Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links

A few weeks back, I wrote about how there were a few rumors swirling around about changes to the Chase Sapphire Reserve. This week, we’re getting more information about the same and I sense that we’ll probably hear from the official channels soon. Given the multitude of sources, it seems like something is on the horizon.

Chase Sapphire Reserve

Right after Chase launched their Sapphire Reserve product, it featured prominently in the lists of premium credit cards in the market. The 100,000 points sign-up bonus made a huge splash and served as a major driver for new card acquisitions. However, it has been over three years since this product launch. We were all expecting some changes. Today, we have some more details about those changes.

DoorDash Benefits

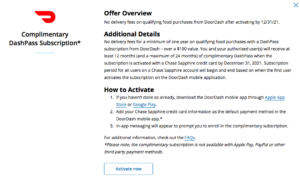

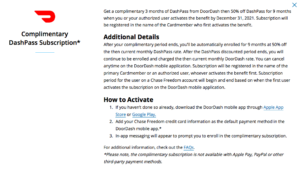

If you head over to the ‘Card Benefits section in your Chase account, you’ll see that these benefits are already listed on the page. You need to activate the benefit in order to use it. I looked at my Chase Sapphire Preferred account benefits and saw this.

Similar benefits show up for the credit cards in the Chase Freedom family.

Annual Fee Increase

Doctor of Credit reports about possible new card benefits and an annual fee increase. Please note that these are still not confirmed from official Chase channels. However, given some of the moves Chase is making, it does seem like we’ll see some announcements soon. The DoorDash benefits seem to be a step in that direction.

The article highlights a few key points with regards to changes to the Chase Sapphire Reserve:

- New Annual fee will be $550 for new users on January 12th, 2020

- Annual fee will be $550 for existing cardholders in April, 2020

- You’ll not be able to product change to the card until after January 12th, 2020 (new $550 annual fee will be applied)

- $60 DoorDash credit to be added for 2020 and 2021

- Complimentary Lyft Pink membership to be added on January 12th, 2020

Analysis and Data Points

Reader Stacy provided this data point on this post confirming these upcoming changes:

They’re raising it to $550 on January 12. Just got off the phone with them. Adding Doordash and Lyft benefits only. Not worth it IMO.

If these changes indeed go into effect, it signals a worrying trend. Chase has essentially copied Amex’s breakage strategy. With Citi also removing key travel protections from the Citi Prestige, 2020 has started with a decline in value of products that we all considered to be of premium value.

Chase truly innovated by introducing the Sapphire Reserve. It’s sad to see them simply copy Amex in just three years after the product’s launch.

My Strategy Going Forward

I’m glad that I downgraded my Chase Sapphire Reserve more than a year ago. Going forward, I’ll continue to carry these credit cards as part of my points and miles maximizing strategy:

- Amex Gold Card: With Amex’s new travel protections, I’ll use this card to book flights and get 3x Membership Rewards points on each booking. I’ll continue to earn 4x on dining and on US groceries.

- Chase Sapphire Preferred: This is my go-to card which ensures that I have to ability to use Chase’s transfer partners. It also allows me to redeem them at a flat 1.25 cpp value through Chase’s portal. I use this as my go-to card when I travel internationally, especially in countries where Amex card acceptance is particularly lower.

- Hilton Aspire Card: Given that most of my hotel stays are with Hilton, this is my go-to card for Hotel stays around the world. The card also give me Priority Pass select. Other benefits like the annual free night, airline credit and the resort credit pay for the annual fee of $450 each year easily.

The Pundit’s Mantra

All in all, I’m happy that I didn’t end up upgrading my card. If the annual fee on the Chase Sapphire Reserve goes up, I’ll continue sticking to the Chase Sapphire Preferred. Also, the standard sign-up bonus on this card is also higher than that on the Reserve. Currently, you’ll earn 60,000 Ultimate Rewards points after you spend $4,000 in the first 3 months. The Chase 5/24 rule does apply to this card.

If the annual fee goes up to $550, would you still continue holding the Chase Sapphire Reserve in your wallet? Let us know in the comments section.

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

Definitely worth it. I’m a heavy Lyft user + postmates unlimited. I’ll cancel the postmates and switch to DoorDash. Huge fan of this.

Great! Glad that these changes work positively for you.

For people who travel/dine a lot and have the reserve card (that’s the target audience after all), I don’t at all understand downgrading. Leaving aside all the transfer games and so on, look at the simplest case. 3x points redeemed for travel at 1.5 is a better deal than 2x points redeemed at 1.25. After you spend $3444, you make up the $155 difference in annual fees. Plus you don’t have to spend $450 on some other card for priority pass or other benefits.

Those looking for the simplest solution will just keep the CSR.

Hi Fred, Thanks for your analysis. Here’s the segment that Chase is really targeting with these changes. People living in big cities who don’t own a car, travel frequently and also use ride share services and food take out services like DoorDash. Your analysis is based on the fact that you want to redeem your points from the Chase portal for optimal value. Almost 95% of my Chase redemptions are via points transfers to their partners. I rarely use the portal to make bookings. Also, I tend to eat out instead of ordering takeout and rarely use services like Grubhub/DoorDash.… Read more »

That’s fine but it doesn’t answer why you would recommend downgrading to preferred. If you’re transferring points, you have 50% more points to transfer with CSR; you can do a calculation similar to the portal calculation above and figure out the break even point, but if guess it isn’t high. If you are using a different card for 3x travel benefits, then why bother with a Chase travel card at all? I’m missing something, I guess.

The last part of your statement actually is the crux of the decision making process. Do you want to hold a single UR card or multiple ones? Do you want to collect points in a single transferable currency or more? I’d rather have multiple mid-tier cards earning transferable points instead of a one or two major premium cards with the a fee upwards of $450.

Oh, please. What a dramatic and misguided headline. The card – which at its core incentivizes travel and dining purchases – is raising its fee and in turn providing credits for what? Travel and dining! If this change tips the scale for you and is no longer providing value, you were probably going beyond your means to hold this card in the first place. Plenty of other great rewards-earning options from Chase to pick from! Please downgrade and clear out of the airport lounges, thank you.

Thanks for your detailed and passionate response, I’m glad that you love the CSR. My critique of these changes was that Chase simply copied Amex’s breakage strategy and collaborated with DoorDash. They’ve gone from innovating in the premium card market in 2016 with the CSR launch to copying what Amex is doing in a span of 3+ years. Travel and Dining card – great! A simple $60 dining credit would make me keep the card for sure, just the way the travel credit is, which is easy to use. I already have PP through the Aspire card, which I use… Read more »

Sorry if I’m missing a bonus somewhere, but how do you earn 4x on airline bookings with the Amex Gold? I thought it was 3x for airlines. I’m also mulling whether to cancel my CSR, or at least downgrade it to CSP so I don’t lose my UR points till I can spend them and grab an Amex Green for 3x travel category… the only perk I really used from the CSR is the 3x travel earn and PP access and I can kind of live without that. Haven’t had to use any travel coverage, but it would still be… Read more »

Thanks for pointing out the typo, just updated it. Yes, the Amex Green is a great option if you’re looking to rack up more MR points. Otherwise, downgrading to the CSP is the best option if you want to stick to the Chase ecosystem.

I don’t use either DoorDash or Lyft. Can barely use my Amex Uber perk. I’ll likely cancel come fall.

I’m in the same boat. I downgraded my personal Platinum card a few months back as well. I rarely use ridesharing services so I find it really tough to justify the annual fees.

Like The Points Pundit, I’m downgrading to the Sapphire Preferred when my annual fee comes due. I have three other Chase UR-earning cards, so having the CSP makes a lot of sense for my strategy.