Over the last few years, I’ve been pretty vocal about how issuers have constantly been ramping up fees on credit cards. As much as I love travel, I’ve pared down my stack of premium credit cards. Back in the day when I entered this space, premium card annual fees were in the 400s. It was practical to carry many premium cards, given my volume of travel.

Fast forward a decade later and fees have more than doubled and I’m not traveling as much as I used to, especially after Covid-19. This WSJ article sheds some light on an interesting aspect about what our premium credit cards have now become. Some in this space call them coupon books, while others still say that they can ‘maximize’ them. But there’s a hidden cost as we run around trying to ‘maximize’ these cards.

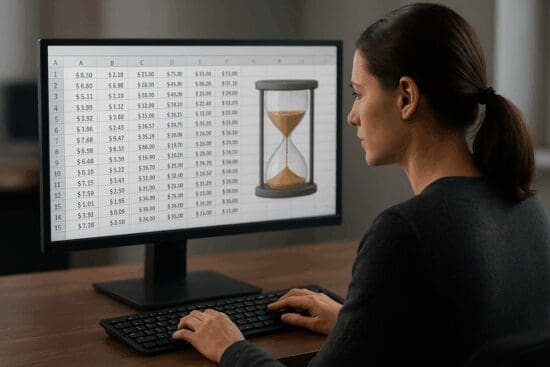

Premium Credit Cards in 2025: Full Time Jobs that suck time & money!

One line from the article really resonated with me.

The real price of a premium credit card isn’t the three-digit annual fee. For some, it’s the hours spent in spreadsheets trying to get their money’s worth.

Over the last few years, card issuers have adopted almost the same model.

- Firstly, increase the annual fee well upwards fo $600 or even $700

- Secondly, introduce merchant funded offers

- Thirdly, split those offers across different time frames and dollar values

- Market these cards as offering “$3,000” in value or even more

When Eric May orders an Uber, he has to pull up the spreadsheet on his phone to figure out which credit card to use. Several of his and his wife’s cards come with Uber credits.

Making matters more confusing, each one works differently. Some can be used only for Uber rides, others for Uber Eats and one, he thinks, covers only airport trips.

Certain credits are parceled out quarterly or even monthly, and premium cards can have the feel of a coupon book. But Eric finds the effort is worth it. The spreadsheet indicates that he and his wife are receiving about $900 more in credits than they pay in fees.

In the investment space, there’s an old adage: “don’t work for money, let money work for you”. In the miles and points space, unfortunately, it seems like it’s not the card that’s doing the work for you to help make your travel smoother, but you are doing the work. That’s where the time investment factor comes in. While we all love ‘maximizing’ our premium credit cards, are we considering the amount of time and energy we’re spending to save that extra $75 this quarter or that extra $50 every six months?

Most U.S. consumers pay more in credit-card interest than they get in rewards. But for the few who try to take advantage of everything they are entitled to, the cards can feel more like a part-time job than a lifestyle upgrade.

That job has been getting harder lately. To justify raising the annual fees on premium cards, banks have been packing them with additional perks. But instead of juicing cards’ cash-back percentages or points multipliers, issuers have offered more in credits that can be redeemed only with certain merchants. Those credits cost banks less but come with technicalities that suck up consumers’ time.

Unused Rewards

You might be thinking – wow, so many people are chasing these rewards and trying to get maximum value out of these cards. Surely, the banks must not be making a ton of money on these products. You’ll be surprised by what the data says.

Few people use all that their cards offer. Of the more than $40 billion that U.S. cardholders earned in rewards in 2022, more than $33 billion went unclaimed, according to the latest data from the Consumer Financial Protection Bureau.

That’s a wild statistic. This means that almost 83% of all rewards earned in 2022 went unused. Precisely the reason why these products works so well for the card issuers.

My Current Strategy

At the moment, I’m carrying two premium credit cards. I have the Charles Schwab Amex Platinum Card and the Marriott Bonvoy Brilliant Card by American Express. In case of the Amex Platinum Card, I’m able to earn 5x on flights, use Centurion lounge access frequently, the $600 hotel credit works very well for my style of travel. Also, I love the fact that I get complimentary Hilton Honors Gold status.

On the other hand, the Brilliant card, while it charges an annual fee of $650, grants me complimentary Platinum elite status, which gives me free breakfast at most Marriott portfolio properties worldwide. Moreover, I also get one free night certificate that I can redeem every year at a luxury property. The $300 dining credit is easy to use and works all over the world when you simply pay with your card at a restaurant.

I’m also carrying the Chase Sapphire Preferred card, a card that I really like and have kept in my wallet for many years. It works perfectly well with the $95 annual fee, the $50 annual hotel credit and the points that I can earn on dining and travel spend worldwide.

The Pundit’s Mantra

$50 annual hotel credit, in addition to offering great rewards on travel and dining spend worldwide.

So, moving forward, I think that a ‘less is more’ strategy works well for me, especially given everything going on with work, family, etc that also requires time and energy, instead of spending it on another spreadsheet tab to ‘maximize’ a new card.

Are you still carrying multiple premium credit cards in your wallet, tracking everything meticulously in a spreadsheet? How has your premium credit card strategy evolved as fees have constantly been increased over the years? Tell us in the comments section.

___________________________________________________________________________________________________________________

Subscribe to my YouTube channel for the latest in miles, points & travel…

___________________________________________________________________________________________________________________

New Credit Card Offers

American Express Business Credit Cards

- Earn 200,000 Membership Rewards points with the Business Platinum Card

- Earn 150,000 Membership Rewards and enjoy a 0% intro APR on the Business Gold Card

Chase Sapphire Cards

- Earn 125,000 bonus points with the Chase Sapphire Reserve Card

- Earn 200,000 bonus points with the Chase Sapphire Reserve Card for Business

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!