The Covid-19 pandemic has truly altered consumer behavior over the last couple of years. Card issuers have reacted by revamping their card portfolios and by offering temporary incentives like extra points and credits. However, many people are simply not willing or able to travel in the current situation. In that case, should you hold on to your credit card that charges you an annual fee? Many may be sitting on the fence, but you can always ask for a retention offer. If you’re still unsure, simply check with you card issuer and ask politely for a retention offer. Here’s how you can go about it.

My most recent retention offer

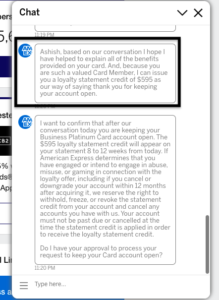

My Business Platinum card was recently up for renewal. Instead of calling, I decided to simply use the chat option after logging into my Amex account. I mentioned to the rep that I was not quite sure about renewal due to the uncertainty around travel in the coming year.

The chat rep immediately asked me if a $595 credit to offset the annual fee would work. I said yes right away and that was it. $595 in annual fees saved and it only took me about five minutes.

This is the first time I used the chat option as I usually tend to call in order to request a retention offer. While this strategy may or may not always succeed, it’s always good to have a template in mind before you make that call.

RETENTION OFFER CALL

Before we get into the details of how you should put your case forward, let’s get the basics out of the way. The main purpose here is not to just call and ask for free points or statement credits. Banks make money because of the business you offer. The purpose of your conversation is to request them to provide you with an incentive or a retention offer, in order to keep your business.

YOUR VALUE AS A CUSTOMER

When you call in for a retention offer, you need to strike the correct tone. Explain to the rep how you are a customer in good standing. Following that, clearly outline any problems or shortcomings that you think the credit card has. The more specific and genuine your concern, the more likely you’ll have a positive response.

KEEPING IT SHORT & SWEET

Most banks have retention departments that have set budgets. It’s always best to lay out your case in the most concise way possible. Always make sure you have a few talking points ready, so that you can make your point clearly.

HUCA

Hang Up, Call Again or HUCA is a common tactic. Very often, the first representative may not be able to help you out with a credit or some extra points. In that case, you can always politely end the call and call back at a later time.

THE SCRIPT

I’ve previously written about how I’ve received lucrative offers for credit cards during the time of renewal. I’ve had the most success rate with American Express, especially on their high annual fee cards like the Amex Gold and Amex Platinum.

Here’s how I usually structure these calls. You can replace the bank name and card name and tailor this to your situation.

Me: Hi, I just logged into my account and saw that the annual fee was charged to my card. I’ve been a customer with [insert bank name] for over X years now. However, I’m not sure about whether I should renew this card for another year.

Rep: May I know the reason why you’re considering this?

Right after this, you may usually see the rep read a laundry list of the benefits of the card. This is their first move. At this point, the rep is looking to see if you can be convinced to renew the card without them having to offer you any renewal bonus.

Me: Yes, while I love benefits X and Y, I just read that benefits A and B are being reduced. Also, I’ve changed my travel patterns, so I’m no longer in a position to fly with Airline C. As a result, I’m not able to fully utilize the rebates and credits on offer.

Please ensure that your reason for cancellation is specific and clear. At this point, you’ll probably get a first hint of what the bank wants to offer you.

Rep: Thanks for being a customer with us since XXXX. We really value your business and would like to offer you 10,000 points. Let me know if this works for you and we’d be happy to keep your business for another year.

At this point, it’s your call whether you want to take the initial offer or play hardball. There are pros and cons, depending on which option you choose. If you’re looking to get a better offer, you can always politely ask if there’s a better offer available. In my experience, I’ve received some pretty good retention bonuses at the first request, especially from American Express.

THE PUNDIT’S MANTRA

Retention offers can go a long way in alleviating some of the burden from a high annual fee credit card. While all issuers may not be offer a retention bonus for their products, it always never hurts to ask for the best possible retention offer for your credit card.

What have been some of your success stories while requesting a retention offer? Tell us in the comments section.

___________________________________________________________________________________________________________________

American Express is currently offering limited time elevated offers on their co-branded Hilton credit cards. You can earn up to 180,000 Hilton Honors points from a single credit card bonus. Click here to know more.

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!