Over the last few weeks, we’ve covered some stories outlining how major issuers like Amex and Chase are tightening their belts. Chase’s most recent financial results indicate that this trend may continue for a much longer time than expected. What does this mean for those looking to apply for a Chase credit card? It could well mean lower odds and more restrictions for approvals and lower credit limits.

Chase Credit/Debit Card Sales

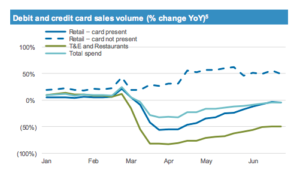

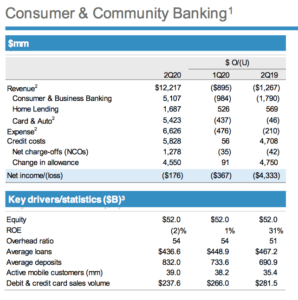

Chase’s most recent results from the second quarter paint a grim picture. The data shows a slight recovery in the restaurant and retail category. However, overall spend continues to remain depressed. The report highlights the fact that Chase’s overall debit and credit card sales volume fell by 23% YoY. The chart below depicts how the numbers have steadily dipped. The very last row at the bottom represents debit and credit card sales volume.

Earnings Call

During their most recent investor call, Chase executives seemed cautious when asked about their outlook for the next quarter. However, if you read the entire transcript, you’ll figure out that the outlook doesn’t look all that great. JP Morgan CEO Jamie Dimon outlined his overall outlook for the next quarter during the call.

We cannot forecast the future. We don’t know. We’re also very clear that, I know at least I think, you’re going to have a much murkier economic environment going forward than you had in May and June, and you have to be prepared for that. You’re going to have a lot of ins and outs. You have people that’s scared about COVID. They’re going to be scared about the economy, small businesses, their companies, bankruptcies, emerging markets. So it is just going to be murky which is why if you look at the base case, an adverse case, an extremely adverse case, they’re all possible and we’re just guessing at the probabilities of those things; that’s all what we’re doing.

On the consumer side, we like other banks you’ve seen are kind of prudent and tightening up with how you do credit. That’s already happened and obviously you can do some more.

The Pundit’s Mantra

Banks, just like other businesses are simply responding to existing market conditions. I won’t be surprised if other card issuers follow a similar path. Banks will continue to remain gun shy and offer lower credit limits and tighten up card approvals. Similarly, we’re already seeing data points showing how Chase is only approving customers who have a Chase business banking account for their small business credit cards.

I haven’t applied for a credit card for the last few months, let alone a Chase card. I have a sufficient chunk of miles and points to use right away after travel returns to normal. Therefore, I plan to sit out and wait for better sign-up bonuses and lower card application restrictions to return.

Have you applied for a personal or small business Chase card recently? What was your experience like? Tell us in the comments section.

___________________________________________________________________________________________________________________

This travel credit card is one of my favorite hotel credit cards. With this card, you’ll not only earn a free night each year when you renew the card, but If you pair it with this limited time offer, you’ll also earn 25% points back when you redeem your points until October 8, 2020.

You can earn a welcome bonus of 50,000 points when you apply for this card using the link below!

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

They need to bring back Refer a Friend. I have a friend who wants the CSR and is waiting for me to invite him so I can get the points, bless his heart. I checked yesterday and the offer was not available on my card. Boo!

Applied for Sapphire Reserve a month ago. Approved after providing required documents with a pretty good credit limit. Credit score about 740/750, several other cards with 10k, 20k limits but limited 2 years of credit history and tons of hard pulls in it. It was my first Chase credit card although have about a year of relationship with them as Checking account customer and monthly direct deposits of my salary.

Hi Alex,

Thanks for sharing that data point. It surely seems like Chase is asking for more info. Direct online approvals seem to be not so common for the time being.

I was approved instantly a week and a half ago with a 20k limit. The largest I’ve ever had. I’m military and wonder if that might have something to do with it.

i hope they get rid of the 5/24 rule. That will get more card applications.

If they’re tightening credit, they certainly aren’t interested in those that are applying for multiple cards/year.

Jassi, as Rico correctly pointed out, I don’t see them removing 5/24 any time soon. Also, per their own words, they’re looking to tighten up how they do credit, so I don’t see them going after new applicants any time soon.