Earlier this week, I wrote about how I used my Amex Platinum card in order to book a stay that was on my bucket list for a long time. I used my Amex Platinum card to make the booking via their Fine Hotels and Resorts program. American Express offers a nice portfolio of credit cards that help you earn points quickly and also redeem them for memorable flights and hotel stays. However, there’s another reason why I’ve stayed loyal to the Amex brand for many years.

Amex Purchase Protection

In this post, I highlighted how I made a mess while finding the correct airport lounge. Thankfully, Amex helped me out with their excellent customer service. Banks often advertise additional benefits on their cards to attract customers. However, not all benefits are created equal. Firstly, are they easy to use? Second, does the customer derive tangible value from the benefit?

I’ve been an Amex customer since 2010. I’ve now used their purchase protection benefit successfully for the third time in over 12 years. This time, it was for a brand new Apple Watch that I accidentally dropped.

What Happened

On a Sunday night, I was exhausted an about to hit the hay. I realized that the watch’s battery was low. I got up and walked toward the charger connected to the wall. That’s when I dropped the watch and heard a thud. I looked down sheepishly but the damage was already done. A massive crack right through the screen of the watch.

Amex Purchase Protection Benefit

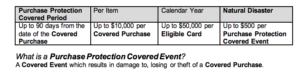

With qualifying American Express cards, the purchase protection benefit is automatically activated. You simply have to use your eligible American Express card in order to make a purchase. A list of policies depending on your card can be found here.

As per the terms and conditions, you need to make a claim during 90 days from the date of purchase. I quickly looked up the purchase on the Amex app and heaved a sigh of relief. It was day 85! I then called up Amex’s customer service. An agent quickly jotted down all the details and gave me a claim number.

Response Time

After turning in the application, I received a response from Amex asking me to send a copy of the original purchase. Since I’d made the purchase on Apple.com, I quickly looked up the purchase and sent them the details.

However, two weeks passed and I didn’t hear anything back. In the past, Amex has closed claims in as quickly as 1-2 business days after receiving all the documents. I called Amex once again to check status. A representative mentioned that they were a bit understaffed and that applications were taking longer. He gave me an estimate of 15 business days for completion of the claim.

The Pundit’s Mantra

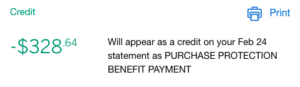

In less than 15 business days, I got another letter from Amex which said that the claim had been passed. The entire purchase amount was refunded back to my original form of payment. I’d made the purchase with my Hilton Aspire card, which automatically triggered the purchase protection benefit.

While I’ve been critical of Amex increasing annual fees on many of their credit cards each year, I’ve been impressed with the quality of their service. Good products may win your business, but good service is what keeps you as a customer. In Amex’s case, their purchase protection and extended warranty benefits have gone a long way in in reducing the pinch whenever something breaks or gets lost.

How has your experience with Amex’s purchase protection and extended warranty benefits been like? Tell us in the comments section.

___________________________________________________________________________________________________________________

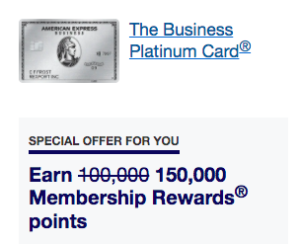

The Business Platinum Card from American Express is offering a welcome bonus of 150,000 Membership Rewards points!

APPLY NOW

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

1 comment