Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links

As hotels remain largely closed and planes remain grounded, airlines and hotels are looking to generate cash flow from other sources. Off late, we’ve seen them sell their miles and points at a discount. With normal travel not resuming any time soon, should you buy?

Miles & Points Promos

Alaska Airlines, Hilton as well as United are selling their points at discounted rates. In the coming months, we may see more brands jump on to the bandwagon. However, does it make sense to take part in these discounted sales?

Base Redemption Value

On the internet, you’ll see many articles stating CPP (cent per point) as the basis for valuing miles and points. However, that’s only partly true. While you may redeem Hilton points at only 0.4 CPP, you can earn them a lot easier, thanks to Hilton’s amazing co-branded card bonuses.

While CPP is a guideline, it doesn’t give us the full picture. CPP simply represents the value at which you redeem your points. It doesn’t take into account other factors like the ease of earning, lucrative promotions and availability of redemption options.

Cash Crunch

Airlines and hotels are facing a cash crunch. Customers aren’t buying tickets at the rate they were a few month back. They’re now looking at their loyalty programs to help them out.

Immediate Need

In the past, I’ve bought points at a discount. However, I’ve only done so when I’ve fallen short for a specific redemption. For example, I’ve bought Hilton points in the past when I’ve fallen short by a few thousand points in order to use Hilton’s 5th night free benefit.

Similarly, I’ve bought Alaska miles when I’ve fallen short by a few thousand miles in order to redeem for a Cathay Pacific business class flight to Asia.

Hoarding

Even if you have excess cash on hand, hoarding points may not be the best option. Airlines and hotels have full control and can make changes of bring about devaluations to their loyalty programs. For example, even though I’ve never bought Delta miles, my six figure SkyMiles balance isn’t worth as much as it was 5 years ago.

The Pundit’s Mantra

In the coming months, I won’t be surprised if more travel companies extend similar miles & points sales. If you have excess cash on hand and have an immediate use, it makes great sense to buy them. However, you may be putting money on an asset that is most likely to depreciate in value over the long term.

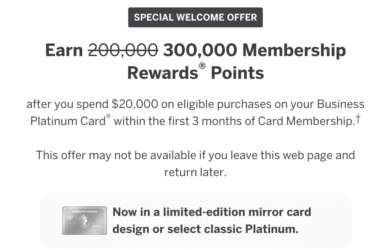

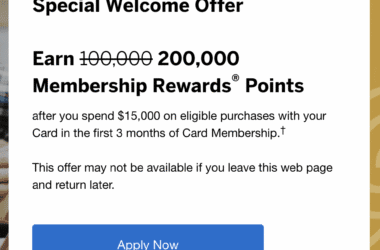

I still find credit card welcome bonuses to be the best option to rack up miles & points quickly. With Amex and Chase points, I have easy access to top off my balance in most of the major airline and hotel programs.

Will you buy points in the upcoming weeks if these historically discounted sales continue? Let us know in the comments section.

___________________________________________________________________________________________________________________

This card is currently offering a 50,000 points bonus and a 0% Intro APR for 1 year, with a $0 annual fee!

___________________________________________________________________________________________________________________

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

I have a trip tentatively planned for Q4 2021 and I’m keeping my eye on point/mile sales to top up for that trip. That said, it’s too far out for speculative buys right now. The only time I’ve ever bought miles was from Avianca and they’re at risk of collapse right now, which highlights the other big problem…none of us know now whether the hotels and airlines we buy points for will still be around in 18-24 months, when travel really begins again in earnest.

Hi Mallthus,

Thanks for your comment. 2021 seems far away indeed. I’m skeptical that loyalty programs may increase redemption values once the market bounces back and normal travel resumes.

At least for me, these sales just aren’t compelling. Hotels and airlines are offering somewhere in the neighborhood of 10% better prices than a normal sale. That’s nice, I suppose, but in many to most cases you’re not really saving much while you’re dealing with devaluations, not meeting spending thresholds for elite status and limited inventory allocation. If you could still get that second first class seat on Cathay with Alaska miles, then those miles are worth more and conversely since you can’t they’re worth less. If United (as an example) were to sell miles at a really compelling price like a penny a mile, they would have a lot more takers and vastly improve their cash flow. Instead they and the others are offering halfhearted sales that are pretty uninspiring.

Hi Christian,

Thanks for reading. As you pointed out, the selling price isn’t as compelling. To take the example you quoted, United has also removed award charts. So even if we were to buy United miles as a 1 CPP value (if they’d ever sell it that low), we’d still be subject to United’s whims and fancies during a redemption. If you buy points looking to fly international biz, they may price it at 75k, 85k or even 100k, thereby rendering the points sale less useful.