There are a lot of things to love about the American Express Platinum Card and one thing not to love, the $450 annual fee. Last August I got in on a great sign-up bonus of 100,000 Membership Rewards Points after $5,000 of spend in the first three months. I met the minimum spend, got the points and they sat there for nearly a year.

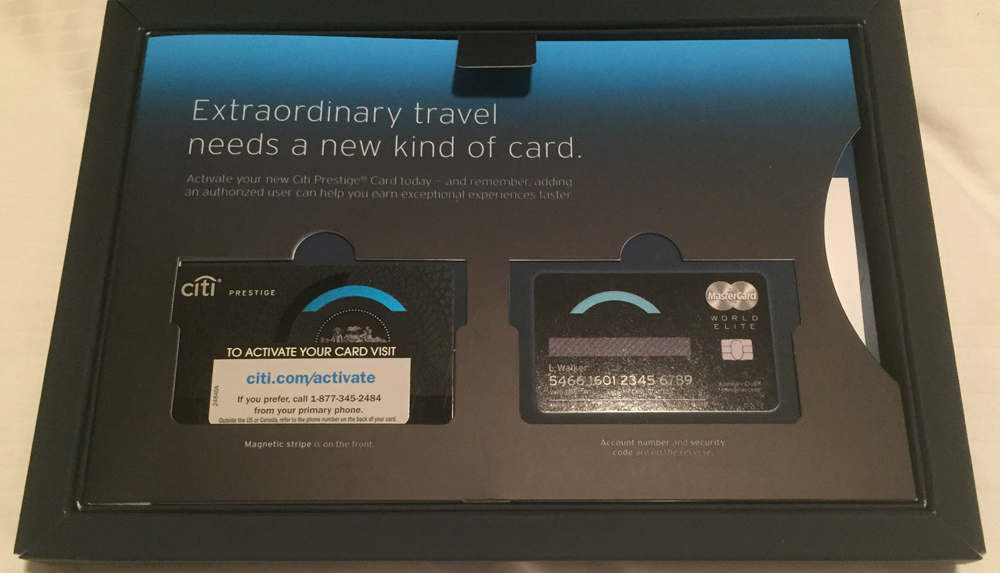

I recently transferred them to Aeroplan for a business class award to Asia and used the scraps for the recent Amazon $25 off of $50 when using American Express points to pay. After using the airline fee credit to purchase $400 worth of Southwest gift cards between 2015 and 2016, it was time to cancel to make room for the Citi Prestige.

Retention Offer?

I called the American Express Platinum customer service number in hopes that they would offer me some kind of a retention offer, perhaps $100 off the fee or an incentive to spend for bonus points. After telling the rep that I was “considering” canceling the card he immediately transferred me to the team that handles this type of situation.

After listing to the 5 minute rant about the wonderful benefits I was finally asked why I wanted to cancel. I told him that the Citi Prestige was less restrictive on how the airline fee credit could be used, the fourth night free benefit was great, and they offered a better priority pass membership, etc. His response was, “Well they copied us” to which I replied, “yes, but they improved upon it.” I told him that I really love the Centurion Lounge benefit and that it was a big selling point for me.

Seeing where this call was heading, I flat out asked if there were any offers for me that would incentivize me to stay. There were not. This didn’t shock me since I had the card for less than a year and burned the points pretty quickly. After hearing that I decided it was time to let it go and cancel the card.

Beginning September 1, 2016 Amex will no longer prorate annual fees, meaning if you only keep the platinum card for six months, they will start charging you the full $450 instead of crediting back $225 after canceling. Thankfully, there are a number of other Platinum cards in the Amex portfolio, including the Mercedes Benz Platinum which I will go for next year.

Final Thoughts

The American Express Platinum is a great card to get when the sign-up bonus is big, but not one I would keep around long term. There are so many quirks and restrictions with American Express that really bother me. Keep in mind, if you have only had this card for a year and have put less than $50,000 in spend on it, don’t expect a retention offer. Amex has gotten a lot stingier over the years and have become very selective with these offers.

5

Thanks for the information. I am new to the American Express Platinum Card kindly explain how and where to purchase Southwest gift cards?

You’ll first want to log-in to your Amex account and go to the Benefits tab. There you’ll find a section about the Airline Fee Credit. If you click on that, it will prompt you to select an airline in which to use this credit. Or, you can always call Amex to select your airline. Select Southwest, then go to southwest.com and purchase the gift cards from there. Make sure you buy 2 x $100 gift cards at least a day apart. If you purchase the full $200 at once it won’t be reimbursed. It can take up to a few weeks for these charges to credit to your account, so be patient.

Here is a link to a flyertalk thread on this topic:

http://www.flyertalk.com/forum/american-express-membership-rewards/1300482-airline-fee-200-100-reimbursement-reports-wn-fl-southwest-only.html

I just cancelled my Amex PRG card and expected something from them in regards of retention offers. Even $100 dollars off the AF or anything. But I was shocked when there was nothing. Oh well I guess.

Yeah, they have gotten a lot more strict it seems.

Good stuff, we got the 100,000 offer a couple moths ago before it expired. I didn’t realize we could get the airline gift cards, so that’s pretty sweet. About to cancel wife’s Prestige as I’m holding onto mine because of the CitiGold TY points offer I took advantage of recently. Wondering what Citi will offer us on retention?

The gift cards are the only way I can justify it to my wife! Haha! I should add it only works with certain airlines like Delta, AA and Southwest. If you want to do it for United gift cards, you have to create a MilagePlus wedding registry which allows people to gift you United credit. Send the registry link to yourself and pay with the Platinum. Don’t forget to select your airline with Amex first. Made that mistake before, not fun. Can’t wait to get me a Citi Prestige 🙂

Wow, thanks for the pro-rate info. So should I cancel on the 364’th day or will that trigger some sort of outrage that I got 100,000 points?

Well if you cancel on the 364th day you’ll only get a credit of $0.81. If you can, I would reccomend using the points now (if it makes sense), make sure you’ve used all of your benefits like the $100 credit toward a Global Entry application, $200 in airline fee credits, get all of the car rental and hotel statuses you can and close it if you don’t need it. They don’t care for people like me who just sign up for the big bonus, meet minimum spend and cancel, but I doubt they will hold it against you next time you apply for a new card. Just my two cents.

4.5