- Part 1: How I Got My $40,000 for $3,000

- Part 2: Flight Review: Emirates First Class

- Part 3: Touring Oman

- Part 4: Flight Review: Etihad Business Class

- Part 5: Hotel Review: Park Hyatt Saigon

- Part 6: Touring Vietnam

- Part 7: Hotel Review: Park Hyatt Siem Reap

- Part 8: Touring Cambodia

- Part 9: Touring Singapore

- Part 10: Hotel Review: Park Hyatt Maldives

- Part 11: Touring Abu Dhabi

Introduction

Last year I traveled to seven countries in one trip all made possible by using miles and points from various travel rewards programs. The countries visited on this trip were Oman, Vietnam, Cambodia, Singapore, Maldives, UAE, and the US starting out from Germany, where I currently reside.

Once a year I try to plan at least one long vacation that lasts two or three weeks. Contrary to popular belief, I actually have a full time job. Usually, I just take many short trips over the weekends which makes it seem like I’m always traveling instead of working.

Planning

This itinerary seems bizarre but its due to me wanting to try out the Emirates First class product. At the time of booking, the cost for this flight was 100,000 Alaskan Airline miles between Europe and the US. The amount of miles required for this has now doubled to 200,000 miles. This reinforces the “earn and burn” philosophy. Do not hoard points/miles!

I would have preferred to fly from Frankfurt (where I’m based out of) to Asia direct on Emirates Airlines, however this was not permitted by the Alaska Airlines mileage program rules, as all award flights on Emirates must originate or end in the US. Fortunately, I was able to include 14 day stopover in the UAE for no extra charge.

So, instead of hanging around UAE for two weeks, I decided to travel to Oman, Vietnam, Cambodia, Singapore, and the Maldives before my connecting flight to the US.

Once I booked my Emirates flights, I looked to see what Hyatt hotels were in Asia because I had a lot of Chase UR points at the time which are transferable to the Hyatt Gold Passport Program. Additionally, I chose only Hyatt hotels because I was attempting to renew my Diamond status by having 25 stays for the year.

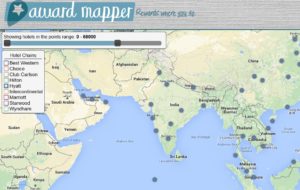

Using Award Mapper, I was able to see where all Hyatt hotels were located on a map with details such as category and points required. As a result, the cities I chose to visit were due to a Hyatt being located there. Especially, in Southeast Asia where Hyatt point redemptions were really low for high end hotels.

Costs

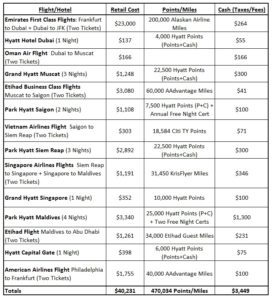

Using Chase UR Points, Alaska Miles, Citi Thank You Points, and AAdvantage Miles, I was able to take a $40,000 trip for $3,000 for two people. See the below breakdown:

How I Earned These Miles

-

Chase Ultimate Reward Points

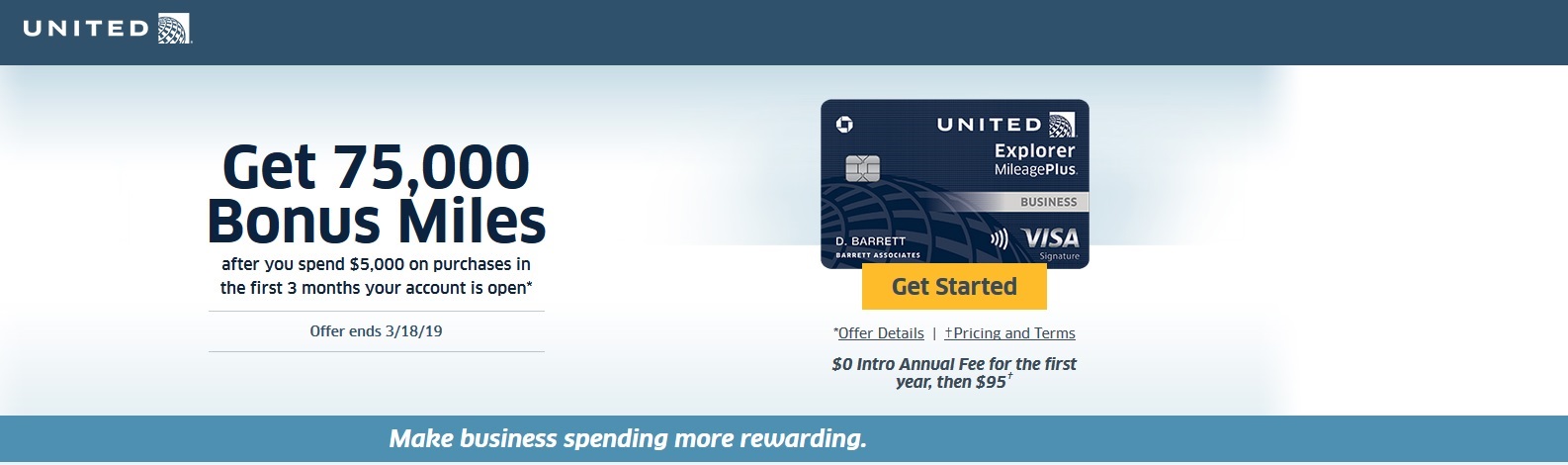

These are my favorite points currency because you can transfer to several airlines and hotels. I almost always transfer to Hyatt because it provides to most value. However, I occasionally transfer to United Airlines.

Chase Sapphire Preferred Credit Card:

-

- 50,000 Points signup bonus

- $4,000 Required spending in first 3 months to qualify for bonus

- $95 Annual fee waived in first year

- Additional 5,000 points when adding an authorized user

- Earn 2x points on travel and dining

Chase Ink Business Preferred Card:

- 80,000 Points signup bonus

- $5,000 Required spending in first 3 months to qualify for bonus

- $95 Annual fee

- Earn 3x points on travel, including airfare, hotels, car rentals, train tickets, and taxis

-

Alaska Airlines Miles

This is a great mileage program that can be used to book flights on Alaska, American, Emirates, Delta, Iceland Air, Cathay Pacific, LAN, Korea Air, and more. Therefore, it is the one of the most flexible rewards programs out there due to its many partner redemption options. My only complaint is many redemption options require starting or ending in the US. Compared to United and American Airlines rewards programs where you can start and end in just about any region, this poses a problem for me since I’m based in Europe.

Bank of America Alaska Airlines Credit Card:

- 30,000 Miles signup bonus

- $1,000 Required spending in first 90 days

- $75 annual fee

-

Citi Thank You Rewards

Like Chase Ultimate rewards, these points can be transferred to several airlines. I usually just transfer these points to Singapore Krisflyer miles or Etihad Guest Miles. You can also book flights on the Citi Thank You portal and pay with points at a rate of 1.33 cents per point if you have the Citi Prestige Card

Citi Prestige Credit Card:

- 40,000 Thank You Points signup bonus

- $4,000 Required spending in first 90 days

- $450 Annual Fee

- $250 annual credit for airline ticket and baggage fees

- $100 Global Entry application fee credit

- 4th night free benefit for hotel bookings

- 3 free rounds of golf per year (until July 2017)

- 3x points on hotel and airfare

- 2x points on restaurants & entertainment

-

American AAdvantage Mileage Program

I like the American Airlines Mileage program because you can book on many partners airlines such as Etihad, Qatar, LAN, Qantas, and other One World Alliance Partners. However, since the merger with US Airlines, there have been several devaluations and benefit reductions. For instance, Hawaiian Airlines is no longer bookable between mainland US and Hawaii and stopovers are no longer permitted.

Citi Platinum Select AAdvantage World MasterCard:

- 50,000 American Miles sign up bonus

- $3,000 Required spending in first 3 months to qualify for bonus

- $95 annual fee waived in first year

It is entirely possible for the average traveler to plan out a truly epic vacation! One just needs to understand the miles and points earning opportunities, airline routing rules, airline award partnerships, and available tools like award mapper to assist in the planning process. Dream and travel big, there’s always a way to make it happen! Stay tuned for part two of this trip where I review the Emirate Airlines First Class product.