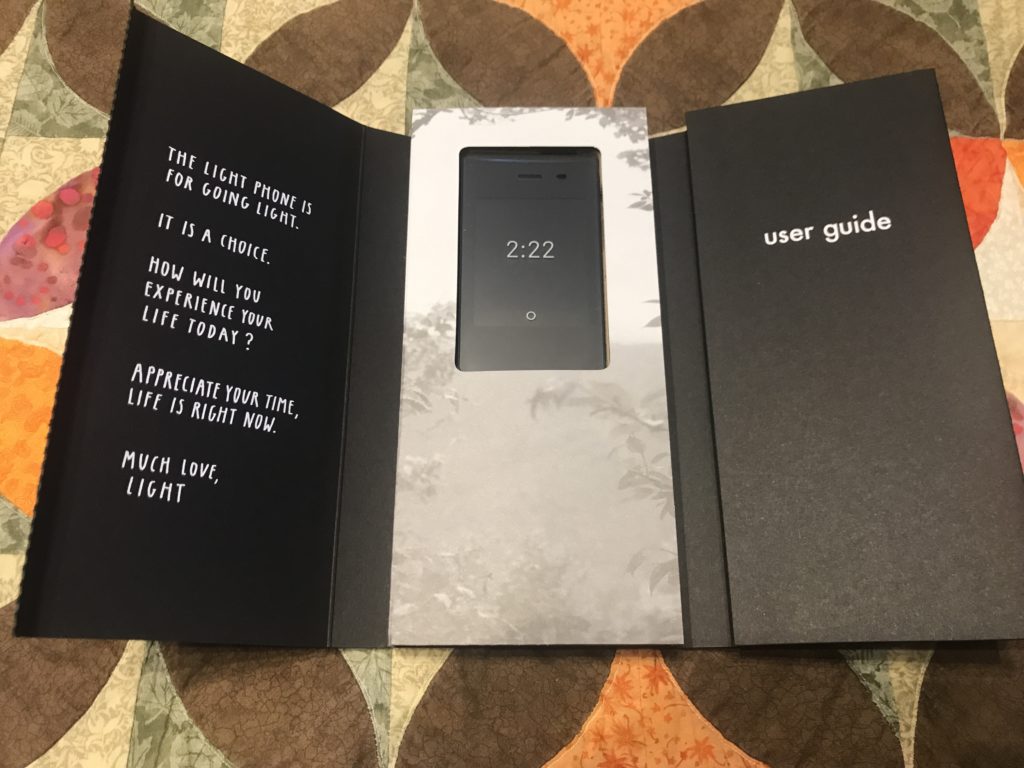

I actually don’t have a smartphone, instead choosing to rock a LightPhone II. If there is one thing I can recommend to help your overall focus and mental health, it’s ditching your smartphone (I do caveat that to say that I kept the iPhone for traveling…needs maps, notes, and camera). The LightPhone, while cheaper than a smartphone, isn’t exactly cheap. I wondered which card I was using to pay the bill. If it wasn’t one with cell phone protection coverage, I could be out $300.

For the cell phone protection coverage benefit to apply, you must pay your wireless bill with the card offering this coverage. I figured out that I was paying my bill with my Chase Ink Business Preferred. Now I feel a little better. The Ink Business Preferred has the following limitations

- The benefit covers “damage to, theft of, or involuntary and accidental parting with the Cellular Wireless Telephone.”

- Benefit is subject to a $100 deductible.

- You can make a maximum of three claims per 12 month period, of up to $600 per claim.

My situation is definitely explainable as “involuntary and accidental parting” with my phone. If I need to make a claim, at least I’d get back $200 of the $300 I spent. Better than nothing, and worth the time to make the claim. More pressing was getting the contact info I need into a new phone. Thank goodness for the Gabb Wireless phone I got for the kids to use! At least I have a stopgap solution.

All’s Well That Ends Well

I headed back to the beach after dropping the boys at school the next morning. After scouring the section of beach we’d occupied, I came up dry. No phone. After trying to call it, I could tell the battery had died during the night. No dice.

I decided to make one final check of the car. We’d cleaned the entire thing out the day before after arriving home from the beach. Lo and behold, I found the phone stuck way under the driver’s seat! I wouldn’t have to make an Ink cell phone protection benefit claim after all. But it’s nice to know I’m covered.

Have you ever had to use a credit card cell phone protection coverage benefit?