A few days back, I expressed my displeasure concerning the slow devaluation of Amex’s credit card offerings over the years. While American Express continues to offer amazing welcome bonuses, their breakage driven strategy is clearly making me rethink once the annual fee hits for one of their credit cards. In this case, I went on a credit card cancellation spree, well almost!

Credit card cancellation request

3 credit cards were up for renewal. I logged into my account and saw that Amex had charged the annual fee in April. I had about a month to decide.

- Business Gold Card: Annual Fee of $375 (up 50%)

- Hilton Aspire Card: Annual Fee of $550 (up 18%)

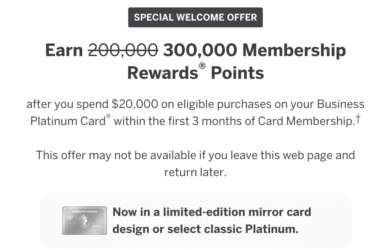

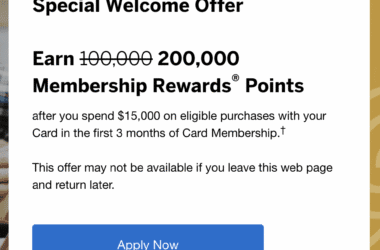

- Business Platinum Card: Annual Fee of $695 (up 26%)

As you can see from the list, the main reason was the annual fee increases. Moreover, I found almost no use of a lot of the new benefits or credits that American Express had added.

- Business Platinum Card: I found the Dell credit really useless after a while. As someone who’s wedded to the Apple ecosystem, I eventually ran out of stuff to buy for either myself or for gifting others. In the end, the credit didn’t make much sense. Even more useless for me was the Indeed credit and Adobe credit.

- Hilton Aspire Card: This was a tougher decision to make. For me, the deal breaker was the resort credit being split into a bi-annual credit. I love the free night certificate that you can earn with the Hilton Aspire card, in addition to top tier Diamond status. However, I realized that I was going out of my way to book “resort” properties just to use the credit. I eventually decided to pull the trigger. Also, I already have the Schwab Platinum card. The card gives me complimentary Gold status with Hilton Honors anyway. Therefore, moving from Diamond to Gold wasn’t a big deal for me.

- Business Gold Card: In this case, Amex removed the 4x points on flights and once again added monthly credits. Since my Amex Platinum card gives me 5x on flights, I thought that it doesn’t make sense to keep the card for another year.

Retention Chat

For each of these cards, I reached out to Amex’s chat reps to request a possible retention offer. Here’s what happened:

- Business Platinum Card: The retention offer was for 10,000 Membership Rewards points after spending $5,000 in 3 months. I refused and canceled the card.

- Hilton Aspire Card: In this case, no retention offer was given.

- Business Gold Card: In this case, Amex offered me a retention bonus of 40,000 Membership Rewards points after spending $5,000 in 3 months. I decided to keep the card open.

The Pundit’s Mantra

I recently signed up for a second Blue Business Plus card. In my opinion, it’s a fantastic credit card that gives you the ability to transfer Amex points to transfer partners. Moreover, it charges no annual fee whatsoever and you earn a simple 2x on all spend.

As Amex increases annual fees on many of their card, I’m looking to trim accordingly and focus on lower annual fee cards that still offer a decent return on everyday spend.

___________________________________________________________________________________________________________________

With these limited time offers by Chase, you can currently earn 75,000 Ultimate Rewards points from a single credit card bonus.

Click here to know more…

___________________________________________________________________________________________________________________

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

In 2023 I spent an average of $7,500 a month on my Amex Delta Reserve card. In 2024 I’ve spent $300 total in 5 months. When renewal time comes I’m planning to quit after more than 10 years with the card. Major increase in annual fee and now limited lounge visits? Super high unattainable thresholds for earning Diamond on Delta when I live outside the US and earn pennies on the dollar towards “Delta flight spend”? No thanks. Delta and Amex have shown once and for they don’t value global based American card members like me. I’m already working on Global Services on United.

Blue Business Plus app coming up. Thanks for confirming my thinking.