Have an interesting travel story? Subscribe to my podcast and join the conversation

___________________________________________________________________________________________________________________

The Amex Platinum Card revamp was met with both relief and frustration. Some people loved the new benefits and features, while others balked at the upgraded ‘coupon book’.

Over the last couple of weeks, I’ve covered the card extensively and you can refer to the links in this article to follow some of the coverage. The Amex Platinum Card now charges a massive annual fee of $895. However, there’s one feature that invites both excitement and derision.

When I wrote this post, I found that a lot of people were dismissing the new design on the card as a massive gimmick. However, if it indeed is a gimmick, why are issuers doing design revamps and do they really work in driving more card sign ups? Let’s have an analytical look.

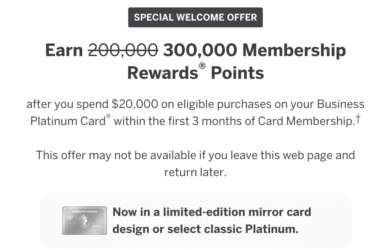

Amex Platinum Card Design

Before we dive deep, here’s what I think. I’ve been in the miles and points space for 12 years. Like for many others in the space, miles and points have opened up the doors to luxury travel, be it flying premium cabins or staying at luxury hotels. So, for me, a metallic card or a ‘mirror finish’ doesn’t move the needle, let alone get any of my time or attention. However, what’s the reason that many issuers revamping premium cards are running after this particular feature? Well, let’s have a look at what the data says and you may be surprised.

“Metal cards attract members”

Card issuers have several teams constantly crunching the numbers and analyzing each and every chunk of data they can get their hands on. If you look at this article by the Credit Union Times, you’ll see why issuers in the premium credit card space are going for metallic credit cards.

“A third of American consumers are willing to switch banks in order to get their hands on a metal payment card, and almost half said they would like their credit unions or financial institutions more if they offered metal payment cards, according to a new survey commissioned by Somerset, N.J.-based card manufacturing firm CompoSecure.

The survey of 18,000 people in 18 markets around the world found that 45% of U.S. consumers said they felt more positively about their financial institution if it offered metal payment cards, and 33% said they would switch to a financial institution that offered a metal card. Payments consulting firm Edgar, Dunn & Company conducted the survey.”

When you look at the key demographic that Amex is targeting with their Platinum Card, it all starts to make sense:

“The preference for metal cards spiked to 73% among millennials (ages 25-34) across all the regions, and particularly in the U.S., where 77% of this demographic said they prefer metal,” it added.

Credit Cards as a status symbol

As per this article by CM Magazine, a section of Millennials in the US see metal cards as a sign of higher status.

“Representing an essential demographic, 24% of millennials in the United States view their credit cards as a status symbol, according to a survey from LendEDU. This is a salient point for card issuers because design and style are of ever-increasing importance to enhance the perceived status. As a Harris study found, millennials have a propensity for social experiences and spend more freely than other generations; this reinforces the interest in the attention garnered from a status card in social situations.”

What’s also interesting is that the research revealed that consumers who value status and link that with a metallic credit card are more likely to take that card out and use it in a social setting.

“The NBER analysis of transactions indicated that consumers in general, not just millennials, were more likely to use a status card for expenditures in a social environment such as in restaurants and bars.”

What’s also interesting is that customers in the US are more than willing to switch to a metal based credit card, since it signifies status and affluence.

“In the United States, 56% would switch to metal, and when viewed by income, the rate increased to 80% among those with an annual income of $200,000 or more. This was mirrored internationally with three of four (75%) affluent people exhibiting a higher level of willingness to switch cards and selecting a metal card with equal benefits and rewards.”

Global Phenomenon

However, this is not just restricted to the US. Over the last half a decade, this seems to be a trend happening globally.

“Today, 70% of global customers say they would use a metal card more often than other cards in their wallets. In an era when banks strive more than ever to establish a primary account relationship with their customers, it is particularly striking that 55% would switch banks to get a metal card.”

Also, a-la-Apple, card issuers are now looking to drive eyeballs and traction through social media by making their card launches and refreshes an ‘event’.

“User experiences created by internet giants such as Google and Apple have recalibrated customer expectations. In fact, today’s consumers expect every company they interact with to provide a similar level of personalization. And the banking and payments realm is no exception. Customers are demanding more personalization, leading to hyper-personalized features that deliver tailored experiences based on every customer’s individual needs and profile.”

Also, card issuers seem to have enough data backing that fact that customers will bite, given that they’re looking to experiences and for products that not just look premium but also feel premium to them.

The Pundit’s Mantra

If you look at research over the last half a decade, you’ll see that the trend is clear. Younger populations around the world are looking for products that look and feel premium. In the era of social media, they not only want a functional product that is good, but also one that they can show to their peers.

Banks are tapping into this very trend, targeting a cohort of younger individuals around the world as their core customers. These are probably up and coming professionals who aspire to be very affluent, but want a product right now that looks and feels affluent, albeit at an affordable price point.

Based on the research and data over the last 5 years, it seems like card issuers are clearly on to something with these design revamps. So, while many might find these things flashy and gimmicky, there’s a lot of data to clearly indicate that when it comes to card issuers, it’s good for business!

What do you think about the trend with metal based credit cards and Amex’s new mirror finish on the Amex Platinum Card? Tell us in the comments section.

___________________________________________________________________________________________________________________

New Credit Card Offers

American Express Business Credit Cards

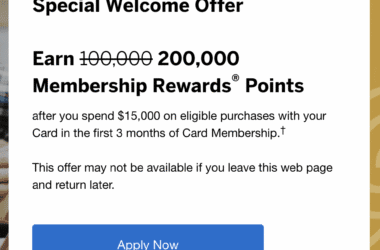

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 150,000 Membership Rewards and enjoy a 0% intro APR on the Business Gold Card

Chase Sapphire Cards

- Earn 125,000 bonus points with the Chase Sapphire Reserve Card

- Earn 200,000 bonus points with the Chase Sapphire Reserve Card for Business

Co-branded Delta SkyMiles cards

- No annual fee for the first year, earn 80,000 bonus miles with the Delta SkyMiles Gold American Express Card

- Earn 90,000 bonus miles with the Delta SkyMiles Platinum American Express Card

- Earn 125,000 bonus miles with the Delta SkyMiles Reserve American Express Card

- No fee for the first year, earn 90,000 bonus miles with the Delta SkyMiles Gold Business American Express Card

- Earn 100,000 bonus miles with the Delta SkyMiles Platinum Business American Express Card

- Earn 110,000 bonus miles with the Delta SkyMiles Reserve Business American Express Card

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

I’m a boomer and I like the metal card and I’d like a shiny mirror new one but they don’t issue them in Australia yet .

I would like my premium charge card to be able to go through a metal detector. Once these cards went metal, I had to start taking my wallet out of my pocket to go through airport security. Ironic that a luxury card makes travel more annoying.

That’s definitely an issue!

I have both the Amex and Barclay metal card for years. I like it. I also like the new mirror version of the Amex platinum card. It is just a matter of taste. You either like it or don’t. No judgement.

That’s great!

Do Gen Z and Millenials actually pull out the card with Apple Pay? I have several metal cards including Amex Platinum but I never carry my cards because Apple Pay is more convenient and more secure

That would be a much longer topic of discussion. I’m pretty sure a lot of people must be requesting the metal cards but not always paying with it. But when surveyed, they’d reply yes when asked if they wanted a metal card in the first place.

And yet so many millennials (as well as boomers like me!) rely on a mobile/virtual wallet today. How does that switch to virtual tally with some of the claims made by CM Magazine? (And I assume that CM Magazine is also virtual today, as paper is just so….old fashioned.

@Jess: Those are different things. People may be ordering the metal cards and then still using mobile wallets to make payments. The survey outcomes are based on how many respondents told that they would get a metallic credit card in the first place if that feature were offered in the first place.

I still remember getting a mailer from Barclay’s Black Card Mastercard which had a graph showing that their metal card weighed the more than American Express Platinum and Chase Sapphire Reserve, as if that is the compelling reason to get their card. They omitted the Chase Ritz Carlton card which weighs even more.

Even the Mesa and US Bank Smartly Visa cards are metal but they don’t seem to make a big deal out of it.

Never know that about the Barclay’s card. Thanks for sharing!

Oh to be young and dumb again and believe that status depends on a metal card in your wallet!

🙂