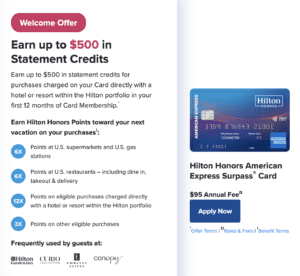

Last week, I saw that American Express had rolled out a couple of different credit card offers on their co-branded cards with Hilton.

In my opinion, one set of offers was clearly better than the other. You can find a detailed blog post about it here.

This offer clearly gives you more than $500 worth value at Hilton properties. However, comparing offers can be a daunting task. If you’re looking to apply for a credit card, then how do you ensure that you get the best possible welcome bonus each time you apply? Here’s a handy checklist.

1. IS THE BEST CREDIT CARD BONUS OFFER THE ONE THAT’S PUBLICLY AVAILABLE?

This is the most obvious bonus that usually pops up when you do a Google search. More often than not, you’ll find that the publicly available bonus isn’t the highest offer available.

2. AFFILIATE CHANNEL

Many bloggers have partnerships with affiliate networks. Banks often partner with bloggers to launch partner only or limited opportunity offers through specific affiliate channels. In certain cases, you may be able to get a higher offer if specifically advertised.

As written earlier, The Points Pundit has no partnerships with credit card marketing affiliates. If you like the content and want to support the blog, I always encourage readers to use my refer-a-friend links.

3. TARGETED OFFERS (ONLINE)

Targeted offers can be of different types. Firstly, a bank targets you for a specific card and a welcome bonus. Very often, you’ll see these offers once you log into your account.

For example, Chase once targeted me with an offer even though I was above their 5/24 threshold for credit card approvals. Similarly, you can find pre-qualified offers when you log into your American Express account. Other banks may send you targeted offers via email.

Similarly, an airline or hotel chain may target you with an offer. Very often, you’ll see these offers once you log into your loyalty program accounts. An airline or hotel may target you for various reasons like recent stays, flights or elite status levels.

4. TARGETED OFFERS (MAIL)

If you play the miles and points game, you’re surely one who keeps a tab of what’s in the mail. Banks, airlines and hotels often target customers with offers sent by mail. It’s always a good strategy check your mail regularly for any offers that may pop up. Who knows, may be your best credit card sign-up bonus arrived by snail mail?

5. IN-FLIGHT SIGN-UPS OR AT AIRPORT KIOSKS

Very often, you’ll find these offers to be lower in comparison to offers that you see online. However, it doesn’t hurt to take a quick look when your airline makes an announcement or passes on co-brand credit card offers while in flight, at an airport kiosk or a lounge.

6. INCOGNITO OFFERS

This is my personal favorite and continues to be for many of my readers, especially for American Express credit cards. I’ve consistently found higher welcome bonuses while using the incognito mode while applying for American Express credit cards. This post details some of the offers and how you can access them.

7. SHOPPING CART TRICK

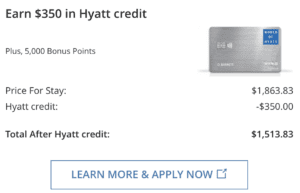

The shopping cart trick is simply a trick where you access the airline or hotel website to complete a purchase but don’t finish it. When you reach the end of the process and you have to enter payment details, you’ll see a small banner with a credit card offer. Very often, these offers provide with handy statement credits of $100 or even more.

8. REFER A FRIEND OFFER

Credit card issuers offer refer-a-friend links to existing customers so that they serve as customer advocates to help acquire their friends or family as new customers. Amex has a fairly lucrative refer-a-friend program where you can refer for a card across the entire Amex portfolio if you hold a card that earns Membership Rewards points. Similarly, Chase also has a referral program, however it’s generally limited to only a particular card or a family of cards.

THE PUNDIT’S MANTRA

Many people make a mistake by getting carried away and applying for offers. Limited time offers are designed to generate buzz and make people apply for a card. However, not all limited time offers may be the best possible offers available.

___________________________________________________________________________________________________________________

HIGHEST EVER WELCOME BONUS FOR THIS CARD!

For a card that charges an annual fee of $150, you can earn 60,000 points + $200 with a single welcome bonus. Click on the link below to find out more…

CLICK HERE FOR THIS LIMITED TIME OFFER

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!