In 2020, as a result of the COVID-19 pandemic, numerous small cash-strapped and debt-heavy airlines shuttered operations. The combination of significantly decreased demand for air travel and a global economic crisis proved too much for a number of airlines. While sadly, this was expected, the COVID-19 pandemic is beginning to impact larger airlines. The most recent stimulus bill in the United States proves as much as debt-burdened carriers like American Airlines and United Airlines successfully secured billions of dollars in cash. However, while American Airlines and United Airlines may face financial difficulties in the future, an impending collapse or bankruptcy is highly unlikely. The same, however, cannot be said for many smaller and less-established airlines across the globe. One airline that appears to be just weeks away from complete collapse is Interjet.

A Brief History of Interjet

In 2005, a new low-cost carrier based in Mexico City made its first flight using a single Airbus A320. The airline, Interjet, sought to follow in the footsteps of popular US carriers like JetBlue and Southwest Airlines. At the time, the Mexican market was dominated by legacy carriers including Aeromexico and Mexicana. As a result of decades of high fares and a virtual duopoly, the early 2000s brought about a flurry of new low-cost carriers to the Mexican market. One of these airlines was Interjet. Other carriers that launched around the same time included Volaris and VivaAerobús.

Interjet experienced significant growth in a relatively short period of time. During the airline’s first two years in operation, it added an additional 4 Airbus A320s to its fleet. By the end of 2010, Interjet’s fleet had grown to 14 Airbus A320s with orders for 35 additional aircraft. At the time, Interjet had already expanded its route network substantially, serving over 20 cities throughout North America.

During the 2010s, Interjet expanded into new markets throughout North and South America. The airline also added dozens of new Airbus A320s, A321s, and later Airbus A320neos and A321neos. During this time, Interjet also became the only airline in the Western hemisphere to order and operate the Russian-built Sukhoi Superjet.

In 2014, arguably around the height of Interjet’s operations, the airline referred to itself as the “JetBlue of Mexico.” Similar to the policies of JetBlue, Interjet did not oversell its flights and offered a more generous baggage allowance than traditional airlines. Other JetBlue-esque aspects of Interjet included complimentary snacks and beverages and enhanced legroom.

Interjet would grow to serve 55 cities throughout Mexico, the United States, Canada, and South America at the airline’s height of operations. However, Interjet’s troubles began soon after its rapid growth and success.

The airline’s decision to acquire the Russian-built Sukhoi Superjet SSJ100 quickly backfired. While the pre-delivery price for the airline’s entire fleet of SSJ100s was reported to be equivalent to a single pre-delivery payment for a single Airbus A320, the SSJ100s proved to be difficult to maintain. In 2018, Bloomberg reported that 4 out of 22 Interjet Sukhoi Superjet 100s were “cannibalized” for parts. That is, due to a lack of spare parts combined with frequent mechanical issues, four SSJ100s were used exclusively for parts to keep the rest of the airline’s fleet of SSJ100s airworthy.

However, the issues the airline was experiencing with its fleet of Sukhoi Superjets were merely a drop in the bucket. Multiple reports––as well as financial statements––show that Interjet lost money quarter after quarter, amassing a significant amount of debt. In 2019, the airline did not publish any financial statements.

COVID-19’s Impact on Interjet

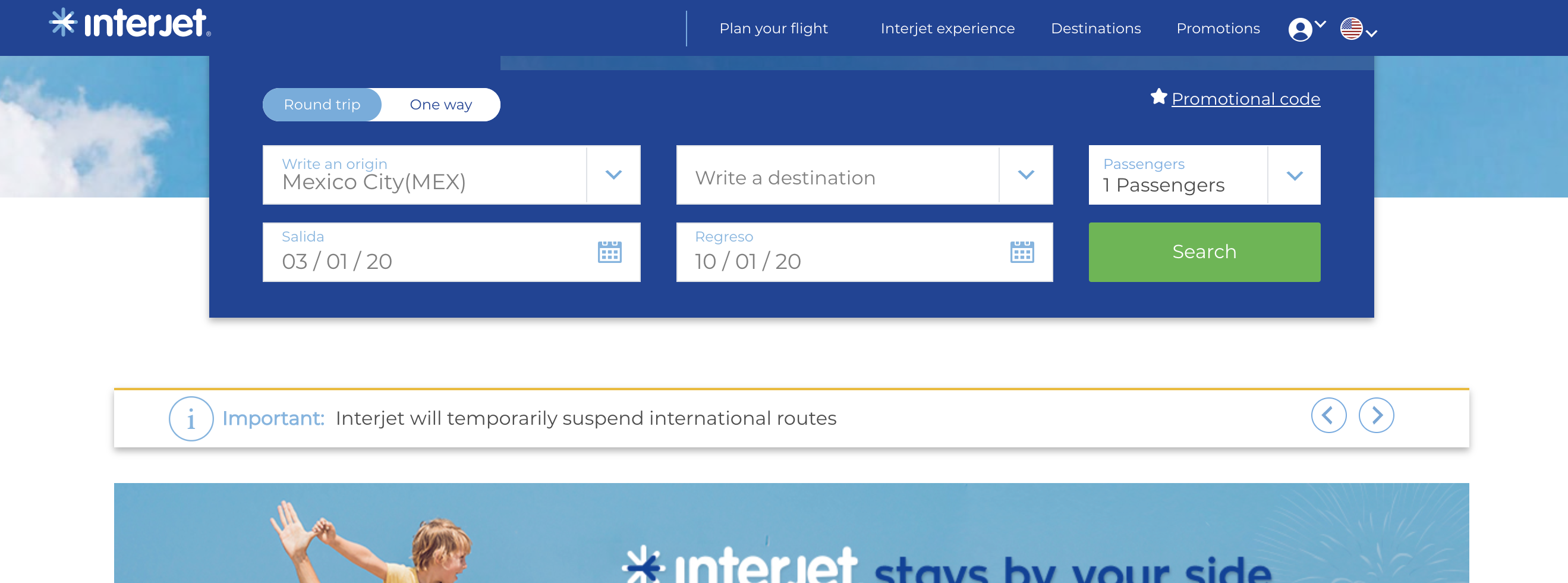

It is not clear just how dire Interjet’s financial situation was prior to the COVID-19 pandemic. However, unlike many other airlines with similarly sized operations, COVID-19’s impact on Interjet’s operations was virtually instantaneous. By April 2020, the majority of Interjet’s fleet of Airbus aircraft had already been repossessed. The airline had already suspended all international flights yet, continued to operate a small domestic route network.

The airline continued to lose aircraft through repossessions and the inability to keep them airworthy. It was not until November 2020 that the true scope of Interjet’s financial crisis set in. On November 1st and 2nd, Interjet was forced to cancel all of its flights after the airline was unable to pay for fuel. A similar situation unfolded in late November through early December. Finally, in mid-December, the airline finally announced that it would suspend all operations.

In addition to mounting debt, Interjet has slashed its workforce and cut pay by 50% for its remaining employees. However, numerous Mexican news outlets report that those still employed by Interjet have gone without a paycheck for weeks. As of January 2021, only 3 Airbus A320s aircraft remain in the airline’s fleet. Additionally, while the airline has managed to keep 22 Sukhoi Superjet SSJ100s in its fleet, only 4 remain in active service. In short, Interjet has gone from upwards of 55 aircraft at the beginning of 2020 to just 4 aircraft in active service.

Interjet’s Future

While there are few airlines, if any, that have not been significantly impacted by the COVID-19, Interjet’s current financial and operational crises are likely the most significant of any major carrier. Most of the airline’s assets (aircraft) have been repossessed. The vast majority of the airline’s workforce has been laid off or have yet to receive a paycheck for weeks of work. Interjet also faces a mountain of debt. Can an airline in this situation survive?

The more appropriate question to ask is “Should an airline in this situation keep fighting and attempt to resume operations?” The short answer is no. The Mexican government has been quite blunt in stating that it will not provide any financial support to Interjet. That is, the Mexican government is not going to bail out Interjet. Furthermore, with hundreds of millions in debt, no liquidity, no assets, and no revenue, the possibility of Interjet receiving a loan from any lender or bank is near zero. Finally, the airline could resume operations however, would be unable to pay for fuel. Additionally, it is highly unlikely the companies that provide Interjet with fuel will continue to do so on credit. This is a result of the airline failing to pay its fuel debts from the months prior.

With the Mexican government making it quite clear that the company, or what is left of the company, is not worth bailing out and no other viable options to inject cash into Interjet, it is quite clear that Interjet is just weeks away from ceasing operations.

Mexican Aviation without Interjet

Since the late 2000s, Interjet has been a major player in the Mexican airline industry. In 2019, Interjet was the third-largest carrier of international airline passengers in Mexico, trailing American Airlines (#2) and Aeromexico (#1). In 2019 Interjet was also the fourth-largest carrier of domestic passengers in Mexico after VivaAerobús (#3), Aeromexico (#2), and Volaris (#1). However, Interjet’s collapse does not create a situation in which there is too little competition in the Mexican airline industry. The following airlines currently control a significant share of the domestic market in Mexico:

- Volaris (31.34%) – Low-cost carrier

- Aeromexico (24.29%) – Legacy/Full-Service carrier

- VivaAerobús (20.19%) – Ultra low-cost carrier

- Aeromar (1.47%) – Regional carrier

- Magnicharters (1.46%) – Regional/Charter carrier

- TAR (1.04%) – Regional carrier

With three airlines––each with a different business model and strategy––controlling the domestic market in Mexico, Interjet’s collapse pales in comparison to the collapse of Mexicana in 2010.

In 2010, Mexicana and Aeromexico were the two largest carriers in Mexico with new-comers Volaris, VivaAerobús, and Interjet trailing both Mexicana and Aeromexico, significantly. With Mexicana’s collapse, there were some concerns that Aeromexico would briefly operate as a virtual monopoly. However, the three new-comers managed to grow significantly in a matter of a few years. In 2021, the Mexican airline industry is far more competitive than in 2010. This means that Interjet’s collapse would not result in concerns of a monopoly or even a duopoly.

Ultimately, while Interjet’s collapse is devastating for those employed by the airline, the market will likely fill in the gaps left by Interjet in a year if not months. That being said, there is little to no rush to rescue the crisis-stricken airline. This means that Interjet, at least the first iteration of Interjet, has already collapsed.

The Bottom Line

I have been following Interjet’s response to the COVID-19 pandemic since late March. At the time, I already had doubts that the airline would weather the pandemic. Now, with the airline essentially down to four aircraft and in a staggering amount of debt, Interjet is likely weeks away from ceasing operations entirely. Interjet’s story is quite similar to that of WOWair. Both airlines were respectable attempts to change the way an airline operated in a certain market. In Iceland, WOWair sought to democratize Trans-Atlantic travel with dirt-cheap fares with free stopovers in Iceland. In Mexico, Interjet sought to bring a JetBlue-esque low-cost-full-service hybrid model to passengers. However, in the end, both airlines took on too much debt as they grew far too quickly.

Personally, I will miss Interjet and the airline’s unique business model. Interjet was an affordable way to travel from major US cities to popular destinations in northern South America. For example, flights from cities like Dallas, Chicago, and Miami to cities like Bogota, Lima, and Panama City were often quite inexpensive thanks to Interjet’s cheap fares. Unfortunately, it does not appear as if the first iteration of Interjet will resume operations and like Mexicana, will announce an indefinite suspension of operations in the near future.

More from Max

Thanks for the comprehensive look at the internals of Interjet.