Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links

Welcome bonuses serve as a major driver for banks who want to entice customers to sign up for their cards over others. While the welcome bonuses are great, they are a major cost driver for the card issuers. As the markets get a major shake up, changes are on the horizon. Many reports are already pointing at how banks are looking to strategize during these times. In such a scenario, many are wondering whether welcome bonuses will be on the chopping block.

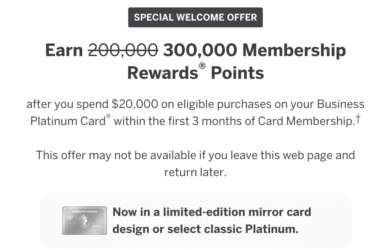

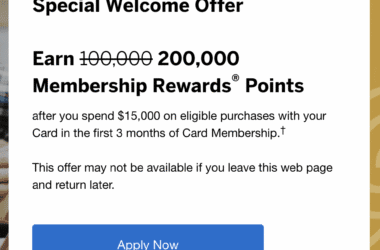

Expensive Welcome Bonuses

Although Chase Sapphire Reserve is one of the most popular travel credit cards, it’s marketing costs are burning a hole in Chase’s wallet. If you go by recent earnings calls and public statements, one won’t be surprised if banks start cutting costs.

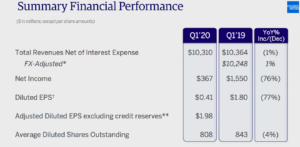

In its most recent earnings call, Amex displayed that it was quickly adapting to the new normal. Amex is developing programs and products in order to support merchants and customers in this economy. Here are a few key snippets. You can access the full presentation here.

This report by Reuters further illustrates Amex’s strategy in the short term.

The company expects operating expenses to be down about $1 billion year over year during the next three quarters and will “dramatically” reduce its marketing efforts, company executives said on a post-earnings call.

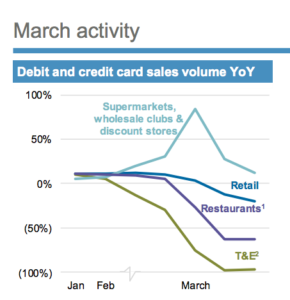

On similar lines, Chase is also developing programs and putting measures in place to help their customers and employees alike. However, on expected lines, interchange fees are plummeting. You can read the full presentation here.

Initial Signs

As per this CNBC report and many other data points, we’re already seeing banks cut credit limits of certain customers without prior notice. This is further hurting their credit scores by shooting up their utilization ratios. Banks are clearly doing this to reduce their risk in a tight market.

To mitigate that risk and compensate for less credit overall, issuers are scaling back consumer credit lines, just like they did a decade ago during the last recession.

With a lower limit, consumers are more likely to use a greater percentage of their available credit each month (or debt-to-limit ratio), which has negative effects on their credit score and ability to borrow money.

The Pundit’s Mantra

The good thing is that the situation globally is slowly coming under control. However, we really don’t know when normal resumption would happen. Also, nobody can really predict what the new normal would be like.

Banks, like most financial institutions are very risk averse while lending money. Cutting credit limits is one way of hedging against customers running up credit card debt. However, while I don’t see massive cuts, we could well see welcome bonuses remain stagnant in the short term. Also, once airlines and hotel open up, we could well see higher than usual welcome bonuses, but initially on co-branded credit cards.

I already have enough miles and points sitting in my accounts for my next trip. As pointed in this post, I plan to go lean and wait and watch as the situation unfolds. Once normal operations resume, that’s when I intend to pounce on those limited time offers and deals.

What’s your short term strategy vis a vis welcome bonuses? If you applied recently, what was your application experience like? Let us know in the comments section. ___________________________________________________________________________________________________________________

This card is currently offering a 50,000 points bonus and a 0% Intro APR for 1 year, with a $0 annual fee!

___________________________________________________________________________________________________________________

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!