Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links.

Over the last few weeks, we’ve seen extensive coverage of the changes made to the Chase Sapphire Reserve. While a few cardholders expressed happiness, many were not too pleased. What could be some of the possible reasons behind the changes that Chase recently made to the Sapphire Reserve? Let’s try to peel back the curtain and have a look.

Sapphire Reserve changes

Before we have look at the possible reasons, here’s a quick rundown of the changes that Chase announced.

- New Annual fee of $550 for new users after January 12, 2020

- Annual fee will be $550 for existing cardholders renewing in or after April 2020

- $60 DoorDash credit to be added for 2020 and 2021

- Complimentary Lyft Pink membership added on January 12, 2020

- Sapphire Reserve Cardholders will earn 10x Ultimate Rewards Points per dollar spent on Lyft rides

These benefits are already active and cardholders can access them after logging into their accounts.

Customer Data

We know what the changes are. However, why were those changes made? Chase has a great deal of access to customer data. This can be in the form of demographic data as well as data on customer spend. Gary Leff of View from the Wing pointed out this interesting report in which Chase revealed some data about its Sapphire Reserve customers.

A few nuggets stand out in the report:

- Chase Sapphire Reserve Customers have an average annual income of $180,000

- The average FICO score of these customers is 785

- Most importantly, Chase Sapphire Reserve customers renew their cards at a 90% rate

This data is from 2018. So why is this still relevant and how does it inform us with regards to the recent changes to the Chase Sapphire Reserve? Let’s have a look.

Market Segmentation

Chase Sapphire Reserve is a premium travel credit card. However, with these recent changes, Chase seems to be drilling one level deeper when it comes to segmentation. The initial aim was to target frequent travelers with a decent income who dine out often. However, the recent changes point to another interesting trend.

The addition of Lyft and Doordash clearly favors certain cities over others. Some may call it the rural-urban divide or the difference between big and small towns. Clearly, Chase’s data tells them that it’s a good strategy to bet on the high earning urban customer who resides in a big city. As this customer resides in a big city, he/she frequently uses public transit to commute.

Given how much time people spend during office commute in most big cities, these people tend to drive less and end up using ride sharing services to get around town. Consequently, the spend less time at home and more time at work or commute, which means that they tend to use food delivery services like Doordash.

If you live in a medium or small town but still have high income and travel frequently, the updated Chase Sapphire Reserve may not be the best deal for you, especially if you drive your own car to work daily.

Lyft and DoorDash Partnerships

These two partnerships present some interesting challenges and opportunities. As Lyft and DoorDash look to penetrate deeper into different markets around the country, the Chase Sapphire Reserve partnership immediately opens up their brands to Chase’s entire customer base in those markets.

Also, for Chase Sapphire Reserve customers who live in cities that also have UberEats and Grubhub, it generates an automatic habit of ordering with DoorDash. This makes the customer develop a habit whereby the customer prefers DoorDash to a competitor because they hold the Chase Sapphire Reserve Card. Similarly, in markets served by both Uber and Lyft, Chase’s customers will automatically choose Lyft over Uber.

There’s a good chance that Chase will update this card next in 2022, once the DoorDash benefits end in 2021.

Market Share

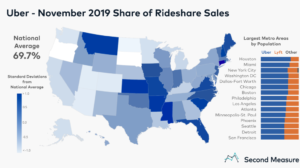

Recent market data suggests how this is a push in order to gain market share with these partnerships. The chart below clearly shows Uber’s dominance with about 70% of market share.

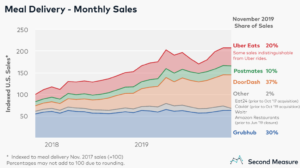

In contrast, DoorDash already has the lead in the food delivery market, with a 37% market share, well ahead of the next best, Uber Eats. Also, DoorDash is raising more capital. The Chase Sapphire Reserve partnership plays well with their goal of further penetrating and solidifying their existing market position.

GrubHub v/s DoorDash

An interesting bit from the report by Second Measure stands out. It clearly outlines one of the key reasons behind why DoorDash would want to partner with Chase.

The top two food delivery services may be close in U.S. market share, but their strongholds are in different regions. Grubhub is the most popular service in many Northeastern metro areas, including New York, Boston, and Philadelphia. DoorDash rakes in more than half the sales in the two biggest Texas metros, Dallas-Fort Worth and Houston.

Clearly, DoorDash sees a great market opportunity in habituating Chase Sapphire Reserve customers in major markets like New York, Boston and Philadelphia to using DoorDash instead of Grubhub and grabbing their share of wallet. The report by Second Measure also highlights how customers aren’t very loyal with regards to food delivery companies. The Chase partnership clearly aims at addressing that issue.

The Pundit’s Mantra

Chase sees an alignment of goals while partnering with companies like Lyft and DoorDash. The northeastern market remains key to them and ties in well with DoorDash’s goal of snatching market share from Grubhub. DoorDash is still lagging behind in market share in major markets like New York City (15%) and Miami (15%).

Any guesses where Lyft is also looking to get market share? As evidenced by this report, they’re looking to snatch market share from Uber in major markets like Houston, New York City, Washington DC, Los Angeles and San Francisco.

These partnerships tie in very well with their definition of the ideal customer profile for the Chase Sapphire Reserve. A recent report by Gallup speaks to the same – 45% of Americans in the age group of 18-29 use ride sharing services. For people earning $90,000 or more annually, 41% of them use ride sharing services. With these new partnerships, Chase gets access to a customer base that’s financially affluent, younger and on the move.

As a Sapphire Reserve cardholder, will this partnership clearly make you choose Lyft and DoorDash over their competitors? If you don’t live in markets served by these brands, do you still see value in keeping the card with the $550 annual fee? Let us know in the comments section.

Are you looking to earn a great deal of Ultimate Rewards points? Then you can apply for the Chase Ink Business Preferred Card. You’ll get a welcome bonus of 80,000 Ultimate Rewards points! (Chase’s 5/24 rule applies to this card)

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

Yup, Uber disco’d the Point A to Point B Fixed Price for Platinum status which left me no choice but to jump ship to Lyft which started the 10pts per $1.

Yeah, if you use Lyft regularly, then the 10x per $ is really great for earning a lot of UR points.

The issue here is many of the bloggers/vloggers live in the middle of nowhere. They don’t have to live in a big city. But for the rest of us schmucks who still work for the man, we are mostly in big cities. Take my cousin, who lives in the City and spends $3k a year on TNCs, he’s keeping the card and switching his TNC usage from Uber to Lyft. He is also single, and can easily spend all the $60 Doordash credit. Most those who hate the changes, don’t live in a big city, but hey that’s exactly Chase’s target market. The CSR was one of those cards everyone knew was too goo to be true. With the changes, it’s still very good as long as you live in the big city.

We’ll know within the next couple of years where this is heading. If those who don’t live in cities end up canceling or downgrading, we could see the next CSR refresh in 2022.

For those on the fence, 2022 will be the real decision date when all these credits/perks are slated to sunset. I am in the suburbs of a major city and, while I don’t use TNCs or delivery that often, the $60 credit can be used for takeout via DoorDash, so it’s only a $40 net increase for the next two years.

Hi Nick, yes 2022 will be key, however, just like I did, I guess there were many more customers who canceled or downgraded after the recent fee increase.

The stats you referenced tells me that the card doesn’t provide Chase with a lot of interest fees; they can only make money on transaction fees and annual fees. The primary way to increase the number of transactions is to increase the earnings power of the card, which was already maxed-out, practically.

That leaves the annual fee as the only viable option, so they followed Amex’s model of “add $100 to the annual fee, while adding $100 in annual benefits that won’t be fully-redeemed”. It’s the credit card equivalent of bloatware.

You analysis is spot on. That’s pretty standard for most premium travel credit cards. If most of the customers are with household incomes averaging 180k a year, there’s less probability of them carrying balances and paying interest.

This card, like the Amex Platinum, now is focused squarely on city dwellers. For those outside major cities, Chase is essentially taking $100 from you and giving it to a more valued customer in an urban area.

The appeal that this card previously held for me is that you didn’t need to go out of the way to use the credits. Not anymore.

Yes, the data clearly shows that it’s their goal and how it defines their target market – Targeting premium credit cards to affluent younger customers in big cities.

I’m thinking I may downgrade to the Preferred, and that’s only to keep me in the UR ecosystem. I have shifted a lot of my dining to the Amex Gold, and may use the Altitude Reserve for my travel expenses.

Bingo! I also shifted to Amex Gold which earns more on dining and the same on a lot of other categories. Once Amex updated the Gold offering it made the CSR less attractive and the new changes add to making it less attractive. This is coming from someone that has held the CSR since it was introduced.

For me, the most positive change took place when Amex made it 4x on dining worldwide instead of just US restaurants.

I did exactly the same recently! 3x on travel with Ink Preferred, 4x on dining with Amex Gold.

If I could get a CIP, I would. Stupid 5/24 :p

LOL, I guess most of us must be way over 5/24 🙂

I agree with Christian renewal rates will drop I am not sure that the market has reached the point of “enough” fees are rising and benefits are falling. At this point in time for a traveler the only “real” value” aside from international transaction fees is the PP restaurant benefit. Past that point there are many middle market cards out there.,

Doubtful. the Amex Platinum still enjoys high renewal rates despite their $550 fee, and as an amex is taken at less places than the CSR visa.

Amex Platinum offers a lot more than the CSR – Delta SkyClub access, Centurion Lounge access, Hilton and Marriott Gold, etc

If the CSR’s price increase came with United Club access (when flying UA), and entry-level status are Marriott, Hyatt, and IHG, I think this would be a very different conversation.

Do not disagree, but CSR still gives you $300 of the $550 annual fee back through a no gimmicks travel credit so even after the increase, the effective annual fee is $250 a year. Meanwhile, the Amex Plat has the same annual fee, but a bunch of credits very few people will use 100%. So yeah, you can mas out the $200 a year in Uber Credit, the $100 Needless Markup credit, and $200 airline (you only get to pick one) and have an effective annual fee of $50, but how many people will do that?

Yes, that’s the major differentiator. I don’t see Amex switching to a ‘general’ travel credit any time soon, so the CSR will always have the edge in that case.

If you have enough assets at Schwab ($250,000), their version of the Platinum card also gives a relationship credit that further reduces the fee. Assuming you have a good deal of retirement assets from a former job, that isn’t too hard to reach,

Both Plat and CSR are competitors in the same market segment, but cater to different travelers. If your home airport has a Centurion Lounge or a SkyClub, then the Platinum is an easy choice over the CSR. I agree with you about Hotel status. Getting Gold status with Hilton thru Platinum is very valuable and gives you a soft landing in a year when you don’t travel as much and still end up with Gold status.

Curious to know if you could point out to data or a report that alludes to the same? It would be great to see actual renewal rates for premium Amex cards.

I’d still say that the PP restaurant benefit is useful only for a few people, depending on the airport they frequent. For example, because of my travel patterns, I never got the opportunity to use the PP restaurant benefit.

I am sure that the following will no longer apply….”Most importantly, Chase Sapphire Reserve customers renew their cards at a 90% rate.” I would expect that number to fall drastically!

Yes, also given that Chase usually doesn’t offer retention bonuses like Amex does, there’s a good chance that the renewal percentage will drop after these changes.