Frequent readers of this blog may have noticed that I primarily book most of my stays with Hilton. The Hilton Aspire card suits my travel needs perfectly. However, one middle tier card often doesn’t get enough attention in comparison to the heavy hitting Hilton Aspire card. The Hilton Surpass card could be a perfect fit for someone who likes staying at Hilton properties every now and then.

Hilton Surpass Card

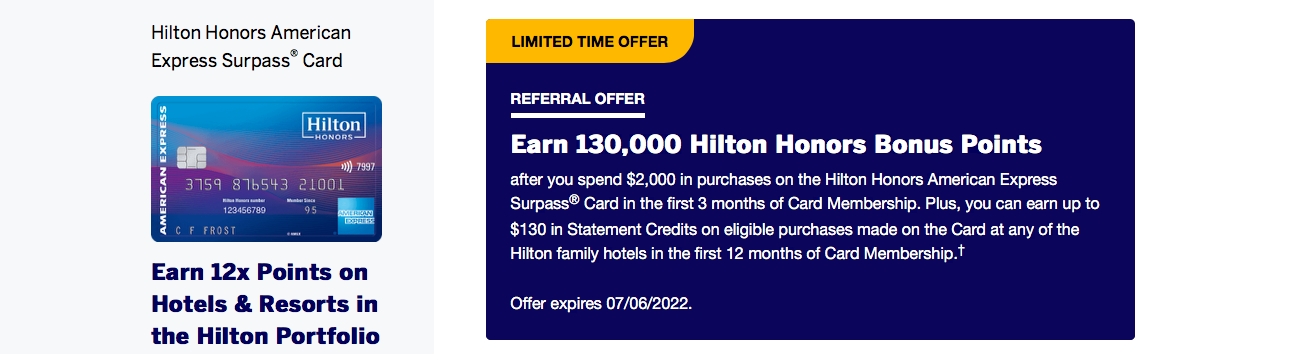

Unlike the hefty $450 annual fee on the Hilton Aspire, the Hilton Surpass card charges a $95 annual fee. Moreover, American Express is offering a limited time welcome bonus on this card.

Limited time welcome bonus offer

You’ll earn a welcome bonus of 130,000 Hilton Honors points once you spend $2,000 in three months. In addition, you’ll also earn a $130 statement credit on eligible purchases at properties in the Hilton portfolio in the first 12 months of your card membership. As per the terms and conditions, it seems like even incidental expenses on award stays would qualify for the $130 credit.

Click here to apply for this offer

To qualify for up to $130 in statement credits, eligible purchases must be charged on your Hilton Honors American Express Surpass® Card directly with a property within the Hilton portfolio, including bookings and incidental charges, within your first 12 months of Card Membership starting from the date your account is approved.

In addition to the bonus, the card offers a pretty lucrative bonus points earning opportunity.

- You’ll earn 12x Hilton Honors points for each $ you spend at hotels in the Hilton portfolio

- You’ll earn 6x Hilton Honors points for each $ you spend on groceries, gas stations, dining and takeouts/delivery in the US

- For all other purchases, you’ll earn 3x Hilton Honors points for each $ you spend

Other Benefits

On top of all the points you can earn, you also have access to some amazing benefits with Gold elite status in the Hilton Honors portfolio.

- You’ll earn complimentary Gold status just for keeping the card open. You can also earn top tier Diamond status if you spend $40,000 in a calendar year

- You can also earn one free weekend night reward after you spend $15,000 in a calendar year

- Each membership year, you’ll also get 10 complimentary visits to Priority Pass lounges

Free night certificates can go a long way in helping you book some really aspirational stays. I used four of my free night certificates to stay at the Conrad Maldives Rangali Island last month.

Hilton Honors Gold

For a card that charges a $95 annual fee, your Hilton Honors Gold status can go a long way in helping you maximize value.

- Complimentary breakfast for two guests outside the US (breakfast credit at US properties)

- Complimentary WiFi and bottled water

- 5th night free while booking with points

- No resort fees on award stays

- Space available room upgrades

- 80% bonus points earning on stays

Maximizing Value

In addition to the welcome bonus, the Hilton Surpass card packs a punch when it comes to its ability to help you earn points. Let’s say you spend a total of $1,000 every month in the grocery, gas and dining category. At the end of the year, you’d earn a total of 72,000 Hilton Honors points on your annual spend of $12,000. Also, your spend of $12,000 will put you only $3,000 away from earning one free weekend night as well.

The Pundit’s Mantra

Overall, for a $95 annual fee card, the Hilton Surpass card offers great value. In addition to the welcome bonus, you have access to mid tier Gold status. You also have the opportunity to earn a decent stack of points on everyday spend. If you simply put $1,250 on the card each month, it’s enough to help you earn a free weekend night award.

If you’re a business owner and don’t qualify for the Hilton Surpass card, then you can sign up for the business equivalent of the Hilton Surpass card. The Hilton Honors Business card is also offering a welcome bonus of 130,000 Hilton Honors points and an additional credit of $130.

If you sill prefer to save on annual fees, then the no annual fee Hilton Honors card is currently offering a welcome bonus of 100,000 Hilton Honors points and a $100 credit as well.

Which co-branded Hilton credit card is your favorite? Let us know in the comments section.

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

1 comment