A few weeks back, I wrote about how people could now be looking at points redemptions differently. The key point of discussion was whether it made sense to simply convert points into cash. Over the last month or so, we’ve seen many issuers revamp card benefits and offer new credits and rebates. In particular, issuers have focused on providing incentives in the dining and grocery categories. Chase was the latest to add a few more benefits and introduced a ‘Pay Yourself Back’ feature. While it’s great that issuers are being nimble on their feet, do these temporary Chase Sapphire benefits really make sense to frequent travelers? Are they really awesome or lucrative benefits? Let’s take a look.

Chase Sapphire Benefits

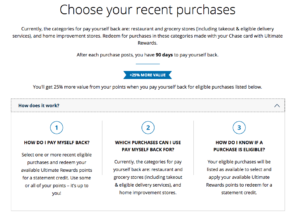

With Chase’s ‘Pay Yourself Back’ feature, you can erase purchases you’ve made in the last 90 days. This feature is pretty similar to how Capital One’s purchase eraser works on the Venture card.

The key point of differentiation lies in value. Till September 30th, you can use your points to erase purchases in the following categories:

- Grocery

- Dining (Including takeout & eligible delivery services)

- Home improvement stores like Home Depot, Lowes

| Product | Redemption Value |

| Chase Sapphire Preferred | 1.25 cents per point |

| Chase Sapphire Reserve | 1.5 cents per point |

Let’s say that you made purchases to the tune of $150. You’ll be able to use 10,000 Ultimate Rewards points to in order to wipe out that purchase if you hold the Chase Sapphire Reserve. However, you’ll need 12,000 points if you hold the Chase Sapphire Preferred.

Earning Extra Points

In contrast to redemptions, I find the extra points earning ability at grocery stores (online included) particularly interesting. However, the offer is only valid for the months of May and June as is capped at $1,500 per month. For example, if you have the Chase Sapphire Reserve and max out spend in this category to earn a total of 15,000 Ultimate Rewards points. With the Chase Sapphire Preferred, you’ll earn a total of 9,000 Ultimate Rewards points.

| Product | Points per dollar spent on Groceries |

| Chase Sapphire Preferred | 5x |

| Chase Sapphire Reserve | 3x |

Retention Goals

Chase has primarily introduced these benefits in response to the Covid-19 outbreak. However, their primary goal with these temporary benefits is to ensure that customers don’t jump ship. While something is better than nothing, Amex has done a much better and comprehensive job in offering benefits on many of their cards.

Sapphire Reserve Benefits

In comparison to the preferred, Chase has offered much more lucrative benefits on their higher annual fee product, the Chase Sapphire Reserve. They’ve expanded the $300 travel credit to include grocery store and gas station purchases. They’ve also offered a lower $450 annual fee for cardholders who renew between July and December this year.

Decision Making

Here are a few factors to consider before you make the decision to use the ‘Pay yourself back’ tool. Every person’s situation may be different. However, some of these factors could help you decide how you’d want to use points in the short term.

- Your points balance: If you have a six or seven figure balance, wiping out a few purchases may not cause that big a dent to your points balance.

- How soon you want to book travel with points: If you’re going to book travel soon, then your points could be more valuable for a premium cabin flight or a hotel suite.

- How badly you need the extra cash to cover key expenses like food and groceries: If you’re facing a cash crunch, then the decision to ‘pay yourself back’ becomes pretty straightforward.

The Pundit’s Mantra

Chase’s moves are smart on two fronts. On one hand, they will earn transaction fees on increased spend in these categories. On the other hand, if people redeem points to wipe out those purchases, that helps Chase wipe out points liability from their balance sheet. However, I intend to sit this out and simply wait for travel to resume in full swing, whenever it does. I’m keen on maximizing the points earning part for now, but not the redemption part.

In most cases, I’m able to get a much better redemption value when I transfer to Chase’s travel partners. As I said earlier, these benefits are good, but they may not be for everyone. If you already have a lot of points and want to save some cash, then you can use the points to wipe out some purchases. However, if you simply want to use your points just for travel in the future and aren’t facing a cash crunch, then it would make more sense to wait it out.

How do you plan to use Chase’s new temporary new benefits? Tell us in the comments section.

___________________________________________________________________________________________________________________

This travel card is currently offering a lucrative 60,000 points welcome bonus, for just a $95 annual fee!

___________________________________________________________________________________________________________________

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!