If you’ve been around in the miles and points space for long enough, then you must be aware that there are complexities that we need to navigate through. One such complexity is that of card application rules set by card issuers. Chase has its 5/24 rule. Similarly, Amex has its ‘no lifetime language’ rule. Then there are rules about specific products and which cards you have had in the past.

No Lifetime Language Rule

If you’ve applied for an Amex card over the last few years, there’s a good chance you’ve come across this in your card application T&Cs.

You may not be eligible to receive the welcome offer, intro APRs, and intro plan fees if you have or have had this Card or previous versions of this Card. You also may not be eligible to receive the welcome offer, intro APRs, and intro plan fees based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for the welcome offer, intro APRs, and intro plan fees we will notify you prior to processing your application so you have the option to withdraw your application.

Bypassing the Rule

The good thing is that every now and then, we come across links that help us bypass the lifetime language rule. This can be done by either getting targeted by email for an offer or applying via a link which doesn’t contain the lifetime language verbiage. Sometimes, these links also show up under the Amex Offers tab once you log into your account.

Blue Business Plus Card

Last week, I wrote about one such offer. I already have one Blue Business Plus card by Amex. When I logged into my account, I found that I was targeted for another offer. Immediately, I checked the terms and conditions and found that there was no lifetime language in the T&Cs.

With this offer, subject to approval, I’d earn 25,000 Membership Rewards points after spending $15,000 in the first 12 months of card membership. The offer also carried an intro APR of 0% for the first year of card membership.

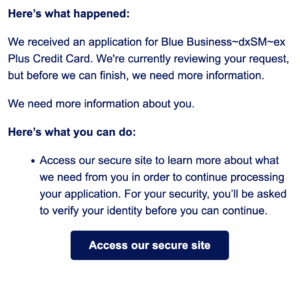

I applied for the card and Amex didn’t approve me online immediately. I was asked to send more information in order to process the application.

In my case, the document request was pretty straightforward. I had to upload either of the following documents:

- Recent bank statement in the last 60 days from a business checking account (non Amex)

- Recent business credit card statement in the last 60 days (non Amex)

- Recent utility bill for the business from the last 60 days

I uploaded the most recent statement from my Ink Business Preferred card. In less than 24 hours, Amex sent me an email confirming that my application was approved.

Since this offer is targeted, you’ll need to click on this link and check if you qualify for the offer.

The Pundit’s Mantra

Targeted offers can go a long way in helping you add more points to your kitty. Welcome bonuses without the lifetime language restrictions can help you rack up hundreds of thousands of points if you plan your spend and apply accordingly.

In my case, I’ve already been able to get more than one Business Gold and Business Platinum card, thanks to targeted offers of up to 150,000 Membership Rewards points.

If you’re eligible for this offer, then the Blue Business Plus card is a solid card for everyday business purchases. You can earn 2x points on all purchases up to $50,000 per calendar year. Moreover, your points are transferable to Amex’s partners. Most importantly, the card charges no annual fee whatsoever.

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!