Covid19 has completely changed the market dynamics. It has triggered a global recession and suddenly changed the way we do things. This shift in the economy has triggered a massive change in consumer spending habits. As travel comes to a standstill, customers are suddenly spending almost nothing on travel. In contrast, people are spending a lot more on food delivery services and groceries. In such a scenario, the Amex Everyday Preferred Credit Card is a fantastic card to carry in order to rack up Amex Membership Rewards points quickly.

Amex Everyday Preferred Credit Card

The Amex Everyday Preferred Credit Card is the more enhanced version of the basic Amex Everyday Card. If you’re spending a lot these days on groceries and other expenses while running the household, this card is a great option. Let’s have a look at some of the key features of this card and why you should get them.

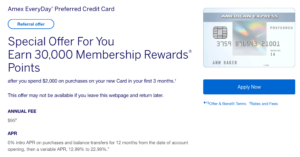

1. 30,000 Membership Rewards points

If you sign up for this card and meet the minimum spend of $2,000 in the first 3 months, you’ll earn a welcome bonus of 30,000 Membership Rewards points. Membership Rewards points continue to be one of my favorite flexible points currencies.

(Open in private/incognito browsing if the 30k offer doesn’t show up immediately)

Apply Now

2. 0% intro APR

If Amex approves you for this offer, you’ll also get an intro APR of 0% for the first 12 months from the date you open the account.

3. 50% Points Bonus

Here’s where you can really earn a lot of extra points to your purchases. On this card, if you use your card 30 times or more in a billing period, then you’ll automatically earn 50% extra points for all your purchases. If you simply break up your purchases into smaller transactions, this should be easy to meet.

4. Bonus Points Earning Categories

Here’s where you can really rack up a lot of points by utilizing the bonus categories.

- You’ll earn 3x points for each dollar you spend at supermarkets in the US. However, Amex caps this at $6,000 per year. If you simply spend $500 on grocery each month, it’s easy to meet or cross the $500 threshold. With the 30 transaction bonus, you’ll earn 4.5 points per dollar spent at supermarkets, totaling to 27,000 Membership Rewards points by simply using your car for groceries.

- You’ll earn 2x points per dollar you spend at gas stations. With the 50% bonus, you’ll earn 3x points for each dollar you spend at gas stations.

- Once you meet the 30 transaction threshold, your 50% bonus will apply to all other transactions as well. You’ll earn 1.5 points per dollar instead of the standard 1 point per dollar.

5. Extra Time to meet minimum spend

While this is not specific just to this card, this is a great benefit if you’re looking to get some extra time to meet minimum spend. As I highlighted in this post, Amex will automatically allow you an extra 3 months to meet minimum spend if you apply for a card before May 31st.

If you apply before May 31st, you’ll get 6 months to meet the minimum spend of $2,000. This extra time could be vital if you’re looking to attain multiple credit card bonuses at the same time.

6. Membership Rewards Program

This is one of the most important benefits of the card. I’ve written before about how Chase cards have one drawback where you need to have a Sapphire card in order to have the ability transfer points to their travel partners. However, just like the Amex Everyday Card with no annual fee, this card earns you points into the Membership Rewards program. You don’t need to have any other card if you want to transfer your points to Amex’s transfer partners.

In previous posts, I’ve written about extensively as to why I love transferring points from the Membership Rewards points and how it helps fuel my global travel goals. By using just 17,000 Membership Rewards points, I was able to fly from the US West Coast to Colombia recently.

7. Other Benefits

In addition to all the benefits mentioned above, this card also comes with additional vital protections and insurances:

- Car Rental loss and damage insurance

- Return Protection

- Complimentary ShopRunner membership

- Fraud protection

The Pundit’s Mantra

For everyday spending, this card continues to be a stellar option to carry in your wallet. Many banks are offering extra points for grocery purchases, but many of them are only for a temporary period.

On this card, by simply maxing out the grocery spending category, you’ll earn an extra 27k points, in addition to the 30k welcome bonus. However, If you want to save some money on annual fees, you can opt for the Amex Everyday Card with no annual fee.

It will be interesting to see how the credit card landscape will evolve in a post Covid19 world. My guess is that grocery store bonuses could only get more popular in the short to medium term.

Which is your go-to card for grocery spending? Tell us in the comments section.

___________________________________________________________________________________________________________________

This card is currently offering a 50,000 points bonus and a 0% Intro APR for 1 year, with a $0 annual fee!

___________________________________________________________________________________________________________________

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

So many errors in this. Try proofreading before hitting “submit.”