Earlier this week, I wrote about how Chase was making it easier for people to get their business credit cards. However, my experience from last week was totally different. I applied for a personal Chase credit card and got instantly denied. The denial letter that came in the mail obviously spelled out the reason, which was also told to me during my reconsideration call.

Chase Credit Card – Instantly Denied

Before we delve into the details, let’s get the basics out of the way. Like many others in the miles and points game, I have a pristine credit credit profile without any negative remarks or other issues. Also, I applied for the card after falling under 5/24. So what exactly went wrong?

Chase Freedom Unlimited

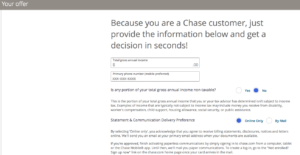

Just last week, I wrote about the newly relaunched Chase Freedom Flex and Chase Freedom Unlimited Credit cards. These cards offer a slew of new benefits and bonus categories. After a hiatus of almost 7 months, I decided to apply for a Chase credit card. I logged into my account and clicked on the section titled ‘credit cards’. I selected the Chase Freedom Unlimited and entered all the relevant details. To my surprise, my credit card application was denied instantly.

Reconsideration

I picked up the phone and called the reconsideration line in order to check what was going on. The rep mentioned this as the reason, which also showed up in the denial letter by Chase.

Insufficient balance in deposit and investment accounts with us

The Pundit’s Mantra

Since I don’t have a existing banking relationship with Chase, I politely asked the rep whether there was any avenue I could pursue in order to get an approval. He politely told me that there wasn’t much that he could do to help me out. Apparently, it does seem that Chase is putting a restriction requiring customers to have a banking relationship. We don’t know if they’re enforcing it across the board, but it’s definitely something to be mindful of as you gauge your approval odds for one of their cards.

Have you applied for a Chase credit card recently? What has your experience been like? Tell us in the comments section.

___________________________________________________________________________________________________________________

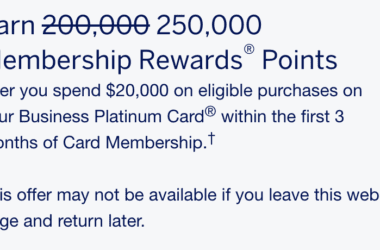

This travel credit card is one of my favorite hotel credit cards. You can earn a welcome bonus of 50,000 points when you apply for this card using the link below!

With this card, you’ll not only earn a free night each year when you renew the card, but If you pair it with this limited time offer, you’ll also earn 25% points back when you redeem your points until October 8, 2020.

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

I got INSTANT APPROVAL without calling.

I have no accounts with Chase this is my first one.

I have a 670 FICO, NO bankruptcies at age of 35, 1 late payment a year ago.

My last credit card was 2.5 years ago. My last inquiry was 2.5 years ago.

I have 3 prior regular cards totaling $1200

income totaling $66k low utilization of 10%. I have a

very low Debt to INCOME ratio.

Many people who have high creditscores and high income and under the 5/24 rule are rejected because of high debt to income ratio.

I think many people underestimate the importance of the low debt to income ratio.

You can be classified as overextended making you higher risk which is undesirable.

I

I was denied for the sapphire preferred because my last two credit card approvals were too close together, which was 11 months.

I got approved for an initial $15k with no prior relationship and a credit score of around 790.

Sorry, double post!

I applied for the Marriott 5 night bonvoy offer. I was actually expecting to be denied (I’m under 5/24). But was instantly approved at 22k. 800ish credit score, 200k+ income. About 150k in credit lines already from other chase cards. No banking relationship. Maybe they are more lenient with the cobranded cards?

I applied for the Chase Freedom Unlimited card after reading your article and was instantly approved and I have no prior relationship with Chase. My card is in the mail.

They also have me a pretty substantial line of credit.

That’s great, Victoria! Thanks for the data point.

I have had a personal banking relationship with chase for 20 plus years. I have a credit score of 745+, after receiving several offers from Chase i decided to apply only to be denied for “insufficient balance on deposits”. To add insult to injury they denied my business a line of credit. Reasoning the business was to new, even though the business has been actively involved in business since April of 2018.

I wonder what’s going on. May be they’re simply going to be this risk averse until we see the economy rebound.

This sounds like a Debt to Income issue.

They are saying your current income level is insufficient for more debt.

Many people underestimate the importance of debt to income. Banks are afraid you are over extended making u too risky.

I was denied last month when applied for Freedom. I have a very good score and have investment with them. The reason – “too many accounts opened recently”. (I believe I opened only one in the last year)

Were you over 5/24?

Could be.

I recently got the chase sapphire Reserve card in July/August. I am 23, great credit, no banking relationship with chase prior, 50k yearly income.

Ryan, that’s great!

Chase seems to have a group of “we’re gonna change things” folks in place right now. I obtained the Chase Unlimited with no problem and use it often. A great card, good benefits. Now the irritation: Chase cancels out my password as soon as I sign off, every time. To get back into my account, I have to go through the whole forgot may password routine. In setting up the new own, if I use my most recent one, it says “you cannot reuse that password” so I know the password is in their system. To reset the password, one has to provide a lot of information and it takes a lot of time. Then I get the password set up, but it works one time only. Unlike my credit union account and Wells Fargo account where they ask questions you have registered with them, or send me a code via text, it seems Chase’s back up security system is to just negate the password.

I’ve had similar IT issues with another bank. I had to call their customer service and almost threatened to close my checking account, then within minutes a senior exec finally called me and fixed the issue once and for all.

After reading this article I’m reconsidering trying to get into the “chase trifecta”. I applied for a freedom unlimited not to long ago and they only gave me a limit of a measly 700 usd. All my other cards have a limit of at least 3.5k and I’ve got the income to back it up. I guess I’ll have to look elsewhere when I’m ready to apply for another card.

Hi Alvin,

I’d say it may still be YMMV. In the past, I’ve been approved for two Chase cards without any issues online, but these are weird times, so you won’t know until you try. 🙂

They told me the same thing but I had an account with them but they are not my main bank so all my money does not go to them. They need to be sued

I get 2 or 3 credit card applications/ month. There are so many available. Why worry about Chase? It has always been

a predatory, high fee bank with lousy service. Incidentally, credit cards issued by S&Ls are usually easierto get and

provide much better service.

It’s the point game man. If you are in the points game, you are definitely going to have chase, and AMEX.

Yup, if you’re deep in the miles and points game, you’re going to deal a lot with Chase & Amex.

Speaking of “Deep in the miles and points game”, I had depth in the 1990s, although back then, I never knew my credit scores nor checked with credit bureaus. Not once. I should have also been deeper in the credit game & how it works. Too bad. After being invited to apply for my first card in my late 30s, Discover (unsecured) approved, don’t remember the credit line, must’ve been decent The next in the flood of offers was the predecessor to Chase/United Airlines Explorer. I had a pretty good run, 2 free RT’s to India, & Boeing 777s economy class seemed luxurious enough, & a complimentary upgrade to 747s Business to Thailand & India. More domestic RTs before removing myself from view of the credit radar 16 years ago.

(A question, is any of that relevant to Chase today)

So I absolutely had to get a car loan, so rebuilding my credit started January 2018, Capitol One Platinum 5500 cl a few months later, AMEX Delta Gold 2500 cl March 1st 2019, accepted Cap 1 offer morphing up to Venture (effing no 50k miles bonus).

Travel, not cash back, is my focus. Being 66 yrs old, my bucket list needs to be addressed. want be careful building up. Without the usual trick of becoming an authorized user on another persons account, I went from no score up to 764 FICO-8. My 3 accounts are in good standing, perfect payment history, credit utilization currently 1 or 2%. I have no qualms about another card with 95$ annual fee, but I hate wasting a hard inquiry.

I’d rather grab Sapphire Preferred

with this 80000 point offering than go up the usual path with Freedom cards. Most of the famous credit monitoring apps give me very good & excellent approval odds. Experian app, the only one using FICO-8 instead of Vantage says go for it. They all know my sub 25k income. I pay no rent. Now I’m reading your story and everyone be else’s weighing in, ….OK, I ve gone full windbag. My final question(s)

Regarding the Sapphire Preferred,

In your opinion (& other’s who chime in), as it seems having a banking relationship can help or not matter, Should I Go For the CSP? Get a Chase checking account prior to it?

Or, should I be afraid…. Really afraid!!!!

I currently have 9 personal chase cc, no banking relationship with chase, had a delinquent card closed by chase in 2004 (balance only $124) & a mortgage with chase in 2005. learned about points/miles & started in 2012.

chase has definitely tightened up in 2018, now I’m down to 2/24, on sideline for next monster card.

I applied for the Chase Freedom Unlimited card and was also instantly denied.

That sucks. Welcome to the club! 😀 🙂

I applied for the card. And mind you I have excellent credit and history, 792 score.. I was denied, I called the reconsideration line and they came up with sorry we can’t help you.. I asked why I was denied? She said discharged account.. I said I don’t have any problem with chase accounts.. come to find out 12 years ago I filled for bankruptcy but still on their records

Wow, that’s a long time for them to cite that reason for denial. They’re certainly tightening their purse strings.

Solar add for home owners. Seems to be a trap laid by other organizations or concerns. I couldn’t get beyond the ads that popped up as soon as I finished the survey.

I recently applied for chase business credit card and was instantly denied because I was a new business. They will not allow any new customers to get a credit card is what I was told even though my credit score is basically perfect. So I chose them for my new business checking account because of the credit card perks like 12 months no interest if you spend over 3000 in first month or so which i was going to do to help my new business out. Instead I’m stuck with a checking account that limits mobile deposit amounts for each month to 2000 and charges higher fees than my local branch which would have given me a basic credit card smh what a horrible experience I’ve had. Oh and don’t fill out applications if you are an llc. It tells you at the end that you have to visit a local branch and get sick. I mean to get approved.

It’s unfortunate that you have to run around in spite of opening that checking account. I was assuming that should’ve fixed it!

Zachary Tomlin, I have a new business as well. I was able to get a business credit card with Bank of America. If I were you, I would apply with them.

Not only was I declined when i applied for a chase ink card. ( that they mailed me the application) . They closed my other Amazon chase card account. Which had always been paid on time and above the minimum. Total b.s.

Did you follow up with them about why they did it? Ideally, they should communicate to you the reason for closing an account from their side.

I got denied because my last two credit card approvals were too close together, which are 11 months apart.

Did they explicitly cite that as the reason for denial, or something else?

I applied for the Freedom Unlimited card online last July & was instantly approved. I do have a banking relationship with Chase & I’ve been a customer of theirs for over 25 years. I hadn’t applied for any credit in many years & my credit score is very high (838).

That’s great. Glad it worked out!

It’d probably a way to make it a “secured”card. If you have a banking relationship with them you have money parked with them and it probably has to be not only higher than an amount they specify but probably also has to have sat there for more than a specific time period. That way they have made a secured card for themselves if you default. Even people with high scores can fall on hard times and not pay and probably already have. Or maybe they run your new “resilience score” and if it’s above a certain level, demand that you have a provable way to pay the balance if you lose a job.

May be they should rename them The Sapphire or Freedom Secured card for the time being 😀

I got one instantly approved in June with an offer from Southwest. No banking relationship with Chase. Spent my $1000 in less than 3 months, pocketed my 40,000 WN points and put it away. Weird.

That’s great. May be folks are having better luck with co-branded products.

I have been banking w chase now for two years plus and am denied each time for a chase credit card now mind you I have multiple others with small balances. I even was denied credit loan for new vehicle how ever was extended loan via my credit union

What did they cite as the reason for denying those cards?

I have been a chase customer for 12 years. I have tried to get a credit card through chase 3 times and a instant denial every time.

I would change banks but unfortunately chase is the only bank in my town. The closest other bank is 35 miles away.

For a personal card, that seems like a very strange reason. I haven’t had a banking/investment relationship with Chase in many years, and I got approved. I think you got a really bad representative when you called Chase, although bad CSRs at Chase have become a common problem lately. I’d call again and try to get a better explanation.

I had a similar experience, although the reason Chase gave was different. I applied for a Freedom card last month. I had a large, >$5k, charge on my American Express Card, so I wanted to be sure and apply for Freedom before my August American Express statement hit my credit report. Chase immediately denied me for the card, and when I called the recon line, I learned that American Express had reported my balance to the credit bureaus earlier than expected and therefor Chase claimed my debt/income ratio was too high.

The solution? I paid off my American Express bill, waited for the $0 balance to hit my credit report, then reapplied with Chase and got approved.

Interesting. Thanks for sharing that data point. They’re surely tightened up things post March.

Was it the 5/24 rule? They will never outright tell you if thats the case (unless you go into a branch and apply in person)

edit: my mistake. forgot that was mentioned early on. haven’t had any coffee yet today. still though, Chase seems to have been reluctant to approve cards in the last month. a few friends with good scores and satisfying other requirements were denied for preferred/reserve.

Haha, glad you brought that up. The people in branch talk to you about it and mention 5/24 in person. 🙂

I applied for the Freedom Unlimited yesterday and got an interesting message after hitting the submit button. They asked if I wanted to consider any other forms of income before submitting. I haven’t applied for a Chase card in a while, but I don’t remember that before. I did not add any additional income, and was instantly approved, but only with a $500 limit. All my other Chase cards have $7,000-$15,000+ limits

I have gotten the same message. That is a common problem with Chase. The Chase computer tends to automatically raise your existing credit lines to the maximum. then when you apply for another card, it will not extend more credit unless you bring in more income.

In the past I have cancelled a Chase Visa, then later found the credit lines on my remaining cards had increased. When I next applied for a new Chase card, I got a letter saying that Chase approved my application, but took credit from my existing lines to approve the new card.

Really, Chase needs to hire some new employees to design a credit program that doesn’t do this.

All my other Chase cards have high-ish limits as well, but they won’t tell me the exact reason for the denial other than what they told me initially.

Hi Ethan,

That’s really odd, but a valuable data point. The income requirement could well be a new thing they’ve added, but the $500 limit is really odd.

Applied for the Chase Preferred on the 19th and was approved right away. No banking relationship at all with Chase. Go figure.

That’s great. Glad you got it!

So you have a bank account with Chase and they denied you a credit card?

Wow, that’s tough!

If you have a bank account they should have approved you. How much money do they want you to have with them?

What was your account balance when you applied?

I fall under 5/24 in two months and was thinking of applying for a Chase card at that time.

Hi Marshall,

No, I didn’t have a bank account with Chase when I applied. That’s precisely why they denied my application.

No, that’s why they said they denied you. I expect other factors were in play.

Just curious ..what was your credit score if you don’t mind me asking