A few days back, I wrote about how I try to use miles and points in the best possible way. The great thing about our hobby is that we get curate our own trips based on our travel goals. Which travel credit cards we get serve as means towards those goals.

Travel credit cards in my wallet

Over the last couple of years, I’ve slowed down my pace of travel. Therefore, my travel is more focused, be it for work or leisure. My credit card portfolio is now narrowed down to the following cards, from two issuers.

American Express

- Amex Platinum Card (Charles Schwab): Even with the steep annual fee, I’m able to get enough value to justify the fee. Also, I love Centurion lounge access and the Fine Hotels and Resorts benefit, from which I derive a great deal of value.

- Business Gold Card x 2: I got these when they were running the NLL offers with 140,000 points bonuses last year. While I love the points earning on business spend, I may cancel one of them and keep the other when the annual fee comes up.

- Blue Business Plus Card x 2: I love the simple 2x on all spend. Most importantly, these cards carry no annual fee. I don’t plan to cancel these cards.

- Marriott Bonvoy Brilliant Card: Recently, I signed up for this card when Amex was running the 185,000 Marriott Bonvoy points welcome bonus. My first experience with Platinum status has been pretty good. The dining credit is easy to use each month and I plan to keep this card long term.

- Hilton Honors Business Card: I still have this card. With the annual fee increase, I’m not sure about renewing this one when the annual fee hits later this year.

- Hilton Aspire Card: Similar to the Bonvoy Brilliant card, this card gives me amazing perks with elite status. Also, the free night certificate and annual credits are easy to use.

Chase

- Chase Sapphire Preferred: In my opinion, this is by far, my favorite travel credit card, given its simple value proposition and reasonable annual fee. Don’t plan to cancel.

- World of Hyatt Credit card (Personal): I’m paring down my Hyatt stays this year and focusing more on Hilton and Marriott. I plan to cancel when the fee comes up later this year.

- World of Hyatt credit card (Business): Just like the personal card, I might axe this one as well when the fee hits.

- Ink Business Cash: Simple credit card for every day business spend at office supply stores.

- Marriott Bonvoy Boundless credit card: While I don’t use this card much, I’ll still keep this one. I has a $95 annual fee and the free night certificate more than pays for the annual fee each year.

- Chase Freedom: This was my first Chase card, following by the Sapphire Preferred. Since it has no annual fee, I plan to keep it open, by putting some spend on it every now and then.

Strategy Ahead

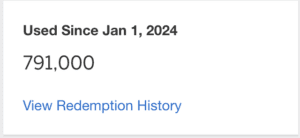

This year, I’ve already used up close to 800,000 Membership Rewards points on trips.

I’m looking out for any NLL offers on the Business Platinum or Gold cards. I plan to jump on them if they show up. I’m also tempted to pick up the no annual fee Hilton Honors card, given its amazing welcome bonus and the fact that it carries no annual fee.

The Pundit’s Mantra

I’m following a two fold strategy for some time now. When it comes to airlines, you’ll see that I have no co-branded credit cards. Most of my travel is international in nature and I see no merit in keeping any airline credit cards open, beyond attaing a welcome bonus. When it comes to hotels, I’m focusing on staying loyal to Hilton, followed by Marriott. Given that I have elite status with both, it’s very convenient as the chains have presence in most parts of the world. Also, with the addition of SLH, I’m even more excited to use my Hilton points and free night certificates for upcoming trips.

By having a significant amount of Chase and Amex points, I make sure that I can book a flight with most airlines in the world by transferring points. By staying loyal to Hilton, then Marriott, I ensure that I can get a room using points in most cities are the world at a short notice.

Which is your favorite travel credit card, if you just had to carry one in your wallet? Tell us in the comments section.

In my case, it would be the Chase Sapphire Preferred.

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!