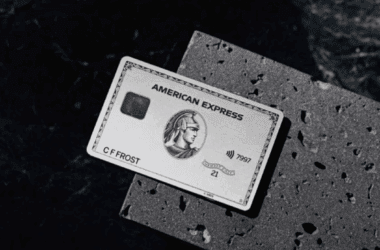

A few weeks back, I wrote about how major card issuers like Amex and Chase are making changes in response to market conditions. Card issuers are approving customers for cards at a much lower rate. Even when they are approving customers, they’re offering lower credit limits and imposing more restrictions. Amex’s most recent financial results provide some interesting insights about many things about the business. However, for the purpose of this blog post, we’ll focus on things that matter to most of our readers, topics like card approvals and rewards programs.

Amex Card Trends

The earnings call and financials provide information on two fronts. Firstly, how the business fared in the previous quarter. Secondly, how the business sees market trends and how they shape its future actions. You can access the report here. Here are a few trends that caught my eye.

- Spending volumes recovered after they fell in April. On expected lines, non-T&E spend is bouncing back faster than T&E spend

- Amex says they’ve been successful in managing customer attrition rates as they haven’t jumped post pandemic. They attribute this success to the fact that Amex revamped many of their cards in line with customer spend patterns. In fact, customers have shown great engagement levels with new rewards categories like streaming, grocery, food delivery and wireless. Amex hinted that they could use these trends as a benchmark for future card product refreshes

- Surprisingly, small and medium enterprise spend showed resiliency. However, corporate card spend, which accounts for a major chunk of T&E spend, remained low. Amex execs expect corporate travel spend to remain low for much longer

- Consumer co-branded cards are surprisingly faring a lot better compared to Amex’s proprietary cards. Amex execs say it’s largely because customers are piling up points and miles to satisfy pent up travel demand in the future. Customers who are spending heavily on these cards are also looking to attain elite status before they resume travel

Risk Management Measures

During the earnings call, Amex execs were asked about the reduced spend on rewards programs. Amex execs hinted that they were spending a lot less on ‘proactive acquisition’. At the same time, they were looking to cut costs and reduce risk where they can.

What we did do is that we slowed our proactive acquisition because there’s just not enough visibility into the actual credit quality of applicants. So you saw our new cards acquired, which was also disclosed in parts of the press tables, were down also significantly year over year. The other thing you would expect us to be doing from a risk management perspective is we have been very diligent about looking at people who are inactive card members and canceling those cards.

You don’t want to have those inactive cards sitting out there in the middle of an economic downturn. So really, that combination of slower new card number acquisition along with some of the inactive cancellations that we’re doing are why, when you look at that total card number, you see the numbers you do.

The Pundit’s Mantra

Amex’s approach seems pragmatic and pretty much in line with other card issuers. It’s no surprise that Amex isn’t actively seeking to add new customers during this downturn. The strategy is pretty much in line with what Amex’s CFO stated publicly a few weeks back.

However, I find it interesting that Amex is actively looking to add new categories to add more value for cardmembers. This is a very encouraging sign and is largely bolstered by the current shift in customer spending patterns.

If you have an Amex card that you haven’t used off late, please make sure that you use it in order to keep it active. There are a few very simple ways of doing it. If you use Autopay, you can simply put your monthly telephone bill or streaming service membership fee on that card on a recurring basis. Otherwise, simply buying a cup of coffee with your card every now and then should suffice as well.

Have you applied recently for an Amex card? If yes, were you instantly approved online? Tell us in the comments section.

___________________________________________________________________________________________________________________

This travel credit card is one of my favorite hotel credit cards. With this card, you’ll not only earn a free night each year when you renew the card, but If you pair it with this limited time offer, you’ll also earn 25% points back when you redeem your points until October 8, 2020.

You can earn a welcome bonus of 50,000 points when you apply for this card using the link below!

___________________________________________________________________________________________________________________

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter and get the latest content!

___________________________________________________________________________________________________________________

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

I applied for the Amex Green card and was instantly approved. I was offered 45,000 rewards points after a $2,000 spend. I already have the gold and platinum versions as well as 5 other co-branded Amex credit cards. I look forward to the cell phone credit of 10.00 per month which I can combine with the platinum credit of 20.00 per month along with the credit for the clear membership.

Along with the platinum’s 20.00 per month streaming credit And bonus on point spends, I’ve come out way ahead. In addition, with the Hilton aspire, I was able to use the 250.00 resort credit for normal restaurant spending, and am in the midst of using another 250.00 resort credit as my anniversary date just came up. I’m hoping to be able to use my 550.00 in airline credits (250 on aspire, 200 on platinum and 100 on gold) before years end.

I regularly use all 7 (8 now) of my Amex products, as the offers are often tailored to my spending habits. I’ve been with Amex since 1988, and have never had anything other than the most positive of experiences.